Many issuers with outstanding variable rate demand bonds (“VRDBs”) have been closely tracking the SIFMA index in recent weeks, due to increased market volatility. On March 18th, the weekly SIFMA index reset more than 390 basis points higher than the previous week’s reset, and then decreased by 49, 288, and 109 basis points in the next three consecutive weeks.

The recent decreases in the SIFMA benchmark do not necessarily imply a stabilization of the market. It is important to also monitor the relative comparison of SIFMA to short-term taxable indices such as 1-month LIBOR, the Fed Funds rate, and SOFR.

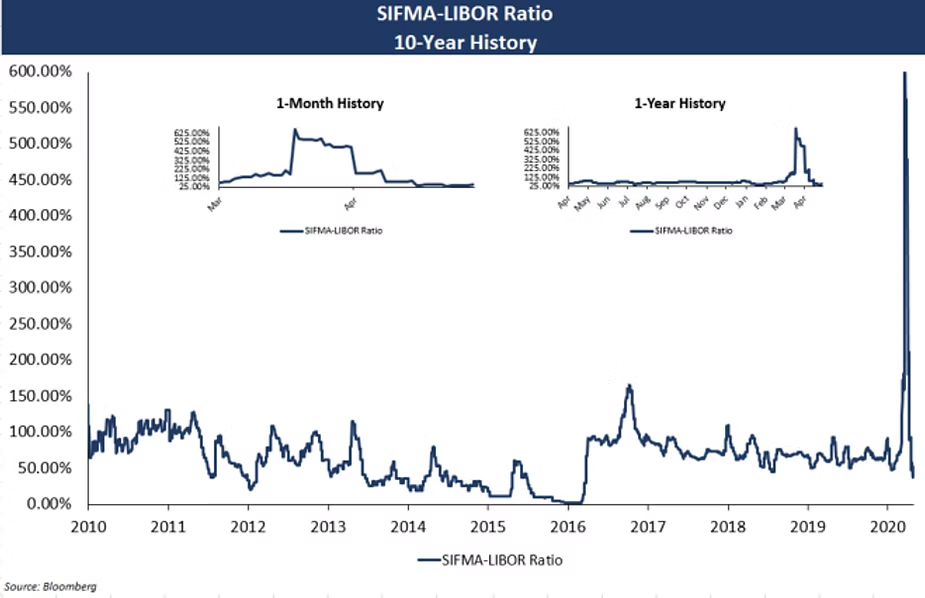

The comparison of SIFMA to 1-month LIBOR is particularly significant for the many issuers that are currently hedging their VRDBs with percentage of LIBOR interest rate swaps (“LIBOR swaps”). Prior to March 1st of this year, the daily ratio of the SIFMA to LIBOR averaged approximately 70.4% since January of 2007 and had not been higher than 110% since November 2016. It is because of this consistency in the ratios of these indices that issuers have often chosen to enter into LIBOR swaps to hedge SIFMA based loans. Based on historical data, the basis risk associated between 67-70% LIBOR and the SIFMA index has provided a reasonable level of comfort for many issuers.

The ratio between SIFMA and LIBOR is no longer as steady as it has been in the past, with the ratio fluctuating violently over the past several weeks, showcased with the 10-year, 1-year and 1-month historical tables below.

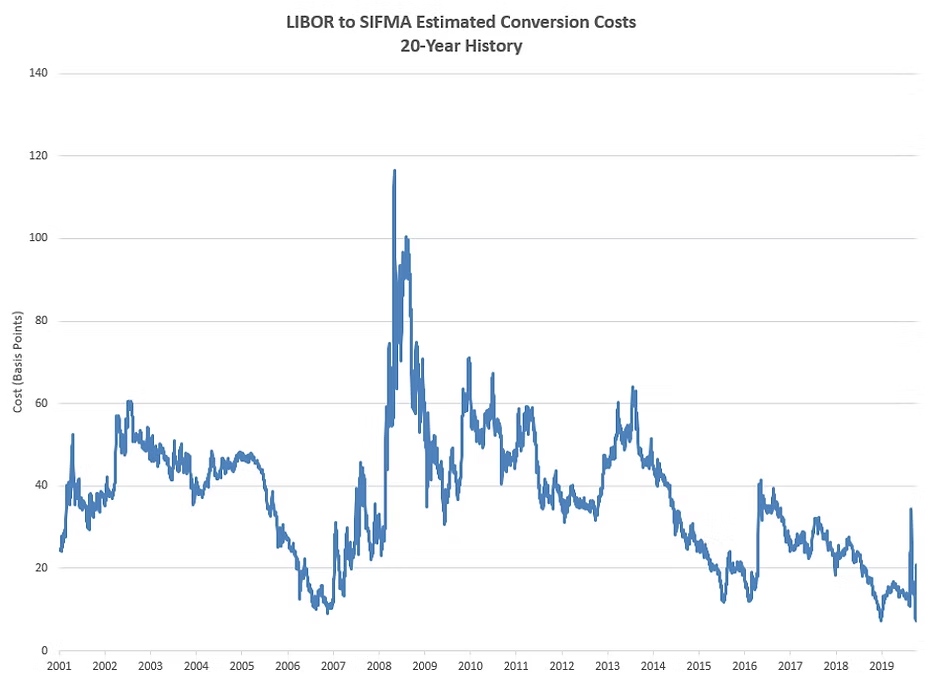

Given where absolute levels are currently, it may make sense for some issuers to convert their LIBOR swaps to SIFMA based swaps. While the cost of converting a 70% of LIBOR swap to a SIFMA swap has historically cost approximately 40 basis points over the last 20 years, due to recent market conditions, it may now cost as little as 10 basis points. The conversion of the benchmark on the interest rate swap would not only reduce basis risk but may also alleviate the concerns issuers may have about a future LIBOR phase-out into SOFR and how that might impact their basis risk going forward. The approximate cost of conversion has increased over the past week but has been fairly volatile in the current market and will need to be monitored with market movements prior to an execution.

We encourage you to reach out to your Blue Rose advisor to determine if you or your issuer could potentially benefit from an interest rate swap conversion from LIBOR to SIFMA.

About the Author:

Georgina Walleshauser, Analyst

Georgina Walleshauser joined Blue Rose in April 2017. As an Analyst, she is responsible for providing analytical, research, and transactional support to senior managers serving higher education, non-profit, and government clients with debt advisory, derivatives advisory, and reinvestment services. She also prepares debt capacity modeling, credit analysis, and market analysis to support the delivery of comprehensive, strategic, and resourceful capital planning tools to our clients.

Georgina can be reached at: [email protected]