The objective of this update is to provide insight into key municipal market developments that have occurred since the start of 2019. Most of these occurrences revolve around yield curves; whether it’s their flattening, inversion, shift, changing expectations, or impending replacement. Overall, the municipal market has had a strong start to the year seeing increased demand for tax-exempt products, while muni issuers have been able to capitalize on a lower rate environment.

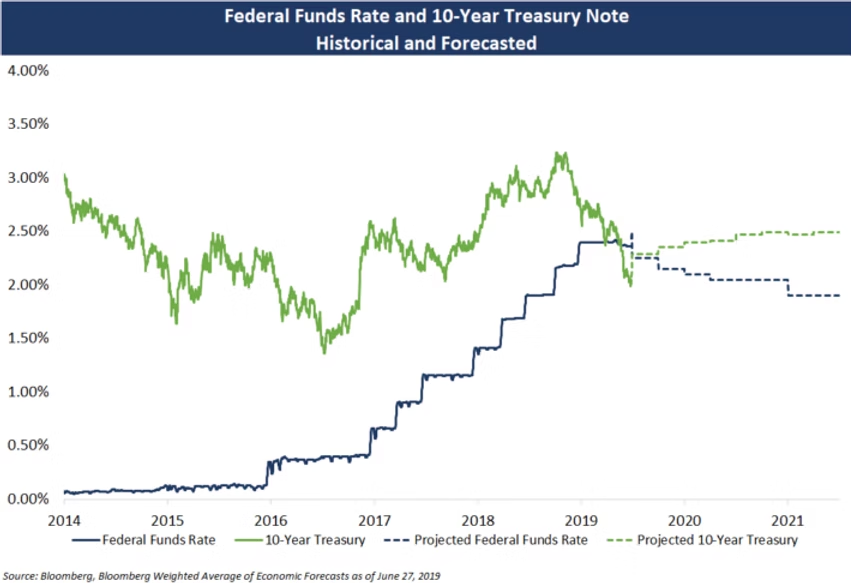

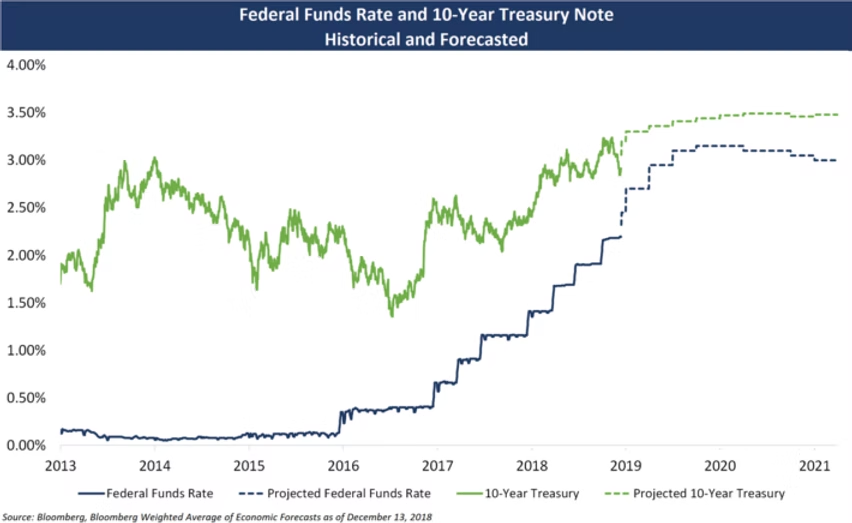

Changing Expectations for the Fed Funds Target Rate

Until recently, the Fed’s monetary policy has involved the use of interest rate hikes to temper a potentially overheating economy, with consistent increases to the Fed’s target rate beginning in late 2015. In 2019 this approach has flipped in light of current economic risks such as trade tensions (most significantly the trade fight between the United States and China), rising geopolitical tensions, a weakening global economic outlook, and stagnant domestic inflation. Expectations now are for a minimal rate cut to curb near term economic risks, as opposed to an overall change in stance corresponding with the beginning of a rate-cutting cycle as has typically taken place in the past. Rate cuts are projected to move the Fed target down by no more than 0.5% by the end of 2019, from a target of 2.25% to 2.5%.

Current Projections:

Past Projections (December 2018):

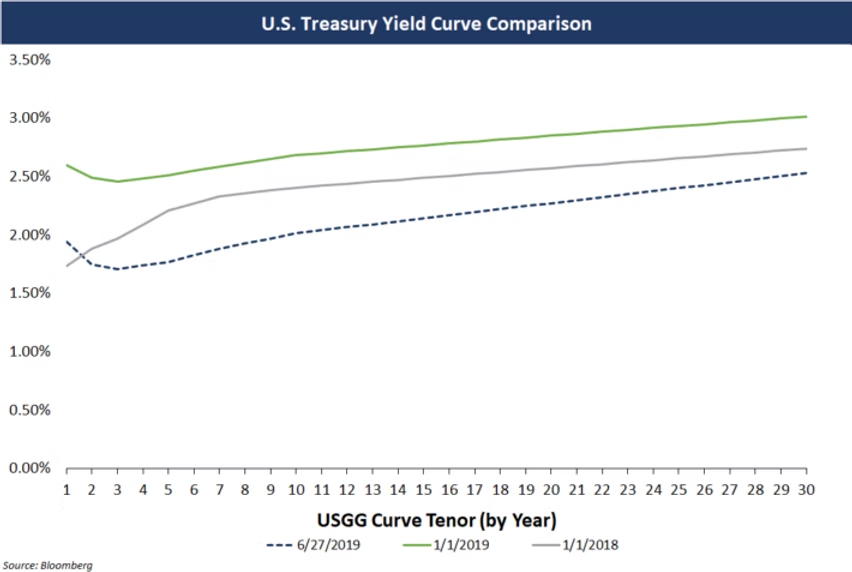

Flattening/Inversion of Benchmark Yield Curves

Another result has been a growing debate on the recession-predicting ability of an inverted curve. Historically, recessions have often followed inversions in the yield curve; however, while some economic concerns remain, the general consensus of Federal Reserve policy makers and the market seems to be that a recession is not looming at present as the business cycle has shifted.

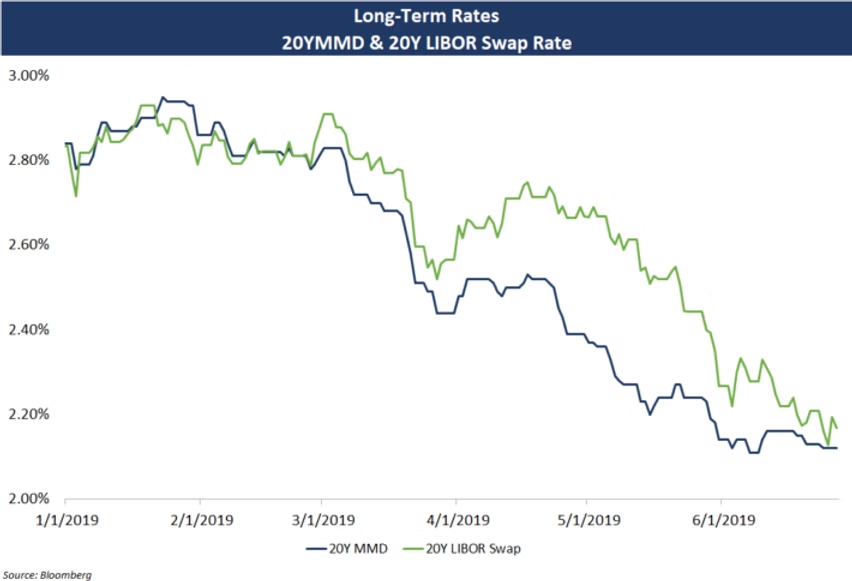

Long-Term Rate Decreases

LIBOR Transition

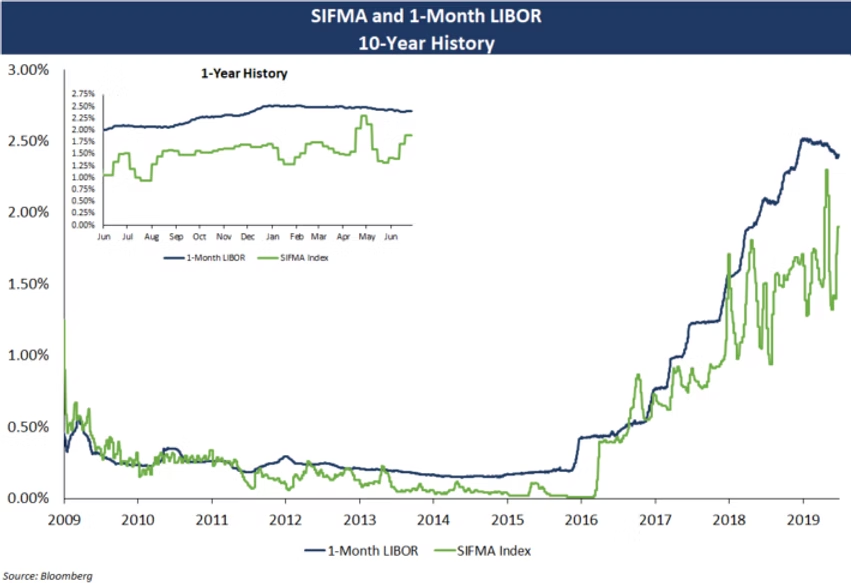

SIFMA Volatility

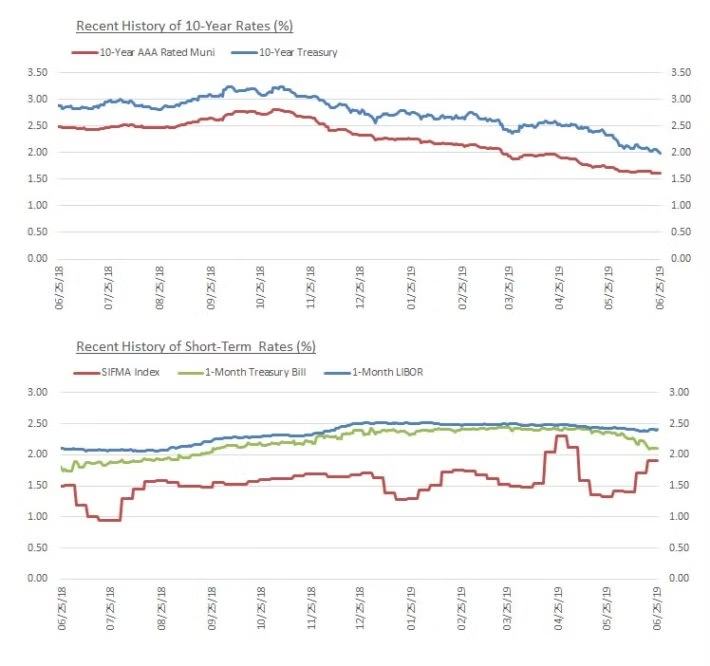

The SIFMA rate has seen significant week-to-week volatility since the Tax Cuts and Jobs Act took effect at the beginning of 2018. The relationship between LIBOR and SIFMA has yet to fully normalize following the change in the corporate tax rate, with tax-exempt LIBOR based direct purchase bonds seeing tax factors hovering around 80% of 1M LIBOR while SIFMA-based tax-exempt VRDBs remain closer to 70% of 1M LIBOR. This mismatch in tax factor has resulted in a relative advantage for many issuers with borrowings utilizing an instrument that proxies SIFMA. Additionally, SIFMA’s typical April (tax season) volatility remains common.

Inflows/Outflows to Muni Funds

About the Author:

Brandon Lippold – Associate.

Brandon provides financial modeling, analytics, market data and research in support of the delivery of capital planning, debt and derivatives advisory and reinvestment services to Blue Rose clients. He holds a bachelor’s degree in financial management from the University of St. Thomas and is a Series 50 licensed municipal advisor representative.

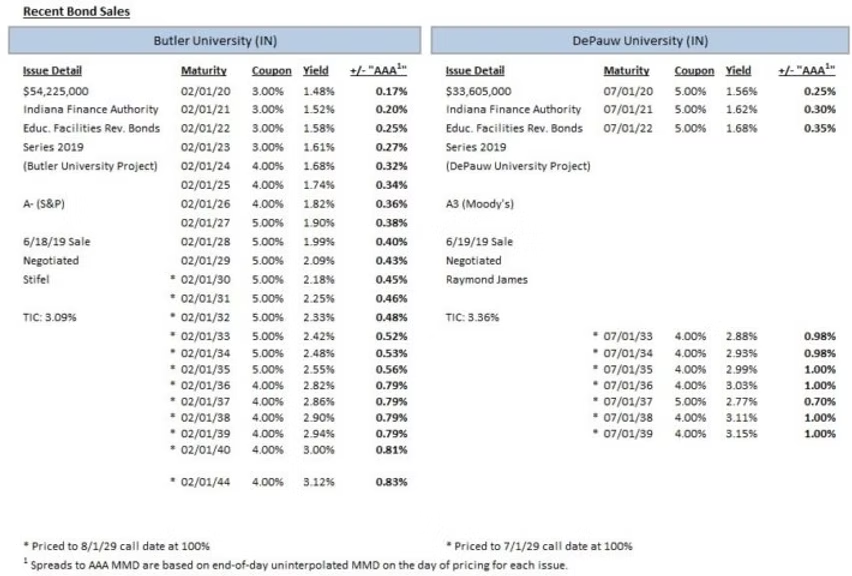

Comparable Issues Commentary

Interest Rate Charts