In my house, baseball season turns to football season, which quickly turns to my favorite – basketball season. For many like us in the northern climates of the U.S., summer sunshine progresses to fall colors which, at least in Minneapolis, very quickly progress to winter cold. Audit season leads, typically none-too-quickly, to draft financial reports and on to final audited financial statements. In 2019, relatively low interest rates at the beginning of the year turned to lower interest rates, which quickly – specifically in July and August – turned to lower interest rates yet. This year, the combination of completed financial statements and low interest rates is turning to yet another season – accessing the bond markets. There are cycles to all these things, some known and anticipated and others completely unexpected. However, despite their repetitive nature, few cyclical items are true traditions.

At Blue Rose, one of our traditions is to gather our entire team in Minneapolis during the fall season for our annual meeting. A goal of this gathering each year is simple – to create an opportunity for our team to fulfill our passion for serving others in a way that is different from our day-to-day advisory work. Our company mission is to improve organizations by providing advices, services, advocacy, and transparency on complex financial matters. Yet, in many instances, the impact of our advisory services is realized “behind the scenes” by the organizations that we serve. During our annual meeting, our team is put to work through a community service project that allows us an opportunity to more tangibly demonstrate our mission and core values.

This year in September, the Blue Rose team ventured to the Ronald McDonald House near the University of Minnesota campus in Minneapolis. Together with our colleagues from HedgeStar, the Blue Rose team assisted in indoor and outdoor cleaning projects, organization of the facility’s library, and preparations for the upcoming holiday season. If you are unfamiliar with this non-profit organization, the Ronald McDonald House Charities’mission is keeping families with sick children together and near the care and resources they need. The average length of stay for a family at the Ronald McDonald House location that we served is a staggering 65 days. This is a long time for a family to be away from home and a normal routine, not to mention the stress that a child’s illness creates on the family unit. As such, it was our pleasure to serve this organization and the families that were calling the Ronald McDonald House home. For more information about Blue Rose’s service projects please visit our website.

As we proceed deeper into the Fall season and each of us soon comes upon annual traditions during the holiday season, I encourage you to consider opportunities to serve others through organizations like the Ronald McDonald House. In the meantime, and as our team continues to fulfill our mission through our day-to-day work, please let our advisors know if and how we can be of greater service to you.

About the Author

Comparable Issues Commentary

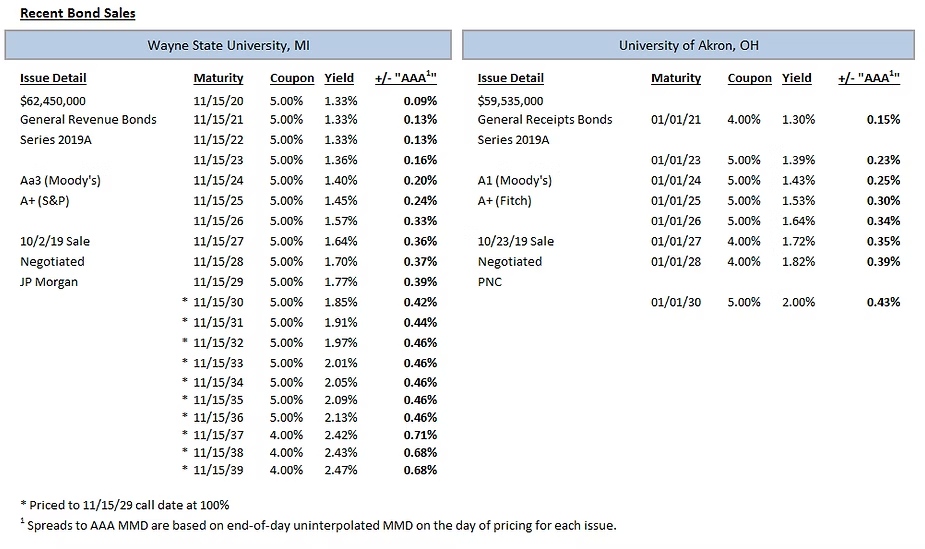

Shown below are the results of two negotiated, tax-exempt higher education issues that sold in the month of October. Wayne State University and the University of Akron priced their Series 2019A bond issues on October 2nd and October 23rd , respectively. The deals were sized similarly, with each university issuing approximately $60M of tax-exempt debt – additionally, both schools issued concurrent taxable bond issues, though Wayne State’s $25.685M Taxable Series 2019B par amount was double the size of Akron’s $12.045M Taxable Series 2019B issue. Wayne State’s deals were rated Aa3/A+ by Moody’s and S&P, respectively, while Akron’s bonds were rated A1/A+ by Moody’s and Fitch. Each university’s deals carried a refunding component, with Wayne State current refunding its 2009A and Taxable 2009B Build America Bonds as part of its 2019A issue while Akron issued its 2019A bonds to current refund the University’s outstanding callable Series 2010A bonds. Wayne State also issued bonds to finance $22.5M of new money projects, which included the renovation of the University’s Science and Engineering Library, modernization/construction of elevators in State Hall, Scott Hall, and Wayne State Stadium, completion of the School of Social Work building renovation, and construction of a new intramural field.

Both deals sold on fairly stable days in the market, with MMD unchanged on the 23rd for Akron’s sale and reduced on the 2nd by 2 bps from 2020-2026 and 3 bps from 2027-2049 on the day of Wayne State’s pricing. Each school generally elected to sell tax-exempt maturities earlier on the curve than their taxable maturities (with the exception of a single 2021 maturity in Akron’s Series 2019B taxable issuance), taking advantage of low, flat, and compressed yield curves that enabled a lower all-in borrowing cost to maturity by amortizing tax-exempt debt before taxable debt. Wayne State’s tax-exempt deal amortized over a longer period, with a final maturity in 2039 compared to the 2030 final maturity of Akron’s 2019A bonds. On callable maturities, Wayne State primarily utilized 5% coupons with the exception of the final 3 maturities in 2037-2039, which were sold with 4% coupons (Akron’s tax-exempt issue did not include callable bonds due to the 2030 final maturity).