The year began with a significant amount of market uncertainty, with many market participants anticipating impending market-wide turmoil. However, contrary to many consensus forecasts, the market saw strong overall performance. Heading into 2020 there appears to be more optimism, but unfortunately, still some uncertainty.

LIBOR Replacement

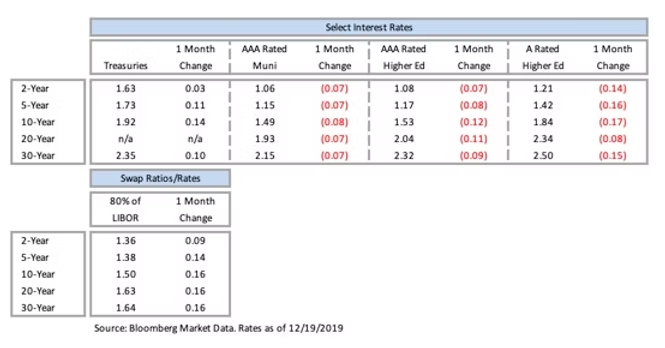

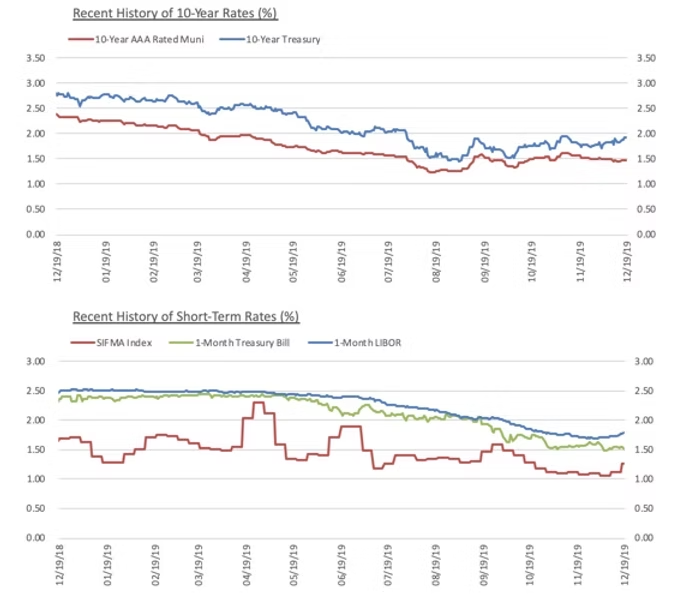

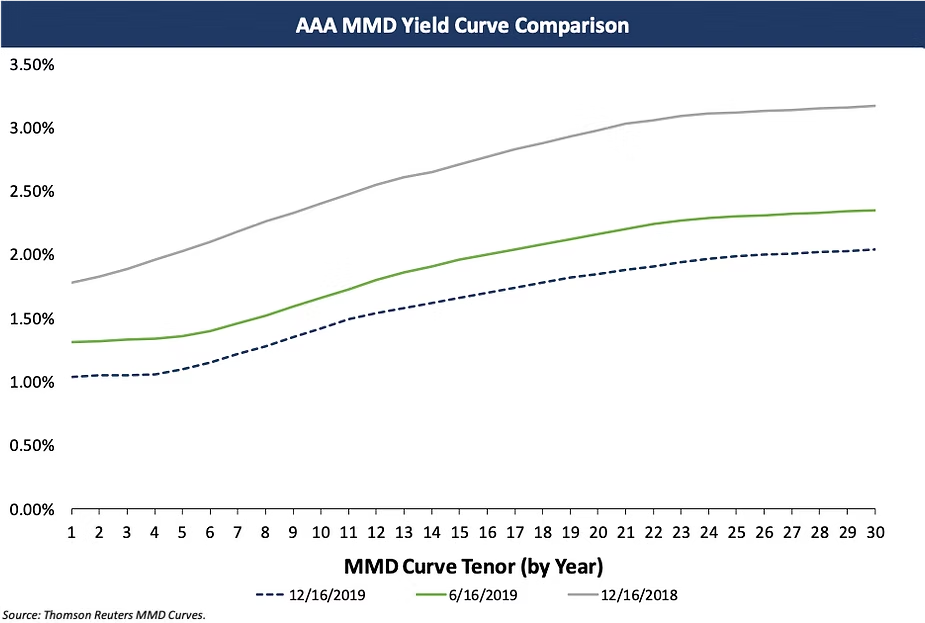

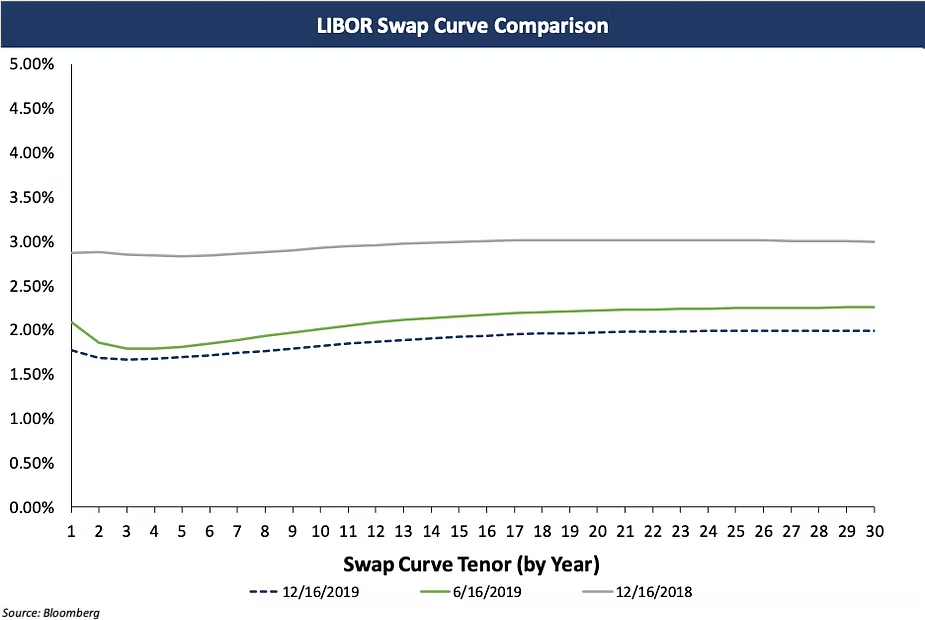

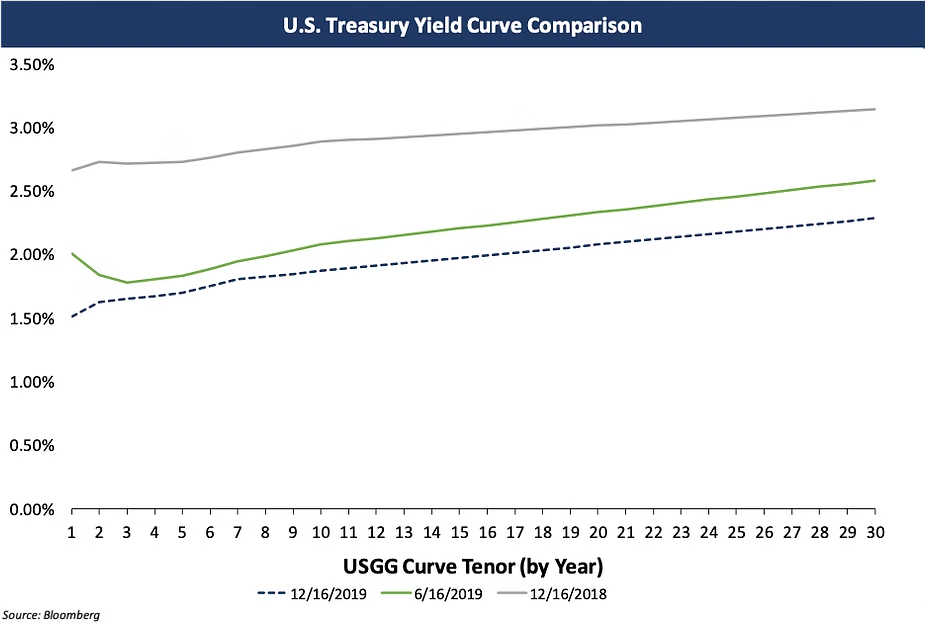

Rate Movements

Since that newsletter was published, the market has trended in a similar direction. Over the past two weeks though, there have been a couple of positive market events which have slowed falling bond rates. These events include the: cooling of trade tensions between the US and China (sparked by a preliminary phase 1 trade agreement), and the Fed signaling that it will maintain its benchmark rate range at 1.5% to 1.75% throughout 2020, illustrating its belief that the economy is better positioned than it had been leading up to its last three consecutive rate cuts.

Refunding Bonds

Higher-Education Difficulty

Market Threats

About the Author

Brandon Lippold, Associate

Brandon Lippold joined Blue Rose in 2018, providing modeling, analytics, market data and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients.

Mr. Lippold holds a bachelor’s degree in financial management from the University of St. Thomas, and is a member of their chapter of the Delta Epsilon Sigma honors society. Mr. Lippold passed the MSRB Series 50 Examination to become a qualified municipal advisor representative and is currently pursuing his Chartered Alternative Investment Analyst (CAIA) designation for which he has passed the level 1 exam.

Brandon can be reached at [email protected]

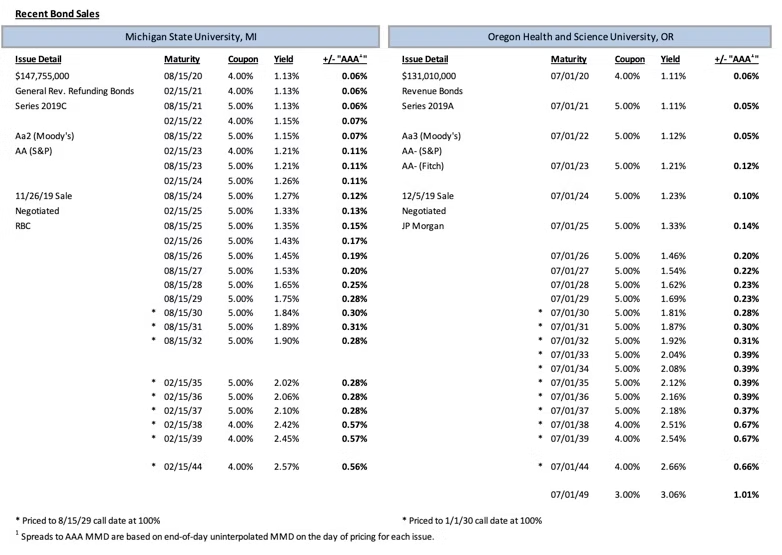

Comparable Issues Commentary

Interest Rate Charts