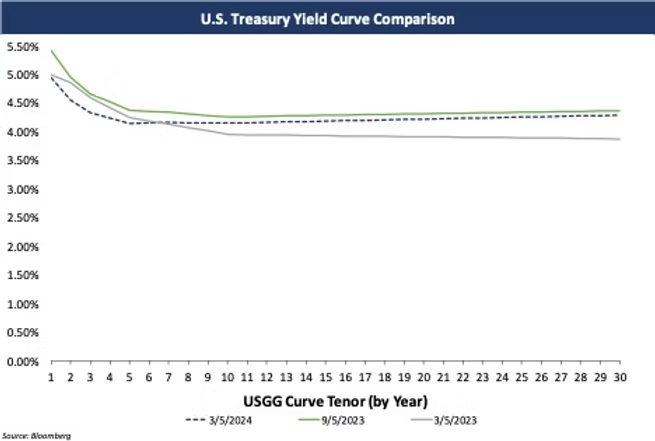

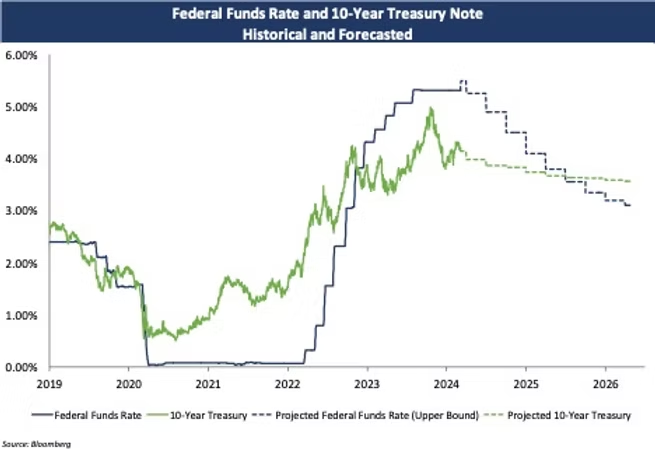

Based on the Federal Reserve’s sentiments and economic data, the market is still expecting to see fed fund rate cuts this year – with fed fund futures pricing in 3-4 cuts before 2025.

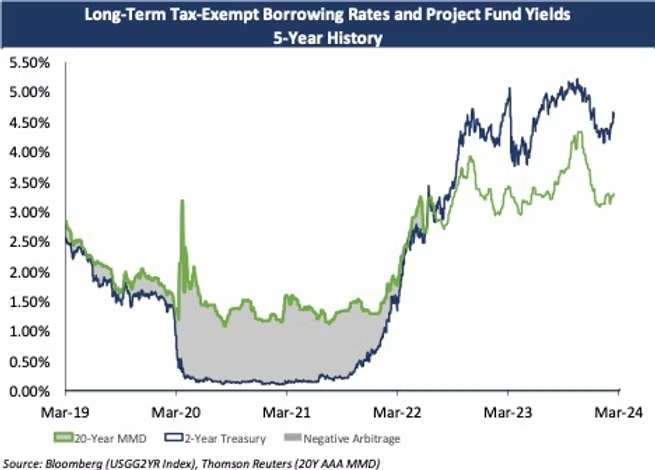

The inverted treasury yield curve, combined with the lower-than-average tax-exempt to taxable ratios, continues to present an opportunity for many tax-exempt borrowers and issuers to earn significant positive arbitrage on their bond proceeds that won’t be immediately spent at bond closing. While some money market fund rates are currently higher than what can be earned with an alternative investment structure, these rates are variable and not guaranteed throughout the life of the investment. We are starting to see more issuers and borrowers prefer to lock in a fixed reinvestment rate now, before the Fed begins cutting short term rates.

For tax-exempt borrowers who are coming to market with new money issuances, or have outstanding unspent bond proceeds, we strongly encourage you to consider the most efficient reinvestment options. Below we show current reinvestment rate indications. For a more tailored indication to your specific fund(s) or to discuss the risks and benefits associated with these structures, please reach out to Georgina Walleshauser or your Blue Rose advisor.

|

Average Life

|

GIC

|

Repo

|

Portfolio

|

|---|---|---|---|

|

1-year

|

5.11%

|

4.40%

|

4.90%

|

|

2-year

|

4.63%

|

3.95%

|

4.50%

|

|

3-year

|

4.40%

|

|

4.30%

|

Georgina Walleshauser, Vice President | 952-746-6036

In her role of Vice President, Georgina Walleshauser manages a number of the firm’s clients, providing them with advice on and ensuring a smooth closing for all types of debt and derivative product transactions, capital planning solutions, and detailed credit assessments. Ms. Walleshauser serves as an advisor to public and private higher education, non-profit and governmental institutions. She specializes in analyzing and assessing reinvestment strategies for clients, leading most of Blue Rose’s reinvestment transactions. Ms. Walleshauser has vast expertise in providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. She joined Blue Rose in 2017 as a Junior Quantitative Analyst.

Media Contact:

Laura Klingelhutz, Marketing Coordinator

952-208-5710