Updated: May 15

The Federal Reserve cut interest rates by 50 bps at this month’s FOMC meeting. Many of our clients have asked us about the market implications following interest rate changes made by the Fed. Similar to the interest rate increases we’ve seen in recent years, this rate cut seems to have been priced into the market for taxable short-term rates prior to the FOMC meeting last week.

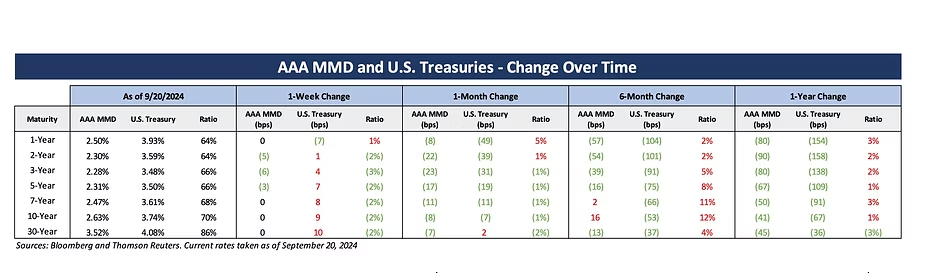

Below is a summary of interest rate changes for taxable and tax-exempt rates over the last year. As you can see, there was little change to the 1-year treasury rate over the last week. However, the 1-year treasury rate has fallen ~50 basis points over the past month. While this is in part coincidental and should not imply there is a parallel shift between the fed funds rate and 1-year treasury, it does suggest that the market was pricing in expectations of falling interest rates leading up to this month’s FOMC meeting. We mentioned in our previous market update that as of August 8th there was a majority consensus for a 50 bps cut in September according to CME’s FedWatch – and that remained consistent over the past several weeks.

The next FOMC meeting will be held November 7th. According to CME’s FedWatch on September 23rd, there is a 49.6% chance of one interest rate cut and a 50.4% chance of two interest rate cuts at the November meeting. There is a 0% chance of no interest rate cut. This, of course, is subject to change between now and November, and the Fed’s decision won’t be certain until the meeting. However, the historical rate changes suggest that whether or not the Fed does cut rates at the November meeting, if more cuts are expected by the market, it may cause further short-term treasury rate decreases prior to an announcement.

We have helped many borrowers and issuers lock in fixed rate products for the reinvestment of their tax-exempt bond proceeds this year. Unlike variable-rate products, their reinvestment rates are not subject to these market fluctuations. Although current short-term rates have fallen sharply, the inversion of the yield curve still presents an opportunity to benefit from short-term investment products, and in a falling interest rate environment we continue to encourage borrowers and issuers to consider fixed-rate products.

Below we show current reinvestment rate indications. For a more tailored indication to your specific fund(s) or to discuss the risks and benefits associated with these structures, please reach out to Georgina Walleshauser or your Blue Rose advisor.

|

Average Life

|

GIC

|

Repo

|

Portfolio

|

|---|---|---|---|

|

1-year

|

3.95%

|

3.43%

|

3.85%

|

|

2-year

|

3.58%

|

3.16%

|

3.50%

|

|

3-year

|

3.60%

|

|

3.42%

|

Georgina Walleshauser, Vice President | 952-746-6036

In her role of Vice President, Georgina Walleshauser manages a number of the firm’s clients, providing them with advice on and ensuring a smooth closing for all types of debt and derivative product transactions, capital planning solutions, and detailed credit assessments. Ms. Walleshauser serves as an advisor to public and private higher education, non-profit and governmental institutions. She specializes in analyzing and assessing reinvestment strategies for clients, leading most of Blue Rose’s reinvestment transactions. Ms. Walleshauser has vast expertise in providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. She joined Blue Rose in 2017 as a Junior Quantitative Analyst.

Media Contact:

Laura Klingelhutz, Marketing Coordinator

952-208-5710