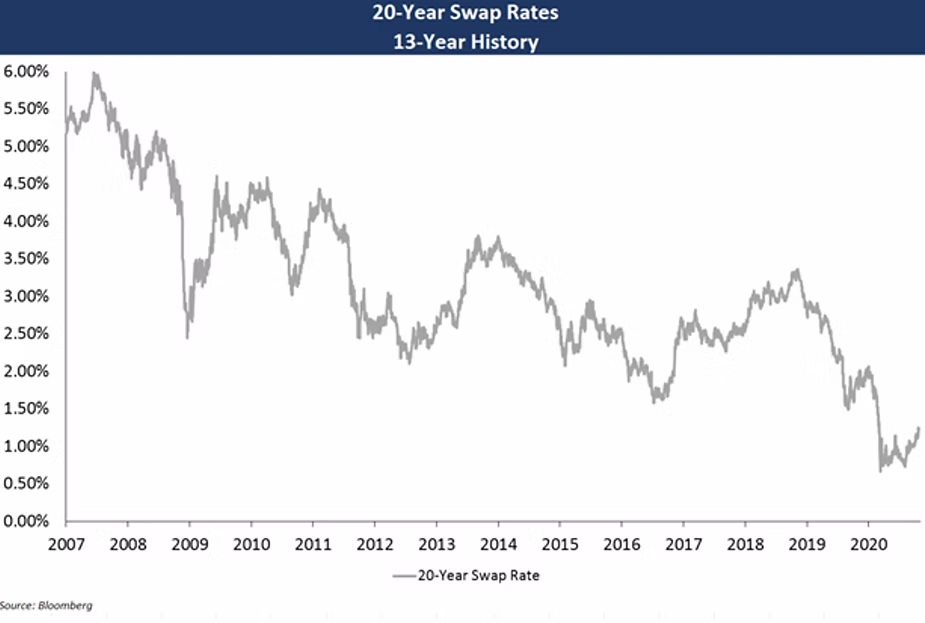

Prior to the financial crisis, long-term interest rates were significantly higher than where they are currently. The graph below shows the decline of the 20-year LIBOR swap rate (as a proxy for long-term interest rates) since January 2007. A sharp decline in rates occurred early this year, creating all-time low rates. Investment contracts, such as guaranteed investment contracts (“GICs”), repurchase agreements (“Repos”), and forward purchase agreements (“FPAs”) are all instruments that utilize fixed rates that closely follow the LIBOR swap rates.

As a result of this decline in interest rates, long term investment contracts that still remain may have substantially appreciated in value. One way to monetize benefit from the decline in interest rates would be to liquidate these types of long-term investment contracts that were put in place years prior. Because they offer a guaranteed fixed rate (which likely would be much higher than what is available now), issuers could realize a cash benefit by terminating the contract and receiving a market-based termination amount. We estimate that some of the contracts that were put into place prior to the financial crisis could be terminated with a termination amount received in the range of 10%-30% of their face value. The earnings to the issuer would then be accelerated into the current fiscal year, rather than seen for the remaining life of the contract. Depending upon the wording of the contract, as well as the tax arbitrage implications of such a termination, it may be possible for such termination amount to be used to create some immediate budgetary relief for borrowers or issuers who have such agreements.

If you or your client has an investment contract from over 10 years ago with three or more years remaining before its expiration and would be interested in benefiting from additional liquidity in the current fiscal year, we encourage you to reach out to your Blue Rose advisor to learn more about this potential opportunity.

About the Author

Georgina Walleshauser joined Blue Rose in April 2017. As an Associate, she is responsible for providing analytical, research, and transactional support to senior managers serving higher education, non-profit, and government clients with debt advisory, derivatives advisory, and reinvestment services. She also prepares debt capacity modeling, credit analysis, and market analysis to support the delivery of comprehensive, strategic, and resourceful capital planning tools to our clients.

Georgina can be reached at: [email protected]