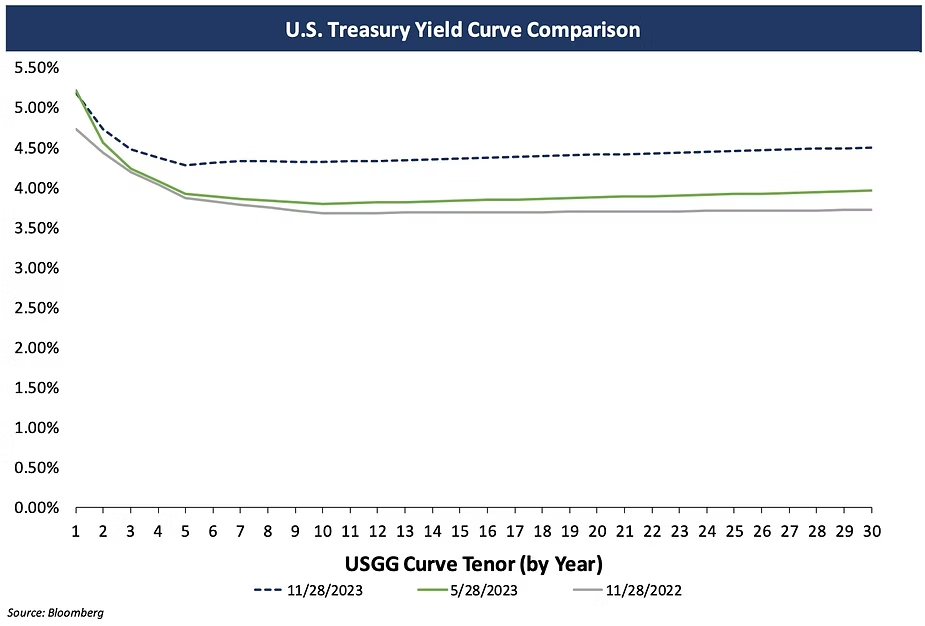

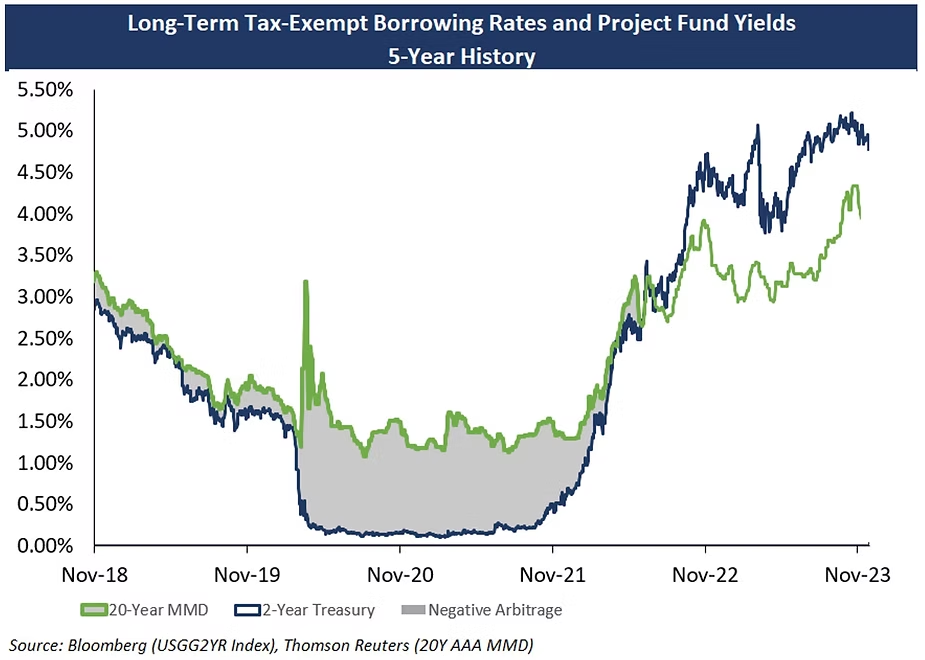

In the past several weeks the market has seen large downward movements in both taxable and tax-exempt interest rates. Nevertheless, the treasury yield curve continues to remain inverted – particularly on the front end – and it continues to be a good time for issuers to benefit from reinvesting bond proceeds and locking in higher short-term investment rates

For tax-exempt borrowers who are coming to market with new money issuances, or have outstanding unspent bond proceeds, we strongly encourage you to consider the most efficient reinvestment options. Below we show current reinvestment rate indications. For a more tailored indication to your specific fund(s) or to discuss the risks and benefits associated with these structures, please reach out to Georgina Walleshauser or your Blue Rose advisor.

|

Average Life

|

GIC

|

Repo

|

Portfolio

|

|---|---|---|---|

|

1-year

|

5.30%

|

4.75%

|

5.10%

|

|

2-year

|

4.95%

|

4.45%

|

4.55%

|

|

3-year

|

4.70%

|

|

4.35%

|

Georgina Walleshauser, Vice President | 952-746-6036