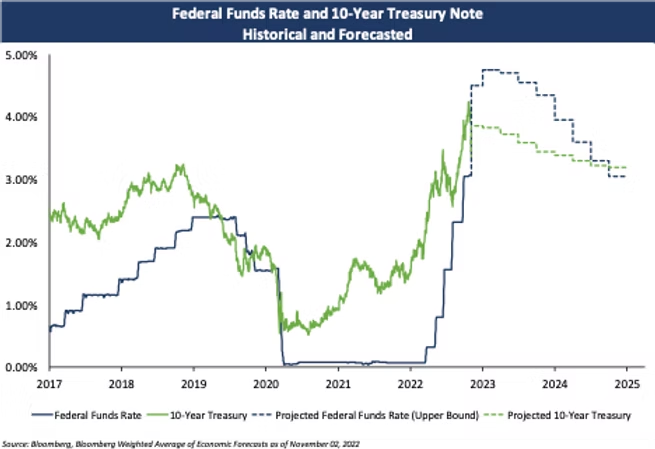

Not surprisingly, the FOMC meeting last week resulted in another 75-basis point rate hike to the Fed Funds rate. Based on the Bloomberg Weighted Average forecast (shown in the graph below), the current market sentiment is that rates will continue to increase through the beginning of next year. The forecasters surveyed by Bloomberg, however, vary in their assessment. Of the firms that make up this weighted average, some believe interest rates won’t decrease until the end of 2024. This idea that rates will continue to rise without an end in sight could be particularly troublesome for borrowers with future capital needs, but it doesn’t have to be.

One strategy for borrowers with near- to medium-term capital needs would be to accelerate their capital improvement plans, lock-in long-term rates before they rise further, and lock in their short-term reinvestment earnings utilizing any number of investment strategies, potentially including a structured product. In many instances, we’re seeing a positive arbitrage environment (i.e., the short-term investment rate exceeds the long-term borrowing rate). Thus, this strategy could create a free (or nearly free) option on higher rates. Rather than wait to borrow for future capital needs, this strategy allows borrowers to earn interest at a rate that is comparable to, or in excess of, their borrowing rate. Structured reinvestment products can provide borrowers with draw flexibility, creating the potential to earn interest on the full amount of proceeds for an extended period of time. Below are estimated indicative reinvestment rates in the current market.

|

Average Life

|

GIC

|

Repo

|

Portfolio

|

|---|---|---|---|

|

1-year

|

5.10%

|

4.85%

|

4.76%

|

|

2-year

|

5.10%

|

4.75%

|

4.70%

|

|

3-year

|

4.90%

|

|

|

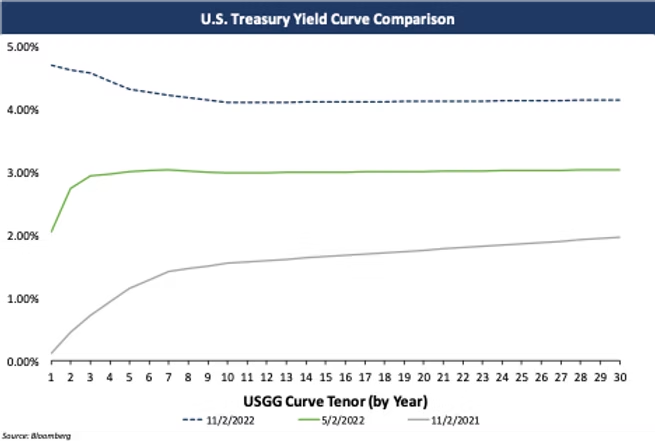

Additionally, we’re seeing investors accepting shorter call dates on public issuances. The inverted yield curve below suggests that rates are expected to decrease in the future, perhaps upon the onset of a recession. To the extent that rates fall, the debt could be refunded sooner if a shorter call feature is included in the bond issue. Alternatively, rather than a long-term borrowing, this strategy could work with a shorter-term borrowing structured with a single bullet maturity.

Of course, there are many factors to consider for this type of strategy, including but not limited to the borrower’s credit rating, the debt structure, the term of the borrowing, the authorized investments, as well as the size and timing of the capital projects. If you or your client is interested in learning more about how to utilize this strategy, please reach out to me to discuss specific situations and reinvestment solutions.

Meet our Author:

Georgina Walleshauser, Assistant Vice President | 952-746-6036

Georgina Walleshauser joined Blue Rose in 2017 as an Analyst, providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. In the role of Associate, she utilized her experience as an Analyst in a more client-facing role, while still performing much of the analysis utilized in this capacity. In her role of Assistant Vice President, she will be tasked with growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056