Traditions are a wonderful way to keep a sense of normalcy when, in such instances as calendar years 2020 and 2021, the realities presented to us may be anything but normal. The continuation of a global health pandemic, civil unrest, and political discord are just three ways that continue to contribute to the challenges of everyday life. Of course, life as we knew it pre-pandemic was never going to remain the same, but it quickly became clear that we all had to adjust to new realities, both at home and at work. However, some things – like traditions – are meant to continue, even if we must adjust them to accommodate our current social environment.

For Blue Rose, our tradition of gathering together for an annual meeting during the fall was once again this year placed on a one-year sabbatical. While it was disappointing to not be able to gather our team in Minnesota this fall (an event that was scheduled but subsequently canceled), we continue to prioritize the health and safety of our team, our families, and our communities as the health pandemic surges on, all the more so in the land of 10,000 now frozen lakes. Yet, as we do our small part to protect each other from the spread of this unfortunate virus and thereby aid our healthcare workers’ ability to meet all of our medical needs, we remain committed to giving back to our communities. In a demonstration of this spirit, our virtual annual meeting and individualized service projects made a return in 2021. With this being the second year of such an event, perhaps we might have just created a new Blue Rose tradition.

“Service” is one of Blue Rose’s six core values. We emphasize this value not only in our daily work of providing expert advice to our clients, but also look to provide opportunities for our team members’ natural gratitude to shine through annual service projects. After all, as an organization we have discovered that all we need to do is provide the time to give; our team members bring the creativity and energy to serve our neighbors and communities in their own unique ways. This year our team members once again completed a wide variety of service projects in their respective hometowns. Among many examples include: garbage clean up at the bottom of a dried-up lake and neighborhood parks, serving at homeless shelters, food shelves, and food packing events at local non-profits, volunteering at schools, and assisting neighbors who cannot easily complete physically demanding chores themselves. The projects were inspiring and impactful, and we give thanks for the opportunity to make a difference in the lives of those around us even in these unusual times.

So, too, do we give thanks for you and your partnership with us in 2021. May you have a healthy and happy holiday season. We hope to see you soon in 2022!

Comparable Issues Commentary

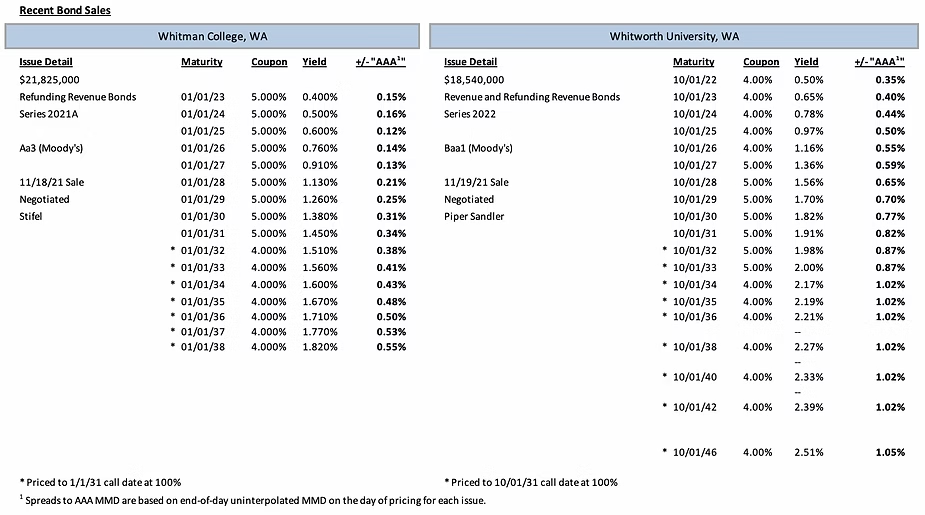

Shown below are the results of two negotiated, tax-exempt private higher education issues from the state of Washington which sold in the month of November. Whitman College priced its tax-exempt bonds on November 18th with Whitworth University pricing its tax-exempt issue the following day, November 19th. Whitman’s Series 2021A bonds were issued to refund its Series 2008 VRDBs and terminate related interest rate swaps. The College also issued a concurrent Series 2021B taxable issue to refund its Series 2004 VRDBs and terminate interest rate swaps related to that issue. These refundings were executed to simplify the college’s debt profile and eliminate covenants associated with standby bond purchase agreements related to the refunded bonds. Whitworth’s Series 2022 transaction was a combined new money and refinancing issue. The new money portion of the deal was used to finance the construction of a new innovation lab to house the University’s Engineering and Physics departments, along with other miscellaneous capital improvements on its campus. Additionally, Whitworth’s deal served to current refund its outstanding Series 2012 bonds.

Both schools’ bonds were both rated by Moody’s, but carried meaningfully different credit ratings. Whitman is rated at “Aa3” by Moody’s, while Whitworth’s credit rating is four notches lower at “Baa1.” The two transactions also differed slightly in amortization structure – Whitman’s tax-exempt issuance was fully serialized across the scale from 2023-2038, while Whitworth had a longer amortization with serials from 2022-2036 and four term bonds following in 2038, 2040, 2042, and 2046. Both schools opted for a blend of 5% and 4% coupons on their tax-exempt transactions. Whitman used 5% coupons on its noncallable maturities before shifting to 4% coupons on all callable maturities, while Whitworth used mostly 4% coupons, covering maturities 2022-2026 and from 2034-2046, including the four term bonds. Whitworth’s remaining maturities in 2027-2033 featured 5% coupons. These deals were fairly close in size with Whitman’s 2021A bonds at $21,825,000 and Whitworth’s Series 2022 issue sized at $18,540,000.

These transactions priced into a stable market environment, with nearly identical conditions owing to the back-to-back timing of the two issues. During the week of November 15th, tax-exempt yields moved higher by 1-2bps on Monday and Tuesday. Rates were unchanged on Wednesday or Thursday, the day of Whitman’s pricing. On the 19th, the day of Whitworth’s pricing, MMD decreased by 1-2 bps. Despite being quite similar in many respects, with both schools located in Washington and sharing near-identical timing and transaction size as well as similar overall couponing, the meaningful differences in credit quality between the two borrowers resulted in credit spreads diverging between the two transactions. Credit spreads on comparable 4%-coupon callable maturities (from 2034-2038) ranged between 43-55 bps for Whitman, while spreads for Whitworth were sharply higher at 102 bps in each of those maturities, showing a gap ranging from 47-59 bps between the two schools.

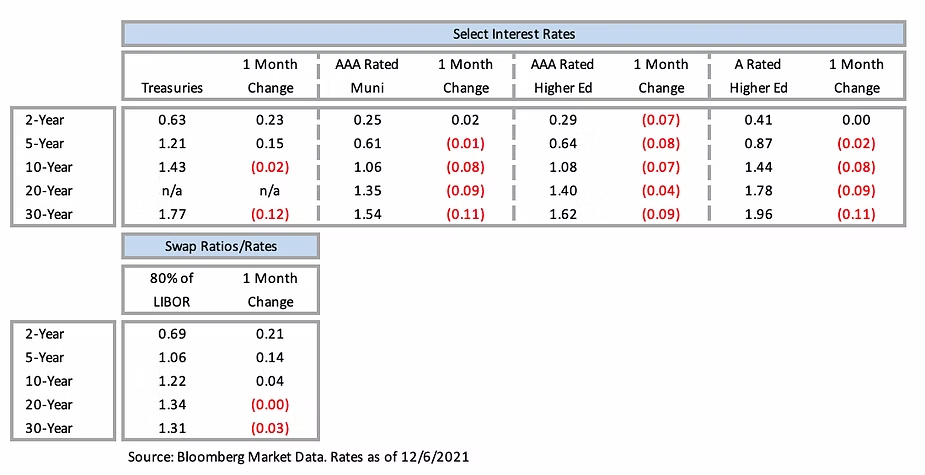

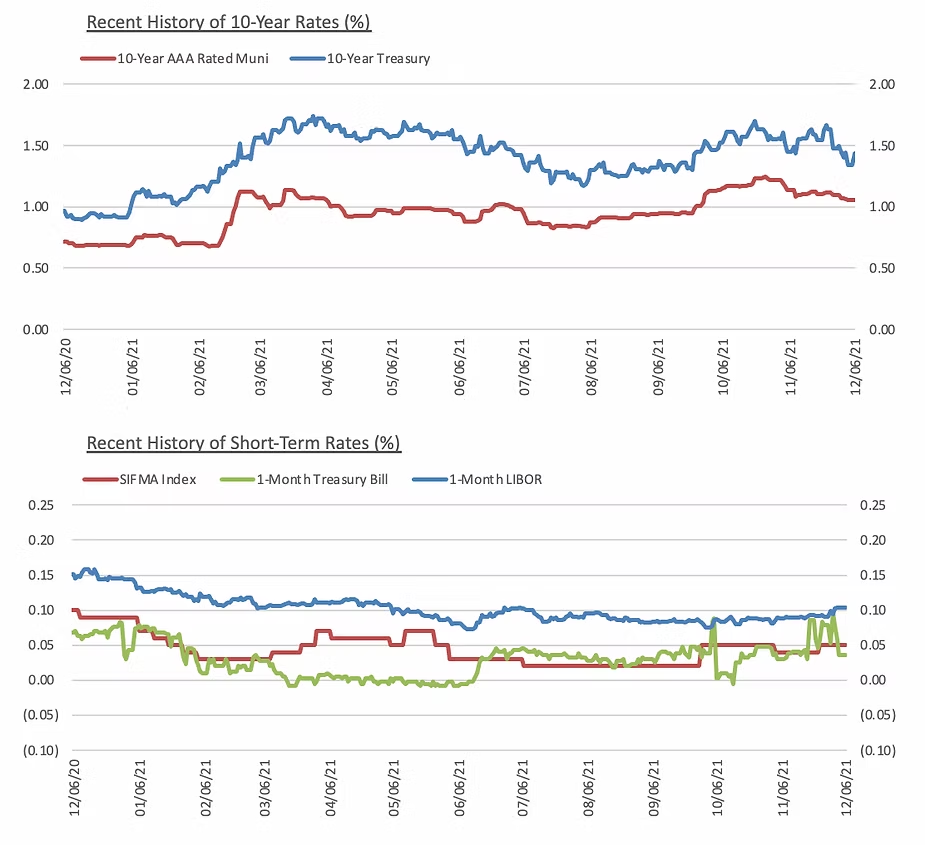

Interest Rates

Meet the Author

Erik Kelly, President | [email protected] | 952-746-6055

Erik Kelly serves as President of Blue Rose, providing leadership, coordination, and oversight of the firm’s advisory services since 2011. He also serves as the lead advisor to many of the firm’s clients, including advising higher education, non-profit, and other borrowing entities on the planning for and execution of all types of debt and debt-related derivative transactions. In managing the firm’s various advisory service areas, Mr. Kelly oversees both compliance with the changing regulatory environment and the delivery of professional advice to the firm’s clients.

Media Contact:

Megan Roth, Marketing Generalist

952-746-6056