At Blue Rose, we’re seeing many issuers are evaluating the trade-off between risk and return associated with Guaranteed Investment Contracts (“GICs”) for the investment of bond proceeds. While both a repurchase agreement (“repo”) and GIC can offer the certainty of a fixed rate of return, capital preservation, and intended liquidity, a GIC can result in a much higher yield. In the current market, the difference between the rate of earnings of these investment structures could be as high as 65 basis points (0.65%), depending on the balance invested, the time period for which the balance is invested, and the type of collateral that is eligible under a repo agreement. We recently closed an approximately 8-month GIC which priced in January 2023 at a rate nearing 4.85% that offers a fully flexible weekly draw schedule. Given these benefits, when should your institution consider using a GIC?

One of the main differences between a GIC and a repo is the counterparty or credit risk. Under a GIC, an issuer’s investment is uncollateralized and, therefore, the issuer essentially becomes an unsecured creditor of the financial institution. To mitigate this credit risk, we recommend that a GIC only be entered into with highly rated banks and financial institutions. Furthermore, a GIC typically also includes a provision that collateral must be posted in the event that the financial institution is downgraded below a specified rating, often in the BBB category. As a result, an issuer’s investment would become secured as the financial institution’s credit deteriorates.

There is a risk that the financial institution’s rating is downgraded below a specified rating and the bank then fails prior to posting collateral. This is an unforeseen risk; however, we also believe the market transparency has improved since the financial crisis of 2008. For instance, we’ve seen rating agencies improve their rating practices, leading to a more rapid assessment of a particular institution’s credit worthiness. Nevertheless, while the risk from a rapid bankruptcy is not fully eliminated, we encourage issuers to consider them in particular for shorter-dated investments, such as construction funds and capitalized interest funds.

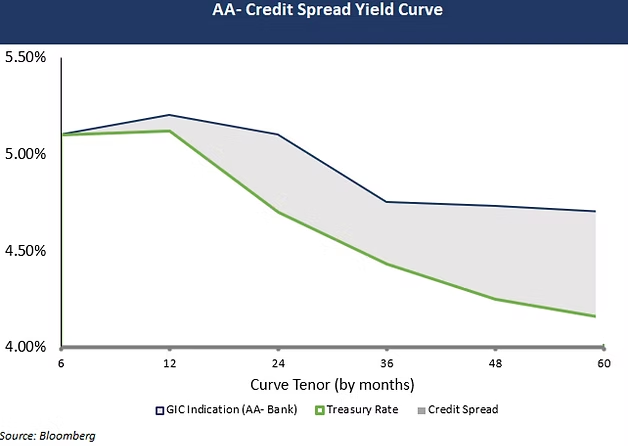

For issuers willing to take on greater risk and utilize a GIC for a slightly longer-dated investment, there is an additional rate of return benefit with utilizing GICs as opposed to a laddered portfolio or repurchase agreement. Unlike these investment products, GICs include a credit component, meaning that the yield does not directly correlate to the heavily inverted treasury yield curve. An unsecured GIC in the current market can slightly offset the negatively sloping treasury yield curve, depending on the bank’s credit rating. For example, in the chart below we show the approximate spread between a GIC rate from an AA-rated bank and the Treasury yield curve. As you can see, the GIC yield curve slightly offsets the negatively sloping treasury curve.

To discuss these types of investments as they relate to your specific needs and risk tolerance, please contact your Blue Rose advisor.

Meet our Author:

Georgina Walleshauser, Vice President | 952-746-6036

Georgina Walleshauser joined Blue Rose in 2017 as an Analyst, providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. In the role of Associate, she utilized her experience as an Analyst in a more client-facing role, while still performing much of the analysis utilized in this capacity. In her role of Assistant Vice President, she will be tasked with growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056