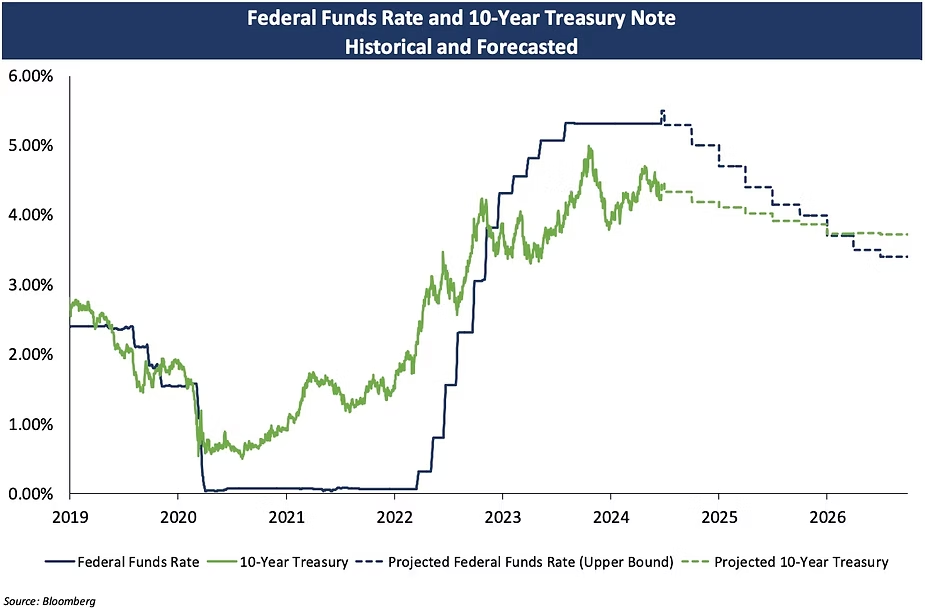

Based on the Federal Reserve sentiments and economic data from mid-June, the market is still expecting to see at least one Fed Fund rate cut before the end of the year.

For tax-exempt borrowers who are coming to market with new money issuances, or have outstanding unspent bond proceeds, we strongly encourage you to consider the most efficient reinvestment options. Below we show current reinvestment rate indications. For a more tailored indication to your specific fund(s) or to discuss the risks and benefits associated with these structures, please reach out to Georgina Walleshauser or your Blue Rose advisor.

|

Average Life

|

GIC

|

Repo

|

Portfolio

|

|---|---|---|---|

|

1-year

|

5.20%

|

4.50%

|

5.02%

|

|

2-year

|

4.88%

|

4.05%

|

4.62%

|

|

3-year

|

4.70%

|

|

4.40%

|

Indicative reinvestment rates as of June 20, 2024.

Georgina Walleshauser, Vice President | 952-746-6036

In her role of Vice President, Georgina Walleshauser manages a number of the firm’s clients, providing them with advice on and ensuring a smooth closing for all types of debt and derivative product transactions, capital planning solutions, and detailed credit assessments. Ms. Walleshauser serves as an advisor to public and private higher education, non-profit and governmental institutions. She specializes in analyzing and assessing reinvestment strategies for clients, leading most of Blue Rose’s reinvestment transactions. Ms. Walleshauser has vast expertise in providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. She joined Blue Rose in 2017 as a Junior Quantitative Analyst.

Media Contact:

Laura Klingelhutz, Marketing Coordinator

952-208-5710