Updated: May 15

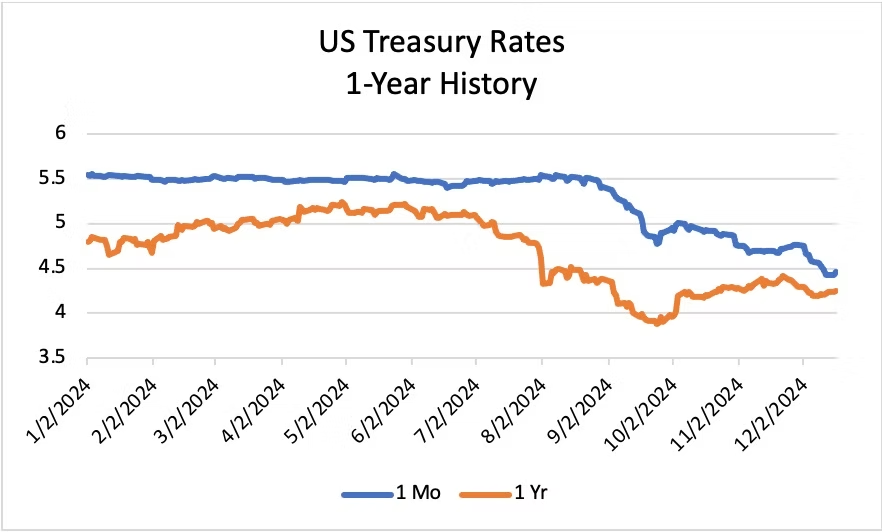

As widely anticipated, the Federal Reserve cut interest rates by 25 bps on Wednesday, lowering the Fed Funds target range to 4.25 – 4.50%. The projections released for 2025 indicate only two additional rate cuts in 2025. This is lower than the projections released in September which had indicated four rate cuts in 2025. As a result, treasury rates in the 1-30 year range increased ~2-5 bps intraday on Wednesday. Conversely, very short-term rates fell slightly by 1-2 bps.

The 1-year treasury rate over the past year has also decreased, but not nearly by the same extent as very short-term rates. Since December 18, 2023 we’ve seen a reduction of ~67 basis points for the 1-year treasury. As a result, we continue to see benefit from fixed rate reinvestment products.

Below we show current reinvestment rate indications. For a more tailored indication to your specific fund(s) or to discuss the risks and benefits associated with these structures, please reach out to Georgina Walleshauser or your Blue Rose advisor.

|

Average Life

|

GIC

|

Repo

|

Portfolio

|

|---|---|---|---|

|

1-year

|

4.30%

|

3.87%

|

4.22%

|

|

2-year

|

4.35%

|

3.77%

|

4.28%

|

|

3-year

|

4.37%

|

|

4.30%

|

Georgina Walleshauser, Vice President | 952-746-6036

In her role of Vice President, Georgina Walleshauser manages a number of the firm’s clients, providing them with advice on and ensuring a smooth closing for all types of debt and derivative product transactions, capital planning solutions, and detailed credit assessments. Ms. Walleshauser serves as an advisor to public and private higher education, non-profit and governmental institutions. She specializes in analyzing and assessing reinvestment strategies for clients, leading most of Blue Rose’s reinvestment transactions. Ms. Walleshauser has vast expertise in providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. She joined Blue Rose in 2017 as a Junior Quantitative Analyst.

Media Contact:

Laura Klingelhutz, Marketing Coordinator

952-208-5710