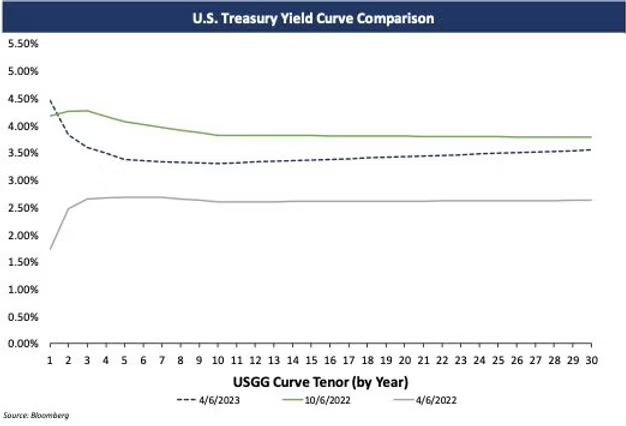

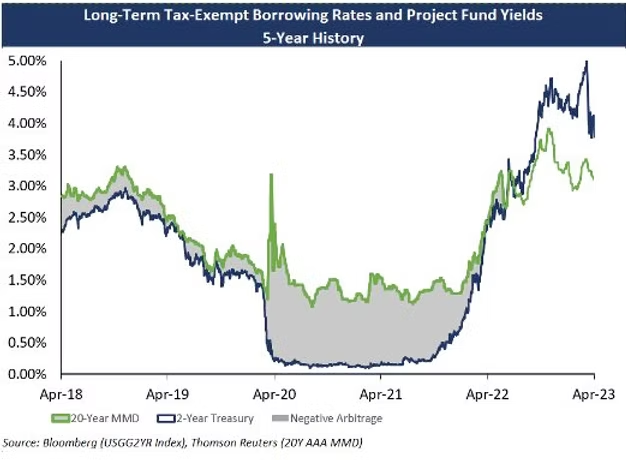

The Federal Reserve raised interest rates again last month by 0.25% and we continue to see a significantly inverted treasury yield curve. As a result, issuers can benefit from reinvesting bond proceeds and lock-in higher short-term investment rates.

For tax-exempt borrowers who are coming to market with new money issuances, or have outstanding unspent bond proceeds, now is the perfect time to consider the most efficient reinvestment options. Below we show current reinvestment rate indications. We encourage you, as always, to reach out to your Blue Rose advisor for a tailored reinvestment indication to your specific fund(s) and discussion of the risks and benefits to each type of reinvestment structure.

|

Average Life

|

GIC

|

Repo

|

Portfolio

|

|---|---|---|---|

|

1-year

|

4.14%

|

3.75%

|

4.40%

|

|

2-year

|

4.04%

|

3.15%

|

3.80%

|

|

3-year

|

3.74%

|

|

3.60%

|

Meet our Author:

Georgina Walleshauser, Vice President | 952-746-6036

Georgina Walleshauser joined Blue Rose in 2017 as an Analyst, providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. In the role of Associate, she utilized her experience as an Analyst in a more client-facing role, while still performing much of the analysis utilized in this capacity. In her role of Assistant Vice President, she will be tasked with growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056