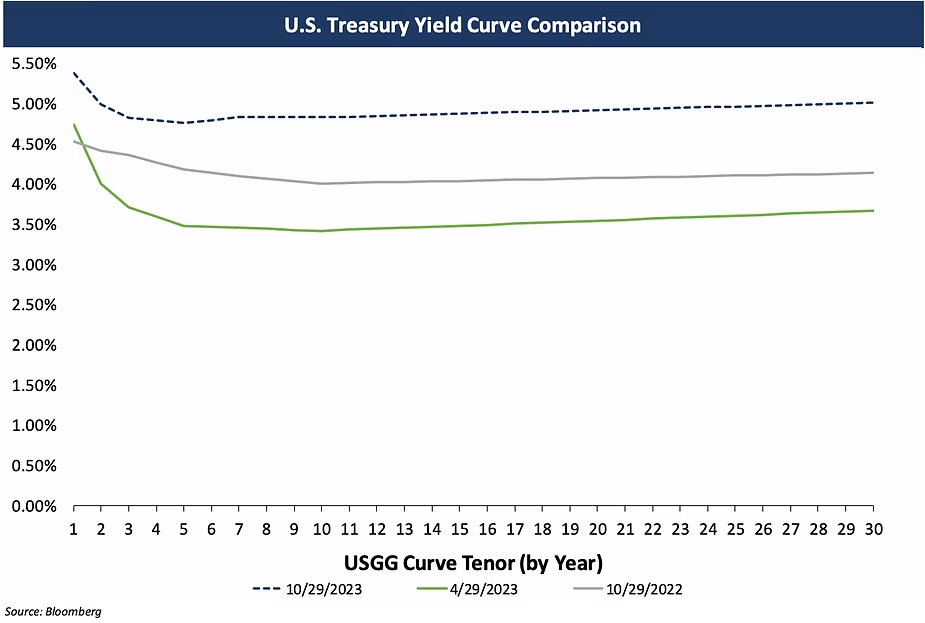

A significantly inverted treasury yield curve with elevated short-term rates continues to persist in the market. As a result, many issuers and conduit borrowers are finding the opportunity to earn positive arbitrage on their bond proceeds.

1. 6-Month Spending Exception

100% of proceeds are spent within 6 months

2. 18-Month Spending Exception

15% of proceeds are spent within 6 months

60% of proceeds are spent within 12 months

100% of proceeds are spent within 18 months

3. 2-year Spending Exception (75% construction issue)

10% of proceeds are spent within 6 months

45% of proceeds are spent within 12 months

75% of proceeds are spent within 18 months

100% of proceeds are spent within 24 months

As evidenced by the current treasury yield curve, the inverted yield curve reveals that interest rates are highest within the first two years of maturities. For issuers and borrowers coming to market with new money issuances for construction projects that will be completed within two years, they have potential to earn and possibly keep a significant amount of positive arbitrage earnings.

|

Average Life

|

GIC

|

Repo

|

Portfolio

|

|---|---|---|---|

|

1-year

|

5.45%

|

4.95%

|

5.30%

|

|

2-year

|

5.15%

|

4.65%

|

4.95%

|

|

3-year

|

4.95%

|

|

4.80%

|

Georgina Walleshauser, Vice President | 952-746-6036

Georgina Walleshauser joined Blue Rose in 2017 as a Junior Quantitative Analyst. She has vast expertise in providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. As Vice President, she manages a number of the firm’s clients and ensures that transactions run smoothly through closing. She specializes in analyzing and assessing reinvestment strategies for clients, leading many of Blue Rose’s reinvestment transactions.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056