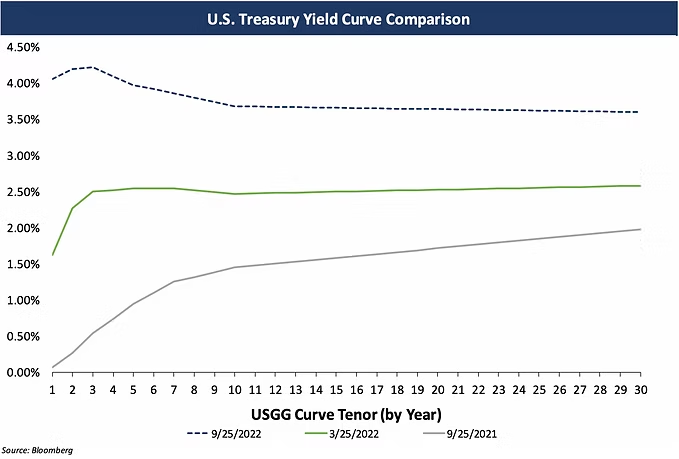

This month the Federal Reserve raised interest rates again by 0.75%, and we continue to see significant increases in treasury rates, particularly on the front end of the yield curve. As a result, the treasury yield curve is now significantly inverted, as showcased in the chart below.

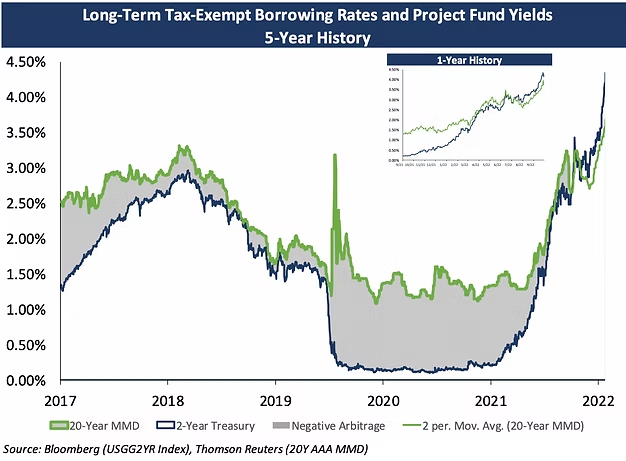

In September of this year alone, the 2-year treasury rate has increased ~70 basis points. Meanwhile, longer term tax-exempt rates have not increased at the same pace. The 20-year MMD rate, representing tax-exempt long-term borrowing costs, increased by ~47 basis points this month. Similar movements in the taxable and tax-exempt yield curves earlier this year have created a market environment where there exists little to no negative arbitrage for new money borrowers.

This presents an opportunity for tax-exempt issuers we have not seen in some time. Not only has negative arbitrage all but been eliminated, but in many cases, the current market environment provides a positive arbitrage situation for borrowers. As of September 27th, 20-year MMD – a proxy for the long-term rate that tax-exempt borrowers can anticipate – was 3.71% and the 2-year treasury – a proxy for where those funds can be reinvested at – was 4.28%. The following chart depicts this recent trend.

For tax-exempt borrowers who are coming to market with new money issuances, or have outstanding unspent bond proceeds, now is the perfect time to consider the most efficient reinvestment options for construction funds, capitalized interest funds, debt service reserve funds, or other accounts with similar time horizons. Below we show current reinvestment rate indications. We encourage you, as always, to reach out to your Blue Rose advisor for a tailored reinvestment indication to your specific fund(s) and discussion of the risks and benefits to each type of reinvestment structure.

|

Average Life

|

GIC

|

Repo

|

Portfolio

|

|---|---|---|---|

|

1-year

|

4.30%

|

4.15%

|

3.99%

|

|

2-year

|

4.325%

|

4.10%

|

4.07%

|

|

3-year

|

4.125%

|

|

|

*Indicative rates as of September 28th, 2022.

Meet our Author:

Georgina Walleshauser, Assistant Vice President | 952-746-6036

Georgina Walleshauser joined Blue Rose in 2017 as an Analyst, providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. In the role of Associate, she utilized her experience as an Analyst in a more client-facing role, while still performing much of the analysis utilized in this capacity. In her role of Assistant Vice President, she will be tasked with growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056