The debt ceiling for the United States is currently suspended until July 31 and at that time, it will be set to the amount of debt on that day. Once that new limit is set, by design, the Treasury department will be legally prohibited from incurring any additional debt. Today, State and Local Government Series Securities (SLGS) are being purchased by issuers for taxable advanced refundings of tax-exempt bonds and, prior to the passage of tax reform legislation that took effect in 2018, they were also used for tax-exempt advanced refundings.

Once the debt ceiling is breached, to create room for ongoing funding of government operations, the U.S. Treasury typically takes so called “extraordinary measures” to create room for the issuance of additional debt under the debt ceiling. Included in these measures has been the suspension of the sale of SLGS. These extraordinary measures typically give the Treasury department some time and room to operate. How long these measures might work before Congressional action is required is difficult to accurately predict in most years.

Because of the uncertainty relating to the cashflows resulting from COVID-19 relief disbursements, U.S. Treasury Department Deputy Secretary Wally Adeyemo said that predicting the date at which “extraordinary measures” will no longer provide relief is even more difficult to calculate this year. The Bipartisan Policy Center recently released a report that suggested that “extraordinary measures” will last until sometime in the Fall. Once these measures are exhausted, the Treasury department will be unable to fund operations and debt service on existing Treasury debt. At or prior to this time, Congress must take action to prevent a default.

Given the current state of the budgetary process in Washington, it is unlikely that Congress will act soon to take any precautionary actions ahead of July 31. As such, it is likely that the SLGS window will close, possibly through the balance of the summer. If the Treasury suspends the sale of SLGS, issuers will need to purchase alternative “open market” securities for escrows that otherwise would have been eligible to be funded with SLGS. These open market escrow portfolios generally consist of U.S. Treasuries and Agencies, with parameters for eligible securities varying by indenture.

Blue Rose regularly serves as a bidding agent for open market escrows, which can prove more cost-effective than SLGS even when the SLGS window is open depending on the size and duration of escrow cash flows. If you are undertaking a refunding or defeasance transaction, we encourage you to reach out to us with indicative escrow cash flows to determine if an open market escrow could provide value, either through generating savings vs. SLGS or as a substitute for them in the event of a SLGS window closure.

Contact the Author:

Sam Gruer, Managing Director

New York Office

Office: 973-671-1741

Email: [email protected]

Media Contact:

Megan Roth, Marketing

Minneapolis Office

Office: 952-746-6056

Email: [email protected]

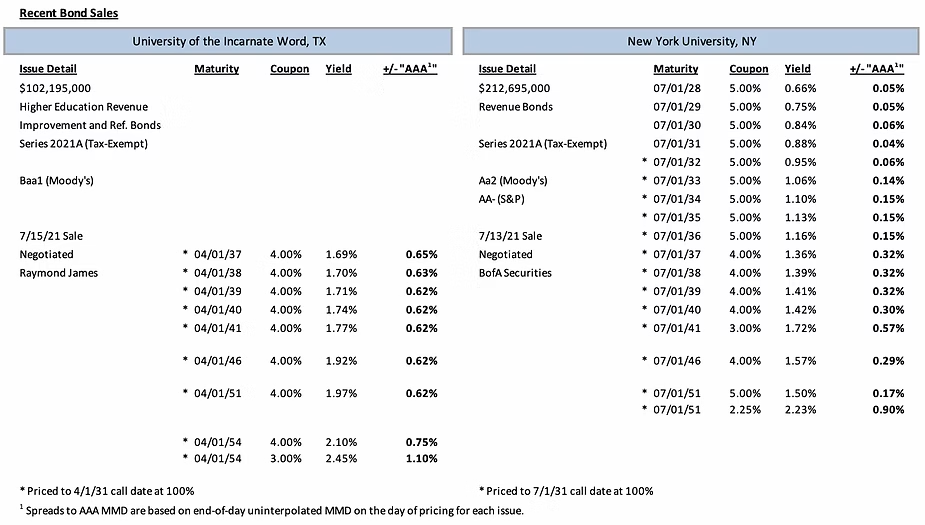

Comparable Issues Commentary

Incarnate Word’s bonds were rated “Baa1” by Moody’s, while NYU’s bonds carried ratings of “Aa2” and “AA-” from Moody’s and S&P, respectively. Both universities opted for a deferred amortization structure for their tax-exempt issues, preferring to amortize their higher-cost taxable series earlier on the yield curve – the first maturity for NYU’s 2021A transaction is a small 2028 serial maturity, while UIW’s 2021A bonds do not begin amortizing until 2037. On comparable maturities, the two schools utilized similar, though not identical, coupon structures. Incarnate Word’s 2021A bonds all carried 4% coupons except for a bifurcated 2054 term bond, which used both 4% and 3% coupons. Meanwhile, NYU also used 4% coupons on its 2037-2040 serial bonds as well as on its 2046 term bond, but used a mix of other coupon structures ranging from 2.25% (on a bifurcated 2051 term bond) to 3% (on the 2041 serial maturity) and 5% coupons (on the bifurcated 2051 term bond as well as on all serial maturities before 2037) as well.

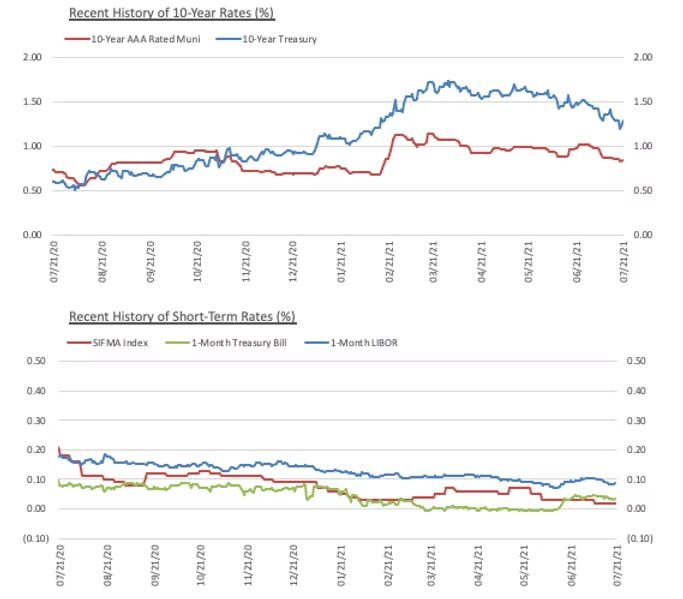

The two universities priced into a strong tax-exempt market, with tax-exempt interest rates falling by anywhere from 4-18 bps across the yield curve in the two weeks leading up to both schools’ bond pricings. Despite this unexpected rally in the tax-exempt market, credit spreads remained tight, providing for an excellent cost of capital for both UIW and NYU. During the actual pricings for both universities, the market was stable, with MMD completely unchanged on July 13th (NYU) and July 15th (Incarnate Word). Spreads on callable 4% coupons ranged from 29-32 bps for NYU and between 62-65 bps for UIW, apart from the 2054 term bond, which priced at a spread of 75 bps.

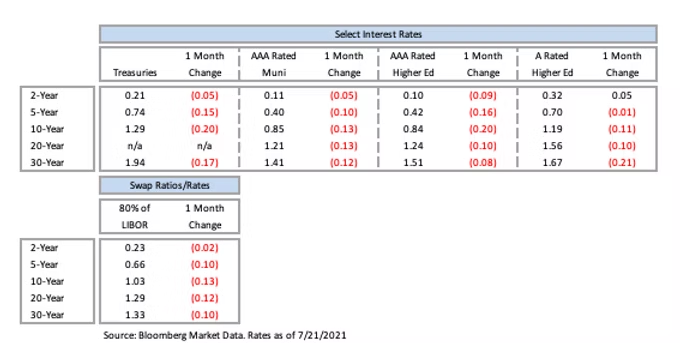

Interest Rates