As FAFSA Challenges Persist, Colleges and Universities Scramble to Adjust

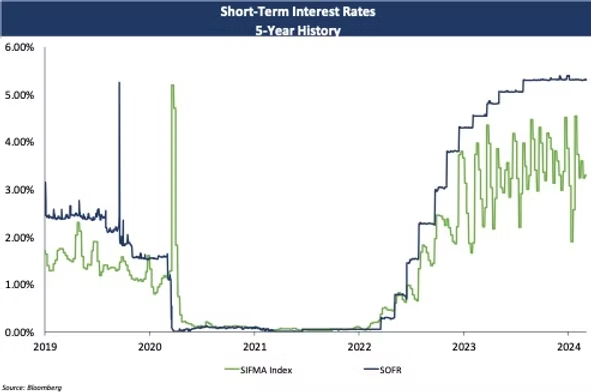

Shrinking VRDB Market and High Short-Term Rates Drive Substantial Swings in SIFMA Resets

The obvious question is this: what is causing such profound change, and is it likely to continue through the remainder of 2024 or even beyond? There are several reasons for this phenomenon, but a key driver has been the impact of reduced tax-exempt money market fund assets, with 2023 showing consistent outflows for many mutual funds that use VRDBs as a vehicle for maintaining liquidity. This lower demand for VRDB investment also resulted in large part due to the increased variety of alternative high-yielding short-term assets such as high-yield savings accounts and short-term Treasuries, both driven by the Fed’s increases to interest rates. These factors have combined with the limited supply of new VRDB issuance and the inconsistent nature and timing of investor demand to create the dramatic ebbs and flows in SIFMA rates in recent months.

Notably, despite this volatility, the average SIFMA/SOFR ratio has remained attractive in 2024 at just over 61%, meaning that the all-in cost of capital over the year for borrowers utilizing VRDBs has been favorable on a relative basis. By comparison, the average SIFMA/SOFR ratio was slightly above 66% in 2023 and upwards of 85% from March 2022 (after the Fed first began its current rate hiking cycle) through December of that year. As such, borrowers willing to accept some added unpredictability in reset rates on a week-to-week basis have benefited from borrowing rates that, on a relative basis, are potentially lower than they might have otherwise obtained using alternative variable rate modes of issuance such as SOFR-based loans. On the other hand, this unpredictability also adds to the risk of SIFMA remaining consistently elevated should market factors or demand changes drive rates higher without a corresponding move from the Fed. Current market expectations are for the Fed to begin reducing interest rates at some point later in 2024, and such a move could begin to mitigate the current volatility of the SIFMA market as the yield curve begins to normalize and the attractiveness of alternative short-term investments starts to be diluted. Nevertheless, borrowers with exposure to VRDBs will want to continue to monitor their reset rates in the interim to ensure that they remain manageable while this uncertain paradigm persists. If you have outstanding VRDBs or are considering issuing them in the future, we encourage you to reach out to your Blue Rose advisor to carefully evaluate the pros and cons of this financing product as well as those of other variable rate alternatives.

Blue Rose Capital Advisors Erik Kelly, President, and Brandon Lippold, Vice President, will present at the Wisconsin Health and Educational Facilities Authority (WHEFA) Lunch & Learn Webinar on March 26, 2024. Erik and Brandon plan to share their insights and perspectives on:

Year-to-date 2024 market activity

Industry prognostications on expected Fed rate setting activity

Historical market performance in declining rate environments

Interpreting the ‘noise’ during an election year

They will also address prevailing capital planning strategies to consider, such as:

Refunding opportunities

Reinvestment opportunities

Strategies to address the inverted yield curve

Pricing dynamics and the utilization of interest rate swaps

Interested in attending? Sign up here: https://whefa.com/resources/whefa-workshop/

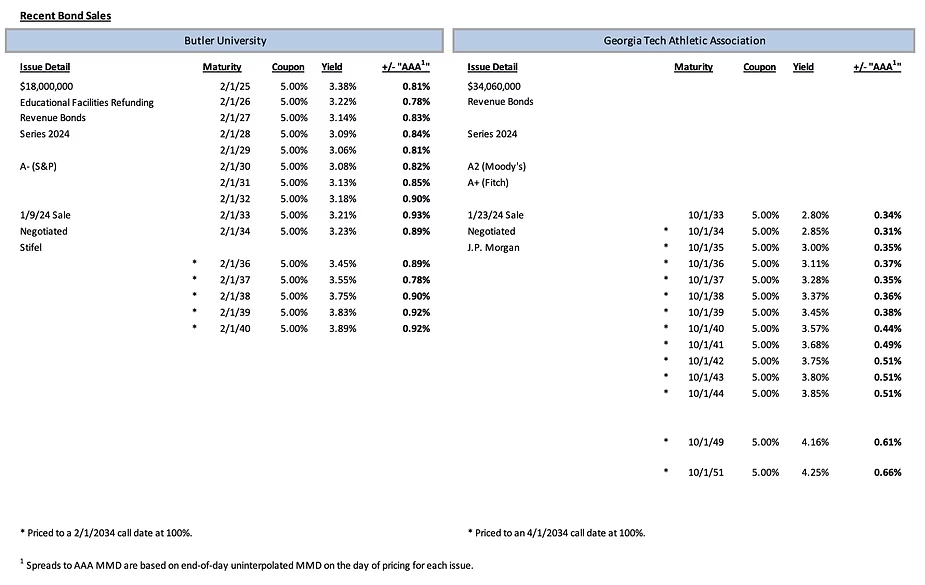

Comparable Issues Commentary

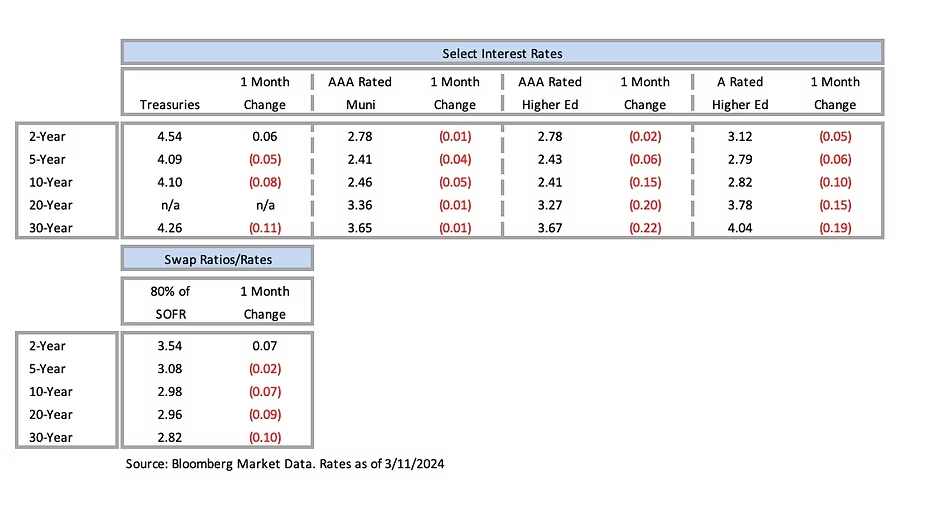

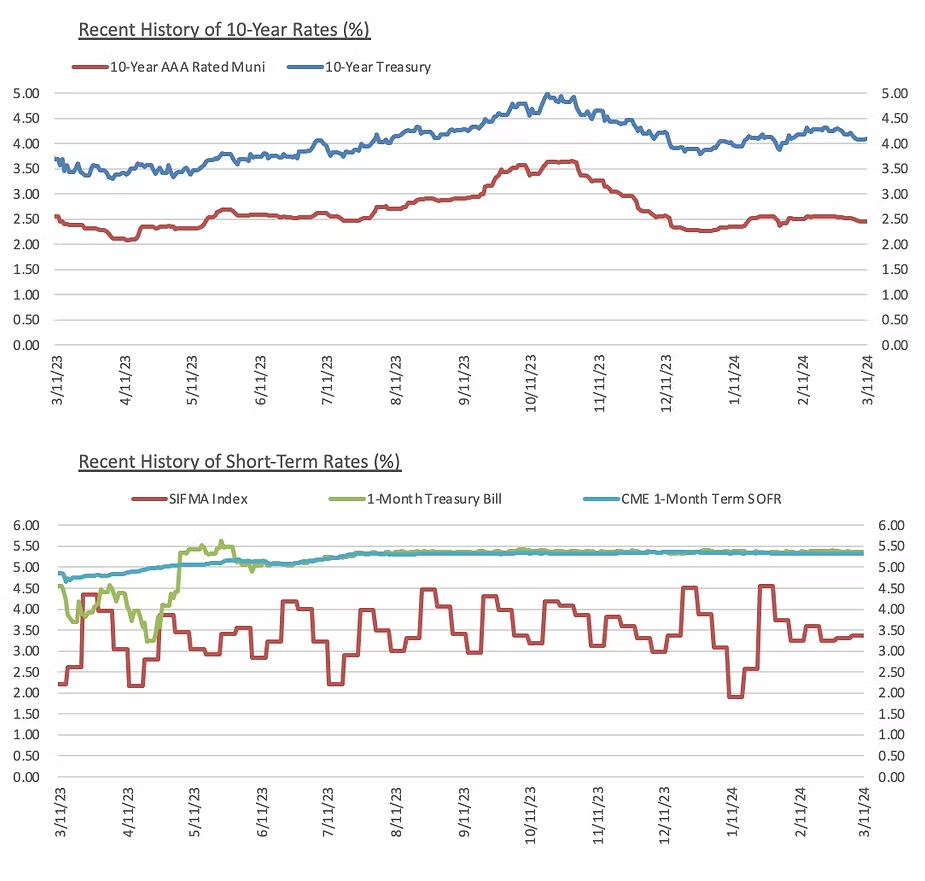

Interest Rates

Meet the Author:

Maxwell Wilkinson | [email protected] | 952-746-6048