Updated: May 15

Fall 2024 Enrollment: Reversal over 2023

First-year students out of high school dropped 5% this fall across the country according to an analysis by the National Student Clearinghouse Research Center (“NSCRC”). This is in contrast to a year-over-year increase of 3% in the fall of 2023. Across the higher education sector, institutions felt the impact differently. Public colleges and universities saw a sharper decline at 6.4%, with private four-years dropping 6.2%. Two-year institutions’ enrollment fell by only 1.7%. From another perspective, colleges and universities saw varying enrollment outcomes based on their level of prestige (as proxied by selectivity) in the higher education market. The most selective institutions (accepting one third or fewer of applicants) saw a drop of 3.4%, while “very competitive” (accepting half of applicants) and “competitive” institutions (accepting three quarters) saw drops of 8.7% and 7.4%, respectively. ⁱ

A large part of this drop may be due to the trials and tribulations confronting would-be students from the rollout of the new FAFSA. As of late November 2024, about 54% of the high school class of 2024 had completed a FAFSA versus almost 61% at that time last year, a decline of 8.7%.ⁱⁱ

The FAFSA debacle may have only been one factor of many. According to Kim Cook, Chief Executive Officer of the National College Attainment Network, which commissioned the analysis by NSCRC, the Supreme Court’s ban of race-conscious admissions and the growing national consensus that college isn’t worth the investment of time and money may all have resulted in the year-over-year enrollment decline. (A recent Gallup poll from this summer shows that 32% of Americans polled had “little or no confidence” in higher education, up from 10% when Gallup first started tracking the question in 2015.ⁱⁱⁱ)

All of this is tough news for the higher education sector, but according to a recently released and much anticipated report, things aren’t expected to get better any time soon.

Fewer Hands Knocking? At the Precipice of the Enrollment Cliff

Fall 2024’s enrollment numbers may be the beginning of persistent negative enrollment trends for the sector, at least at a national level. The Western Interstate Commission for Higher Education (“WICHE”) has published its “Knocking at the College Door” report every four years since 1979. This month saw the release of its newest edition, which focuses on the arrival of the demographic cliff. The report estimates national, regional, and state-level graduation rates through the year 2041 by calculating progression rates for grades one through twelve, while also accounting for immigration, birthrates, mortality, retention, and other factors that might impact high school graduation rates.

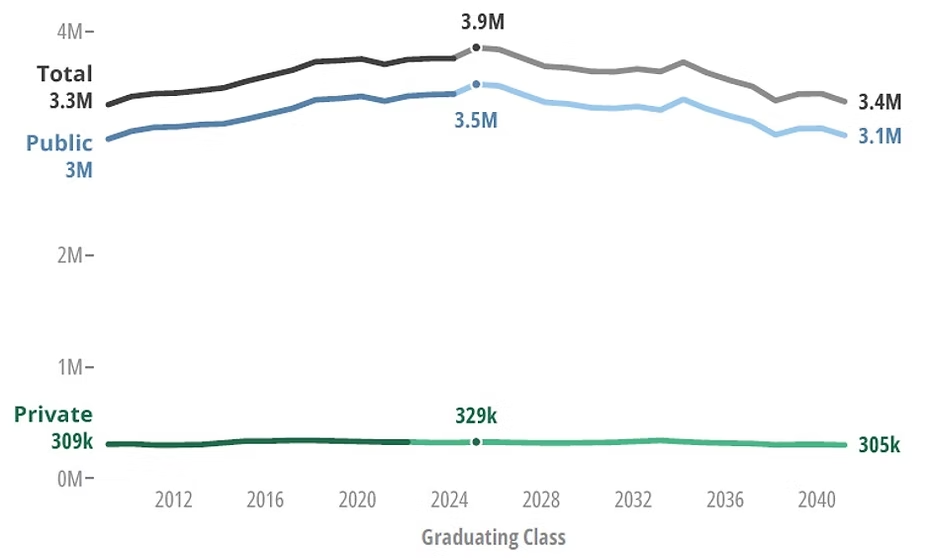

In short? We’re at the edge: the total number of high school graduates across the United States will peak in 2025 at 3.9 million, gradually declining to 3.4 million in 2041 (a decline of 13%). Compared to 2023, the projected 2041 number accounts for a loss of 388,000 students, or a 10.3% decline in the graduating class.ⁱᵛ While it has commonly been called the “demographic cliff” by higher ed industry watchers, however, the decline in total graduates is a steady, slow one instead of a sharp drop.

Table 1 from “Knocking at the College Door,” WICHE, December 2024. High school graduates, reported (2009 to 2023) and projected (2024 to 2041).

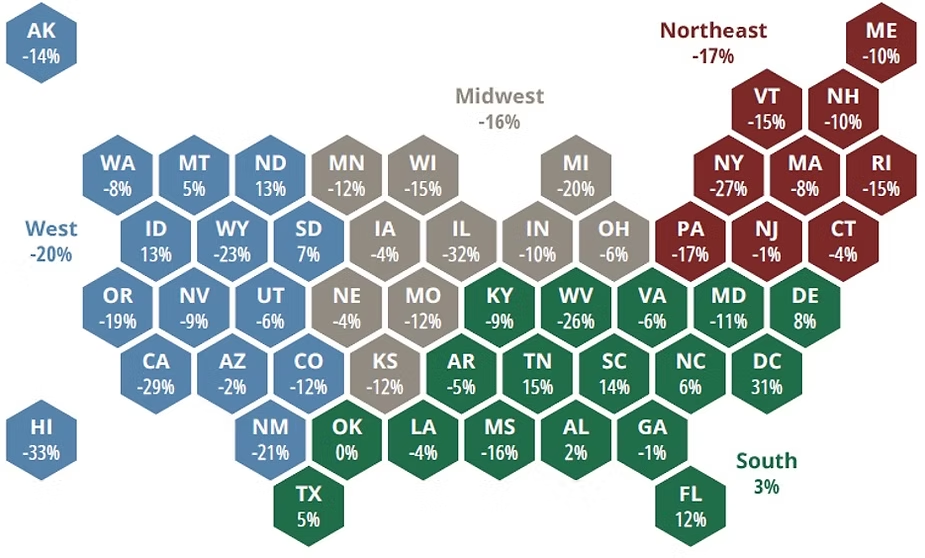

The report examines the effect of demographic changes by region and state as well. Twelve states and D.C. will see projected increases by 2041 – but that means 38 states will experience no or negative growth. For some states, the declines in high school graduates will be stark: California, Illinois, Michigan, New York, and Pennsylvania together account for around 75% of the total national decline in graduates from 2023 to 2041. Most regions at the aggregate level will feature declines as well: the West (-20%), Midwest (-16%), and Northeast (-17%) compare unfavorably to the South (+3%). Florida, Tennessee, and South Carolina stand out among those southern states with projected increases of 12 to 15%; just under half the southern states will see an increase in graduates. In fact, compared to the last edition of “Knocking at the College Door” in 2020, the results for the West, Midwest and Northeast are even more grim in the current 2024 edition, with projected graduates in 2037 (the final year for the 2020 report) shrinking against the 2020 projections by -3.5%, -1.5%, and -5.4%, respectively. The South’s projected 2037 number increased by 4.3% against the 2020 figure. The current report suggests that in-migration from other regions to the South is the likeliest reason for the continued strength in that region.

Table 2 from “Knocking at the College Door,” WICHE, December 2024. Projected percent change in high school graduates, 2023 to 2041.

Now what?

Revenue from tuition and fees and auxiliary sources will increasingly feel stress from growing competition over a smaller pool of potential first-year students. All but the most selective institutions and those with premier brand names will need to develop strategies for survival, better define their value proposition, explore partnerships across the sector, and strategically use resources now to better position their organizations in the future. If you would like to discuss such strategies to bolster your institution’s future success, please reach out to your Blue Rose advisor today.

ⁱ “Amid FAFSA Crisis, Enrollment of 18-Year-Old Freshmen Fell Sharply This Fall,” by Eric Hoover, The Chronicle of Higher Education, December 2, 2024. https://www.chronicle.com/article/amid-fafsa-crisis-enrollment-of-18-year-old-freshmen-fell-sharply-this-fall

ⁱⁱ NCAN’s FAFSA Tracker, accessed December 13, 2024. https://www.ncan.org/page/fafsatracker

ⁱⁱⁱ “U.S. Confidence in Higher Education Now Closely Divided,” Jeffrey Jones, Gallup. July 8, 2024. https://news.gallup.com/poll/646880/confidence-higher-education-closely-divided.aspx

ⁱᵛ “Knocking at the College Door: Projections of High School Graduates,” 11th Edition, Western Interstate Commission for Higher Education. December 2024. https://www.wiche.edu/knocking/

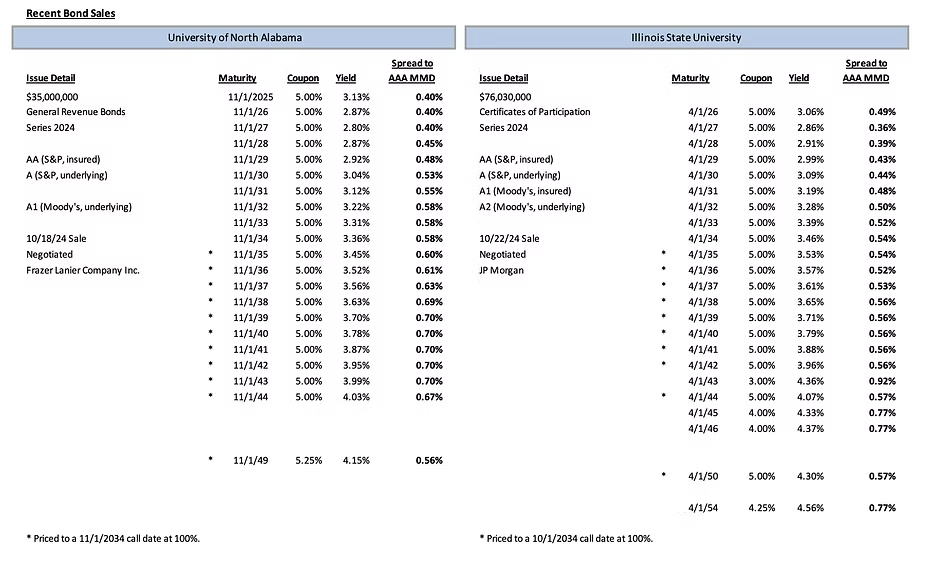

Comparable Issues Commentary

Meet the Author:

John Elliott | jelliot@blueroseadvisors.com | 312-332-1336

Mr. Elliott serves as Blue Rose’s Chief Compliance Officer. He also provides analytical and research support and project management for Blue Rose’s P3, strategic consulting, and debt advisory practice. Mr. Elliott joined Blue Rose’s California office as an Associate in 2021.

Prior to Blue Rose, Mr. Elliott worked as a research associate for a non-profit think tank in Washington, DC and as a compliance consultant for federal contractors.

Media Contact:

Laura Klingelhutz, Marketing Coordinator

952-208-5710