With the passage of tax reform in late 2017, refinancing opportunities for municipal borrowers took a significant hit due to the elimination of tax-exempt advance refundings. Taxable advance refundings, while still a nominal option available to borrowers, have generally not generated sufficient economic benefit to be utilized by most of the municipal market. With interest rates elevated for most of 2018, only the most attractive advance refunding candidates have been able to produce substantial savings through taxable refinancings. However, with both taxable and tax-exempt interest rates falling to near-historic lows this summer, opportunities are emerging for taxable advance refundings to generate savings for a much broader spectrum of deals than in the past.

What Factors Are Leading to Improved Effectiveness of Taxable Advance Refundings?

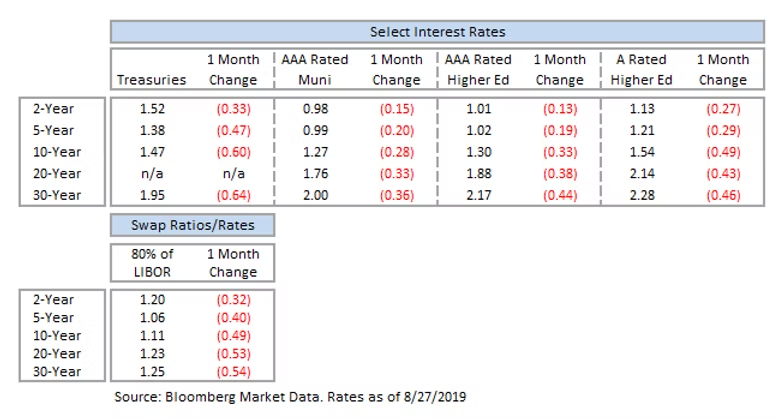

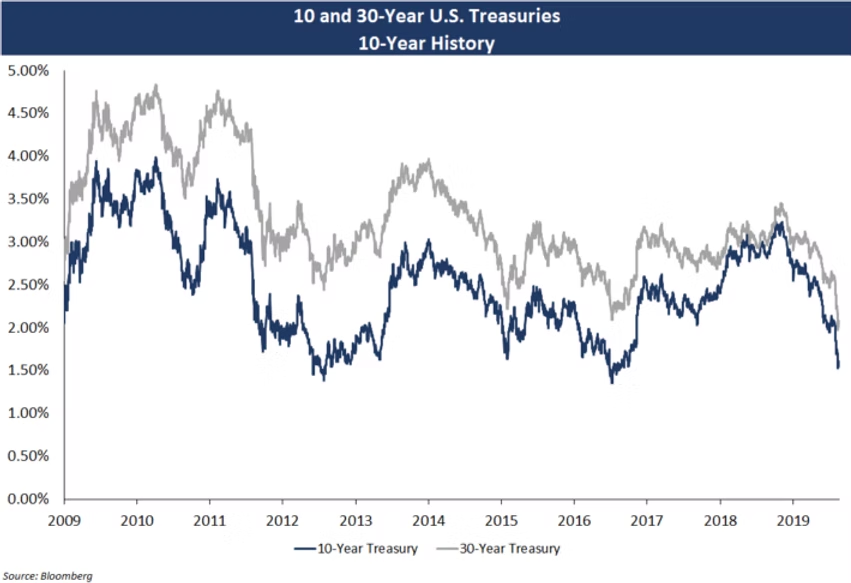

The simplest, and by far the most important, reason for growing interest in taxable advance refundings has been the precipitous decline in interest rates in 2019. With the 30-year treasury falling below 2% for the first time and the 10-year treasury nearing its own historic low (which occurred during Brexit), taxable rates across the curve are as low as ever, and certainly at post-tax reform minimums (see chart below). The last time rates were this low (in summer 2016), tax-exempt advance refundings remained available for issuers to take advantage of, leaving little reason for most borrowers to consider taxable refinancing due to the superior economics of the tax-exempt approach. Now, however, the renewed decline in interest rates means that borrowers with call dates in the next few years have an unexpected opportunity to lock in positive savings on refunding transactions that had seemingly disappeared with the elimination of tax-exempt advance refundings.

In addition to the low rate environment and uncertain future economic climate incentivizing some issuers to lock in refunding savings now, taxable financings allow borrowers to reduce many of the administrative burdens that go along with tax-exempt bonds. Monitoring private use of facilities and tracking the useful economic life of bond-financed projects are examples of items mitigated by the use of taxable financing. Additionally, we have seen clients utilize taxable financing to create additional revenue opportunities for certain bond-financed projects by opening them up to private use that would not have been possible for tax-exempt debt-financed property. The importance of these supplemental factors will vary between borrowers, but they are issues worth examining closely if a taxable refunding is under consideration.

Recent Examples of Taxable Advance Refundings in Higher Education

Decision Points Relating to Taxable Advance Refundings

Additionally, the borrower to some extent must consider both its outlook and the market’s outlook on future interest rates to determine whether waiting until closer to the call date to price a tax-exempt current refunding might be a better option. Blue Rose can perform breakeven analyses to show how much tax-exempt rates would need to rise between now and the call date for a taxable advance refunding to outperform a tax-exempt current refunding. Depending on the result of such an analysis, issuers can consider the tradeoffs between the two options and determine which course of action is the right fit.

Finally, if a borrower has a call date coming up within the next year or two, tax-exempt forward refundings remain a potential competitor to taxable advance refundings. These transactions involve pricing tax-exempt bonds months ahead, but not settling until within 90 days of the refunded bonds’ call date. This allows the deal to be done on a tax-exempt basis, but at the expense of a forward premium charged by investors based on the time elapsed between pricing and closing of the bonds. Despite this premium, forward refundings can often be more cost-effective than taxable advance refundings (albeit to varying degrees depending on the transaction and timing). However, they also carry negatives of their own, with some risk inevitably incurred as a result of the extended closing period, and maintain all of the restrictions and reporting requirements of standard tax-exempt bonds, that can be mitigated by issuing taxable refunding bonds instead.

Conclusion

There are many factors to consider when contemplating pursuit of a taxable advance refunding issue, but the market is in as good a position for these deals as ever, and many options exist for borrowers with relatively near-term refunding opportunities that once would have simply been advance refunded on a tax-exempt basis. If your institution has an issue outstanding with a near-term call date that may generate refunding savings in the current low interest rate environment, feel free to contact Blue Rose and we can help to evaluate potential financing options to capture interest rate savings efficiently.

About the Author:

Max Wilkinson, Analyst joined Blue Rose Capital Advisors in September 2016. In his role as, Analyst, Mr. Wilkinson provides in-depth modeling, research, and analytics in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. He is responsible for preparing analyses considering various bond structuring options, comparable issue pricings, institutional debt capacity constraints, credit rating models, and break-even refinancing rates. Mr. Wilkinson is involved in every step of the financing process for various clients, from initial development of the plan of finance to rating agency presentations to bond and derivative pricing and bidding of reinvestment products. He also maintains databases and performs periodic analyses to identify refunding and other debt restructuring opportunities for current and potential clients.

Comparable Issues Commentary

The maturity structures of the two bond deals differed significantly, with Northern Colorado’s deal concentrating maturities at the front of the yield curve to match the structure of the 2011A bonds being refunded (amortizing over just 12 years). In contrast, Georgia Tech’s issue utilized a 30-year amortization. Both issues defeased maturities prior to the call dates of the refunded bonds, with Georgia Tech utilizing the refunding issue to defer sizable balloon payments of greater than $20 million each in 2019 and 2022. Both deals were priced with a par coupon structure, as is typical for taxable bonds, and each issuer also opted to utilize a 10-year par call option.

Interest Rate Charts