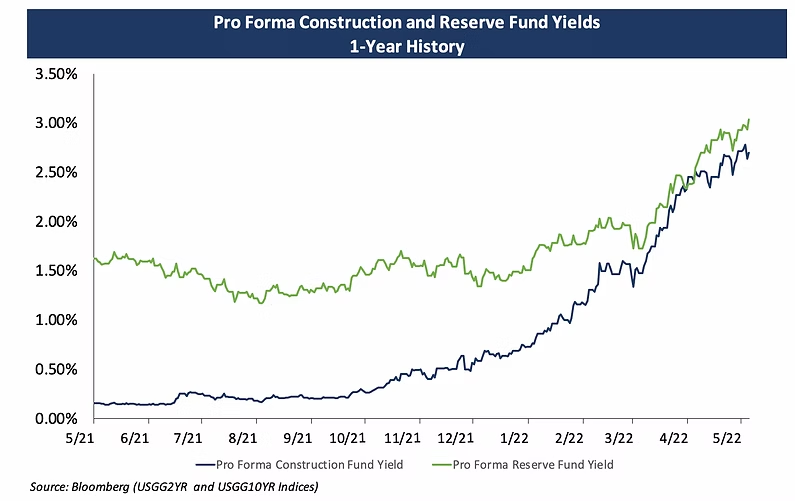

The current market continues to produce extremely volatile interest rates from week to week, day to day, and even intraday. Although such a volatile interest rate environment presents many disadvantages to all market participants, there can also be some advantages.

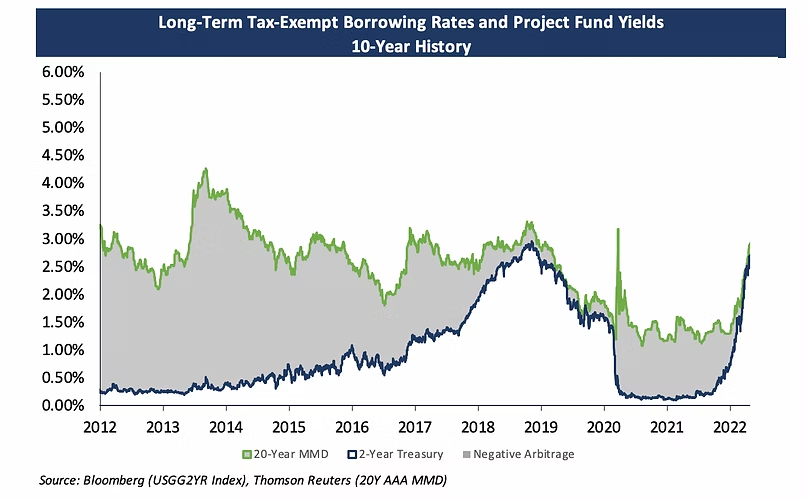

For issuers, one of the advantages of intraday volatility is the ability to bid for Open Market Securities (OMS) on their refunding escrows. While State and Local Government Series securities (SLGS) rates are reducing the amount of negative arbitrage on refunding escrows, we have seen many issuers realize an even greater benefit by utilizing OMS. There have been significant changes in the intraday yields of short-term treasury rates over the last few months. On days when short-term interest rates are rising, since SLGS rates are set in the early morning and OMS rates are set at the time of bidding (late morning or the afternoon), there is an opportunity to realize a significant benefit with OMS compared to SLGS.

For escrows that are allowed to be funded with SLGS, we at Blue Rose undertake an early assessment of the potential advantage of using OMS vs. SLGS. Issuers wondering about the potential benefit of pursuing an OMS-funded escrow can easily find out, since our experts provide this analysis at no cost and with no further obligation for issuers. Furthermore, if OMS do not provide a benefit to SLGS on the day of bidding, there is little to no consequence to the issuer as they still have the ability to subscribe for SLGS.

We encourage you to reach out to your Blue Rose advisor for an indicative escrow cash flow analysis and to learn more about our bidding agent services for your escrow transaction.

Meet our Author:

Georgina Walleshauser, Assistant Vice President | 952-746-6036

Georgina Walleshauser joined Blue Rose in 2017 as an Analyst, providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. In the role of Associate, she utilized her experience as an Analyst in a more client-facing role, while still performing much of the analysis utilized in this capacity. In her role of Assistant Vice President, she will be tasked with growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056