Happy new year! At Blue Rose, we welcome the new year as it presents our advisory team and our clients with another opportunity to improve their organizations and overcome various challenges, whether those be in the capital markets or sector specific. Of course, our team is excited to connect with you, meeting to strategize and execute on various capital planning and transaction pursuits, or perhaps simply to socialize as we build our relationships. To that end, we hope to see you soon at our offices or yours, or somewhere else along the way including various conferences.

A Quick Look Back at Treasury Institute’s Bond Compliance Conference

Before we look ahead at opportunities to connect at 2020 conferences, Blue Rose was pleased to sponsor Treasury Institute’s Tax-Exempt Bond Compliance Conference 2019 on December 9th-11th in Orlando. Erik Kelly and Sam Gruer both attended and presented at the conference, which was an opportunity for higher education constituents and market professionals to provide case studies and deep dive details into the work of tax-exempt bonds for higher education institutions. Blue Rose was delighted to be a part of four of the conference sessions, including:

1. What Happens When LIBOR Goes Away

With the expected phase-out of LIBOR in 2021, Blue Rose is carefully following the LIBOR transition as it develops.

2. The Rating Agency Relationship

A particular emphasis of the panel discussion with Moody’s and S&P credit analysts was placed on the rating agency relationship in between financing transactions.

3. Issuing Bonds in Times of Uncertainty and Adversity

A panel representing various financing working group perspectives discussed the careful planning and considerations of issuing debt during difficult times, with a case study presented by Michigan State University.

4. Long-Term Considerations Around P3s

Tax, business, and long-term considerations of P3 transactions were discussed, with a successful case study provided by Bowling Green State University. Our team would be happy to discuss any of these session topics with you. While each of the sessions provided unique perspectives of the current marketplace, we note that especially the continuing rise of P3 evaluations and transactions and the forthcoming LIBOR transition are topics worthy of ongoing discussion throughout 2020.

Where to Find Blue Rose Advisors at Conferences Early in 2020

Blue Rose is pleased to participate in many conferences throughout the year as it provides us an opportunity to connect with our friends, colleagues, and clients in all of public finance, in addition to sharing our expertise as part of presentation panels when given the opportunity. Notable upcoming conferences that Blue Rose expects to attend in the near-term include but are not limited to:

1. Association of Business Administrators of Christian Colleges (ABACC)

Held in Orlando each year, this conference at the end of February is designed to discuss hot topics, current regulations, and issues on campus with peer institutions who share the same ultimate goal.

February 24-28, 2020

2. Wisconsin Health and Educational Facilities Authority (WHEFA)

Held each spring near Milwaukee, this workshop is provided to Wisconsin constituents to provide the latest information on issues affecting access to capital finance and ongoing financial operations.

March 19, 2020

3. Ohio Association of College and University Business Officers (OACUBO)

Held each spring for Ohio institutions, this conference connects the business office of Ohio to cover current critical topics within the treasury and finance areas.

April 27-28, 2020

4. National Association of College and University Business Officers (NACUBO)

The largest of the CUBO conferences, this event, being held in Washington, D.C. this year, is a terrific opportunity for all levels of business officers to learn about the various challenges and initiatives within the higher education sector.

July 11-14, 2020

Blue Rose 2020 Announcements

Scott Talcott Promoted to Senior Vice President

Mr. Talcott provides financial advisory services to the firm’s clients with respect to the planning and execution of all types of debt, derivative, reinvestment, and P3 transactions. He specializes in analyzing and assessing financial strategies from both a quantitative and qualitative standpoint to assist clients in selecting the most efficient use of capital that best aligns with their strategic goals and objectives. “Scott has demonstrated a keen awareness to the myriad issues that our clients need to consider when evaluating financing alternatives and has provided tremendous advice as a result of his proactive thoughtfulness,” remarked Erik Kelly, President of Blue Rose. “We couldn’t be more pleased with Scott’s commitment to service as a lead advisor to the firm’s clients.” Please join us in congratulating Mr. Talcott.

Max Wilkinson Promoted to Associate

Mr. Wilkinson provides in-depth modeling, research, and analytics in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. He is responsible for preparing analyses considering various bond structuring options, comparable issue pricings, institutional debt capacity constraints, credit rating models, and break-even refinancing rates. Mr. Wilkinson is involved in every step of the financing process for various clients, from initial development of the plan of finance to rating agency presentations to bond and derivative pricing and bidding of reinvestment products. “Max has demonstrated an ability to not only deliver superior quantitative analysis, but he also has a sharp mind for understanding the bigger picture of our client’s capital plans,” says Erik Kelly, President of Blue Rose. “We see a bright future for Max at Blue Rose through his ongoing client service.” Please join us in congratulating Mr. Wilkinson.

DeveloP3rs – A Division of Blue Rose Capital Advisors

Blue Rose is pleased to announce the creation of a new division of our company, DeveloP3rs. DeveloP3rs focuses on the evaluation and execution of Private-Public Partnerships (“P3”) to achieve financial funding for various infrastructure projects such as student housing and other campus facilities. We have developed a 12-step outline for a preliminary housing project plan that your CFO will approve. The first step is:

Have a Master Plan with prioritized projects, considering deferred maintenance. Separate revenue and non-revenue producing projects. Stay tuned for more steps and tips in future issues of the Shield.

Want to Learn More?

Join the DeveloP3rs team for a Lunch & Learn event at the Edina Country Club on March 10, 2020 from 12pm – 2 pm. For this session we’re bringing you an amazing lineup of market professionals to help you learn about Project Finance and developing a facilities plan your CFO and bank will approve.

For any other questions or to receive more information about how DeveloP3rs could help you, please contact:

Justin Krieg, Vice President

952-746-6045

About the Author

Ms. Roth holds a Bachelor of Arts degree in Organizational Communication with a minor in Marketing from the University of Wisconsin — Eau Claire.

To contact Ms. Roth, please email [email protected]

Comparable Issues Commentary

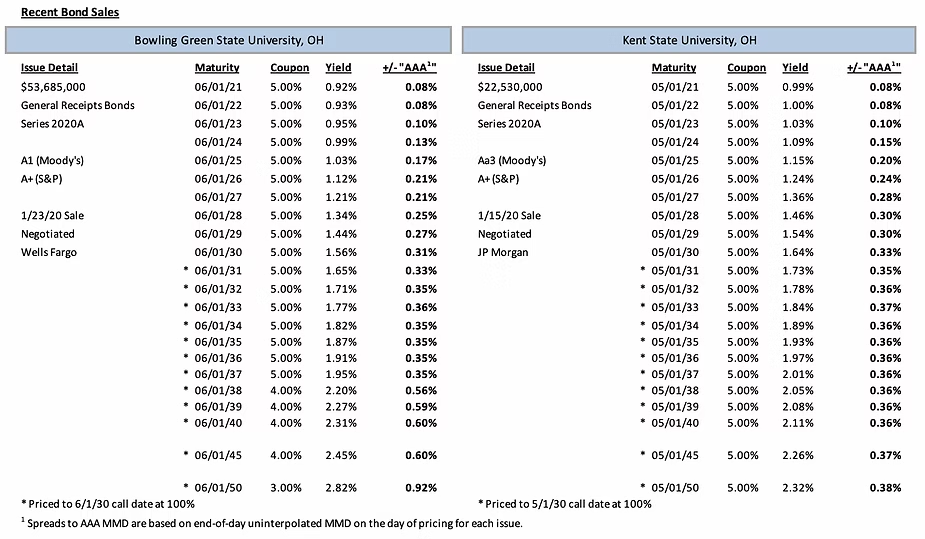

Shown below are the results of two negotiated, tax-exempt higher education issues from the State of Ohio that sold in January. Bowling Green State University (“BGSU”) and Kent State University (“KSU”) priced their Series 2020A bond issues on January 23rd and January 15th, respectively. BGSU’s bond issue was issued with a par amount of $53.685M (compared to a smaller $22.53M issue for Kent State) – however, Kent State also concurrently priced a much larger $172.825M taxable issue along with its tax-exempt bonds. Bowling Green State’s bonds were rated A1/A+ by Moody’s and S&P, respectively, while KSU’s bonds were rated Aa3/A+ by Moody’s and S&P. Each university’s issuance included a new money component, with BGSU financing a number of campus improvements including development of its East Campus, construction/furnishing of part of the Robert W. and Patricia A. Maurer Center, IT network infrastructure improvements, construction of a nursing skills lab, and construction/rehab of the Slater Family Ice Arena, along with other facilities improvements. Kent State’s 2020A bonds were issued primarily to finance the construction of a new 1,100-space parking deck located on the northeast side of its campus. BGSU’s bond issue also included a refunding component, as did Kent State’s taxable Series 2020B.

Both deals sold on favorable days in the market, with MMD reduced by 0-5 bps when Kent State sold its bonds on the 15th and similarly reduced by 2-3 bps across the curve for BGSU’s pricing date of the 23rd. These reductions were part of a broader downturn in interest rates during the month of January, serving to reduce borrowing costs for tax-exempt issuers across the municipal market. The two tax-exempt bond issues were similarly structured, with 30-year final maturities incorporating 20 years of serial bonds followed by term bonds in 2045 and 2050 – both universities also sold their debt with standard 10-year par call options. However, the couponing choices of the two issuers differed slightly, with Kent State using exclusively 5% coupons while Bowling Green State utilized lower 4% coupons on its maturities later on the yield curve, with a 3% premium coupon for its 2050 term bond. BGSU’s callable 5% coupons priced at spreads ranging from 33-36 bps, slightly lower than KSU’s spreads of 35-38 bps. BGSU’s 4% coupons priced at spreads approximately 21-25 bps above those of its callable 5% coupons (56-60 bps), with a 92 bp spread on the 3% coupon term bond in 2050.

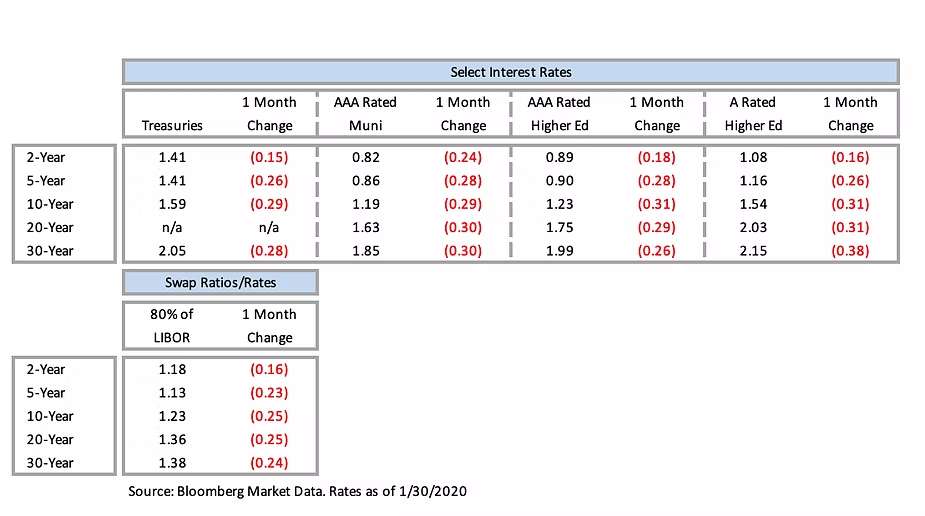

Interest Rates