CPI data came out higher than anticipated this month, a signal to investors and market participants that the Fed may not be ready to cut rates just yet.

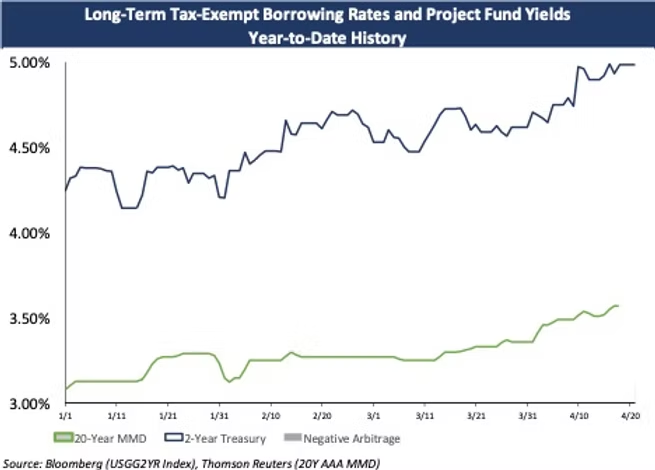

Since March 1st, tax-exempt MMD rates have increased ~30 basis points in the 20-30 year tenor range of the yield curve. Taxable rates in the 2-3 year tenor range have increased by a greater amount in the same time frame – by approximately 45 basis points. One implication of these movements is a greater benefit of positive arbitrage for tax-exempt issuers choosing to reinvest their bond proceeds with fixed rate products in cases where their bond funds have an average life of 2-3 years. Nonetheless, shorter bond funds less than a two-year duration continue to have the potential to earn positive arbitrage as well.

We strongly recommend that borrowers assess each product available to them prior to deciding on a reinvestment structure. Blue Rose Capital Advisors can assist with classifying the benefits and risks associated with each of the various structures. Below we show current reinvestment rate indications for common fixed rate products assuming a $50M bond fund, net of estimated associated fees.

|

Average Life

|

GIC

|

Repo

|

Portfolio

|

|---|---|---|---|

|

1-year

|

5.25%

|

4.86%

|

5.15%

|

|

2-year

|

4.97%

|

4.56%

|

4.95%

|

|

3-year

|

4.88%

|

|

4.82%

|

When comparing these rates to rates offered by a money market fund or similar variable rate product, it’s important to take into consideration how the associated fees will affect the overall yield on your investment. The impact can vary greatly depending on the size and length of any particular investment. For a more tailored fixed rate indication to your specific fund(s) or to discuss the risks and benefits associated with these structures, please reach out to Georgina Walleshauser or your Blue Rose advisor.

Georgina Walleshauser, Vice President | 952-746-6036

In her role of Vice President, Georgina Walleshauser manages a number of the firm’s clients, providing them with advice on and ensuring a smooth closing for all types of debt and derivative product transactions, capital planning solutions, and detailed credit assessments. Ms. Walleshauser serves as an advisor to public and private higher education, non-profit and governmental institutions. She specializes in analyzing and assessing reinvestment strategies for clients, leading most of Blue Rose’s reinvestment transactions. Ms. Walleshauser has vast expertise in providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. She joined Blue Rose in 2017 as a Junior Quantitative Analyst.

Media Contact:

Laura Klingelhutz, Marketing Coordinator

952-208-5710