Last June, Blue Rose published an article discussing the troubles facing LIBOR and introducing the rate currently pegged to replace it – the Secured Overnight Financing Rate (SOFR). It’s been almost 9 months since that original article was published, and in that time the transition from LIBOR to SOFR has seen a few key developments.

Update on the Proposed Timeline

The Alternative Reference Rates Committee (ARRC) published its “Paced Transition Plan” at the start of 2018. This plan laid out an initial framework for the transition from LIBOR to SOFR, with steps along the way meant to help establish a more robust, liquid, futureproof SOFR market. The ARRC is currently ahead of this schedule, and has published a helpful graphic of its original transition plan along with some key developments that have taken place. A few 2018 milestones to note include the following: the Federal Reserve Bank of New York (FRBNY) began publishing SOFR; the Chicago Mercantile Exchange (CME) launched SOFR futures and now clears SOFR swaps utilizing SOFR-based discounting; the ARRC and the International Swaps and Derivatives Association (ISDA) are in the midst of addressing fallback language in new and existing LIBOR contracts; the first SOFR-backed notes have been issued; S&P has recognized SOFR as an “anchor money market reference rate;” and FASB now includes SOFR in its list of benchmark interest rates permitted for hedge accounting. A few important transition milestones the ARRC plans to address or will need to be monitored in the market during 2019 include the need for further growth in SOFR market liquidity, the identification and establishment of indicative SOFR-based term reference rates based on futures trading, and the determination of final recommendations for fallback language in new LIBOR based contracts.

Update on Fallback Language

Fallback language in new and existing LIBOR contracts is a primary concern and dilemma that both the ARRC and ISDA began to address last year and plan to provide official guidance for in the coming months. In the meantime, the ARRC has published consultations related to a few specific U.S. dollar LIBOR-based instruments (bilateral business loans, securitizations, floating rate notes, and syndicated business loans) which lay out an initial framework for adopting SOFR fallback language in new contracts. This preliminary advice is slightly tailored to each product, can vary depending on the preference of market participants, and will be completely voluntary in its adoption once it has been officially published. The most important topics they are addressing include specific triggers, the successor rate, the spread adjustment mechanism, and term structure.

Trigger events prompt the transition from LIBOR to a new reference rate and may occur either before or after LIBOR’s planned cessation. The deliberation about successor rates is primarily related to the “waterfall”, which is a provision specifying the priority of unadjusted rates that will replace LIBOR. The waterfalls proposed by the ARRC provide several potential successor rates and utilize SOFR or some other form of SOFR based benchmark, in addition to a spread. The spread adjustment mechanism will specify the priority of spread adjustments applied to the successor rate to account for differences between LIBOR and SOFR in order to limit value transfer. Because SOFR is currently only published on an overnight basis there will also likely need to be a spread adjustment consideration to account for term differences.1

The final solutions to the above topics are still being considered; however, the general approach the ARRC is utilizing for each of these topics can be gleaned from the original guiding principles they published. They expect considerable uniformity in language between the ARRC and ISDA, and high flexibility and discretion in early suggestions. The ultimate goal of their fallback language guidance is consistency across asset classes providing for limited litigation, minimum basis risk, feasibility of implementation, and minimum value transfer.2

The International Swaps and Derivatives Association (ISDA) has also undergone a “consultation” release process, and recently published its initial fallback language results related to a few non-USD IBOR’s (it is believed that the USD LIBOR guidance will be similar). The primary purpose of this release was to address the rate setting and spread adjustment language that will be adopted in a new set of ISDA definitions. The general consensus was a ‘compound setting in arrears rate’, and a ‘historical mean/median approach’ for spread adjustment. Further detail on the methodologies considered as well as their pros/cons can be found in the ISDA Consultation Report. Keep in mind that the actual methodologies have yet to be finalized and are still under consideration.

Update on Next Steps

The next step recommendation identified in our newsletter last June was to wait on future fallback language clarification, while reviewing existing LIBOR-based contracts and monitoring the SOFR market as it continues to evolve. This recommendation remains relevant; however, it has seen some refinement as the process of replacing LIBOR continues to advance.

The main priority for most market participants should be to review and have an understanding of the fallback language (or lack thereof) included in their existing LIBOR-based contracts (What’s the alternative rate? Who chooses the alternative rate? When is the alternative rate triggered?). More complete fallback language will begin to circulate in the coming months for new contracts, and the ARRC advises issuers to adopt it as it comes out rather than wait until the final, complete guidance has been determined. Their thought is that ongoing integration of new language should provide for a gradual increase in future flexibility with the ultimate adoption of market-wide fallback language. Whether an organization adopts the ARRC proposed language as it continues to materialize is wholly voluntary and ultimately comes down to the goals and individual characteristics of the organization and its LIBOR-based contracts. Fallback language in legacy contracts is not expected to be addressed in the near future, and at the moment many believe that it may be easier to amend existing contracts to a SOFR rate rather than amend their fallback language. This line of thinking is continuing to develop and should be kept in mind as future guidance rolls out. ISDA fallback language guidance follows a similar approach and at the moment is not required to be included in ISDA definitions.

Now that SOFR is actively published, staying up to date on what’s happening in the market should remain a priority. The performance of SOFR compared to LIBOR and the Fed Funds rate is of particular importance. Below is a historic comparison of these indices since 2014.

Market sentiment favors not waiting until 2021 to address the LIBOR phase out, though there is a need to remain patient as the market continues to develop. However, we encourage you to reach out to a Blue Rose advisor to assist in evaluating these concepts and determining what approaches may be beneficial for your institution to consider at this point in time.

About the Author:

Brandon Lippold – Associate

Brandon provides financial modeling, analytics, market data and research in support of the delivery of capital planning, debt and derivatives advisory and reinvestment services to Blue Rose clients. He holds a bachelor’s degree in financial management from the University of St. Thomas and is a Series 50 licensed municipal advisor representative.

Comparable Issues Commentary

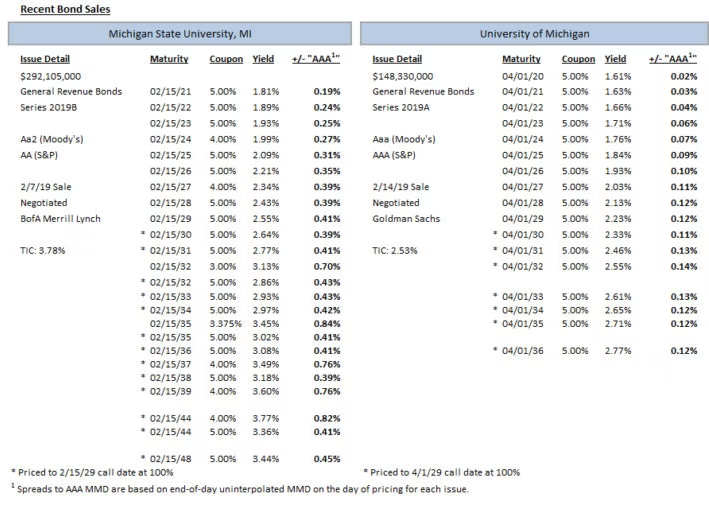

Both universities utilized their tax-exempt bond issues for combined new money and refunding purposes. Michigan State’s Series 2019B bonds financed a large variety of new money projects ranging from new building construction (including, among other projects, a science and technology building, STEM teaching and learning facility, music building addition, significant infrastructure related to the Facility for Rare Isotype Beams, residence halls, and parking) to campus infrastructure improvements (such as power plant modernization and campus water system improvements), with $276.59M of total new money issuance. They also provided for the refinancing of two series of Commercial Paper Notes (Taxable Series B and Tax-Exempt Series F) outstanding in the amount of $51.41M. Similarly, the University of Michigan’s 2019A bonds financed approximately $91.06M of new money projects, including the replacement and renovation of various lab buildings along with the renovation of the Michigan Union, expansion of the central power plant, and construction of additional parking. They also provided for the current refunding of $83.985M of the University’s outstanding Series 2009D bonds.

Both deals priced on relatively favorable days in the tax-exempt market, with MMD yields reduced across the yield curve on both the 7th and 14th. Michigan State’s pricing on the 7th saw MMD reduced by 2 bps from 2021-2024 and 3 bps on the remainder of the curve from 2025-2049 (unchanged in 2020). Similarly, Michigan’s pricing on the 14th saw MMD yields reduced 1 bp from 2020-2022, 2 bps from 2023-2024, and 3 bps from 2025-2049. Michigan State’s bonds were issued with a final maturity of 29 years (February 2048), while Michigan’s issue carries a shorter final maturity of 17 years (April 2036).

The two universities each used a standard 10-year par call structure for their deals, but opted for slightly differing coupon structures for their transactions. Michigan utilized a pure 5% coupon structure across the entirety of its bond issue, while Michigan State used predominantly 5% coupons, but mixed in a greater variety of coupon diversity across the issue, with callable 4% maturities in 2037, 2039, 2044, and 2048 and discount 3%-handle coupons in 2032 and 2035. As part of this strategy, MSU used coupon bifurcation over a number of maturities (2032, 2035, and 2044), allowing for coupon diversification while still maintaining blocks of 5% coupon maturities in those years as well. The debt service structures of the two deals differed slightly as well, with MSU issuing its 2019B bonds to generate purely level debt service through the final maturity of 2048 while Michigan’s 2019A issue provides for higher debt service in earlier years as a result of the 2009D refunding before stepping down after that issue’s final maturity in 2030.

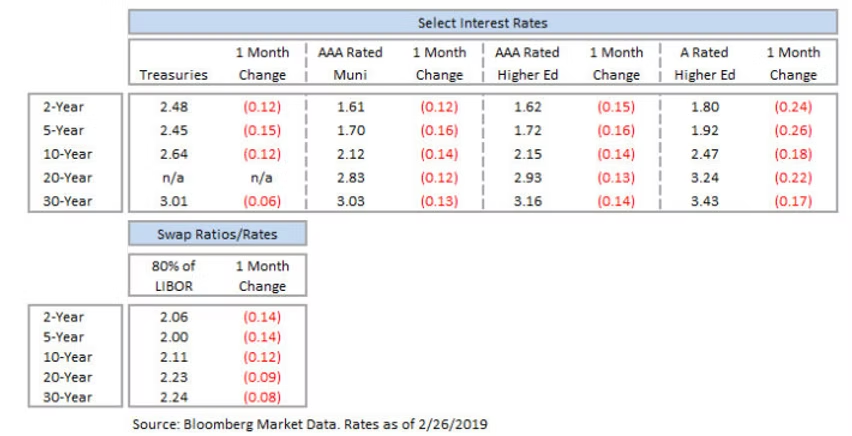

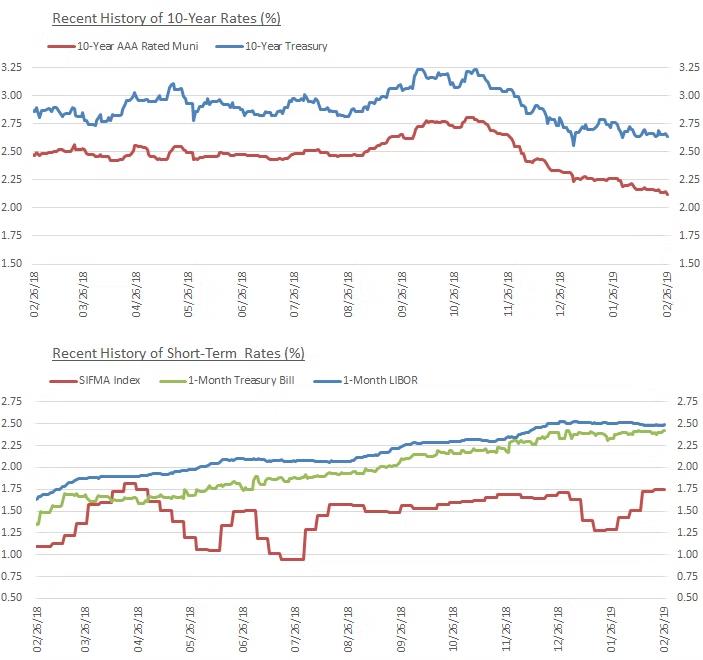

Interest Rate Charts