The current COVID-19 health pandemic is creating tremendous concern for the higher education sector: Moody’s has downgraded the sector to a “negative” outlook, S&P has revised their outlook on privatized/P3 higher education housing deals to “negative,” and each day there are articles discussing the near-term impact of the coronavirus.

Institutions are, undoubtedly, working tirelessly to address the immediate implications of the pandemic. As the situation continues to develop, we would like to highlight the importance for institutions to begin considering the potential medium- and long-term implications of the COVID-19 health pandemic as well, and to start the process of developing contingency plans for these scenarios. Over the past few weeks, Blue Rose has fielded requests from clients for assistance in thinking about and strategizing for the implications of the pandemic. These requests have arisen from a combined need for additional resources, additional expertise and/or simply a desire for an extra set of eyes. To ensure we are providing the best resources for our clients, we have assembled a team of dedicated professionals to provide strategic and operational consulting services, including current members of the Blue Rose team and additional consulting expertise from retired industry professionals (see below). This dedicated team stands ready to deliver significant experience and capacity to aid any institution’s management and finance teams, allowing institutions to continue with standard preparations for the Fall 2020 semester while also preparing strategic plans for operations under very different environments if the need should arise.

Our Starting Point

While each situation is unique, we believe a multi-phased approach will typically work best for such planning efforts. Initial phases are kept at a high level and as the crisis continues to develop, additional steps, efforts, planning, and modeling are executed as needed. Central to this approach is multi-year modeling of the institution’s operations and finances. These models can then be used to explore the implications for a variety of stress scenarios and ensure that institutions have a sound and thorough foundation for developing strategies for critical structural, operational, and economic decisions.

Potential Stress Scenarios

As evidenced by Hurricane Katrina, other disasters, and prior pandemics, there is a real possibility that higher education institutions may not be able to maintain continuity of operations due to COVID-19. In worst-case scenarios, the institutions could face a combination of sustained campus closures, drastic reductions in funding and support, and significant reductions in enrollment and retention. Impacted students may attend colleges and universities in locations less affected by the pandemic, live at home and enroll in different schools, enroll in online courses elsewhere in the United States that offer space in existing online classes or even interrupt/end their pursuit of a degree. Attrition of students may not be temporary, necessitating a reduction in the operational profile of the institution. Although schools will continue to operate and attract students, the pandemic could result in a prolonged recovery period where student enrollment and faculty numbers may not recover to pre-pandemic levels for a significant number of years. The pandemic, the related economic recession/depression, and the potential paradigm-shifting transition to online learning may threaten the viability of institutions as currently structured. Years from now, the operational capability of institutions may be compromised due to sustained structural deficits induced by the pandemic if institutions are slow to react to the crisis.

Addition to the Strategic and Operational Consulting Services Team

In our P3 advisory practice, our standard approach has evolved to incorporate a multi-year financial model of operations. We believe these modeling efforts are essential for institutions to fully understand the financial and operational impacts of a public-private partnership. Our Strategic and Operational Consulting Service Team will leverage the skills and experience from these engagements and combine them with the Blue Rose Team’s expertise in strategic advising, capital planning, and finance/debt structuring. In addition to Blue Rose’s in-house expertise, we are pleased to announce that Bill Decatur, recently retired Vice President for Finance & Business Services, CFO and Treasurer at Wayne State University, has agreed to join our team as a principal consultant. Mr. Decatur’s experience and knowledge will be invaluable in developing contingencies to address the potential operational and financial difficulties identified from our multi-year operational modeling.

About the Author:

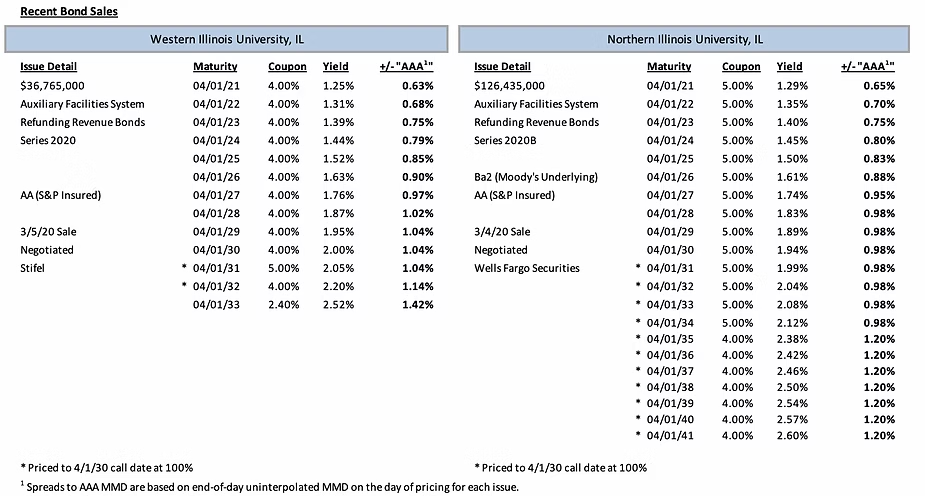

Comparable Issues Commentary

Shown below are the results of two negotiated, tax-exempt public higher education issues in the State of Illinois that sold in the month of March. Western Illinois University (“WIU”) and Northern Illinois University (“NIU”) priced their auxiliary facilities system revenue bond issues one day apart on March 5 and March 4, respectively. Both series were solely refunding issues, with no new money components to either transaction, though the par amount of the NIU deal ($126.4 million) was significantly greater than that of the WIU transaction ($36.8 million).. The two transactions were both insured by Build America Mutual and rated “AA” by S&P. Western Illinois elected not to utilize an underlying rating on the transaction while Northern Illinois did apply its “Ba2” Moody’s rating in addition to the insured S&P rating.

Both bond issues priced into very strong markets in advance of the full advent of the COVID-19 crisis, with MMD rates near their all-time lows and credit spreads at some of their tightest levels in years. This was particularly true for WIU and NIU as public institutions in Illinois, where credit spreads have been subject to significant “Illinois penalties” in recent years due to the State’s financial issues. On the day of sale for both universities, MMD was relatively stable, with reductions on the first 5 years of the curve on March 4th (of 2-4 bps) and on the first 3 years of the curve on March 5th (of 1-2 bps); all years after 2025 were unchanged on both days. The positive market environment and strong pricing results allowed both universities to generate significant net present value savings through their refundings.

Both transactions were fully serialized through their final maturities in 2033 (WIU) and 2041 (NIU). The issues differed slightly in coupon structure, with Western Illinois utilizing 4% coupons on its noncallable maturities while Northern Illinois used 5% coupons. With just 3 callable maturities, WIU opted for coupon diversification after the call date, using a 5% coupon in 2031, a 4% maturity in 2032, and a discount 2.40% coupon in 2033. Conversely, Northern Illinois had a much broader range of callable maturities, and used 5% coupons through 2034 before transitioning into 4% coupons for the remaining maturities from 2035-2041. Both universities priced their deals with a standard 10-year par call option.

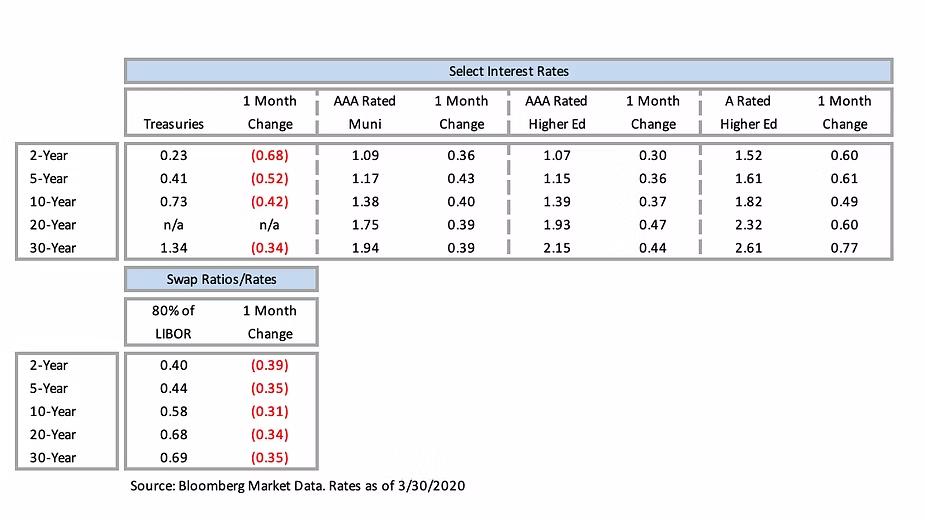

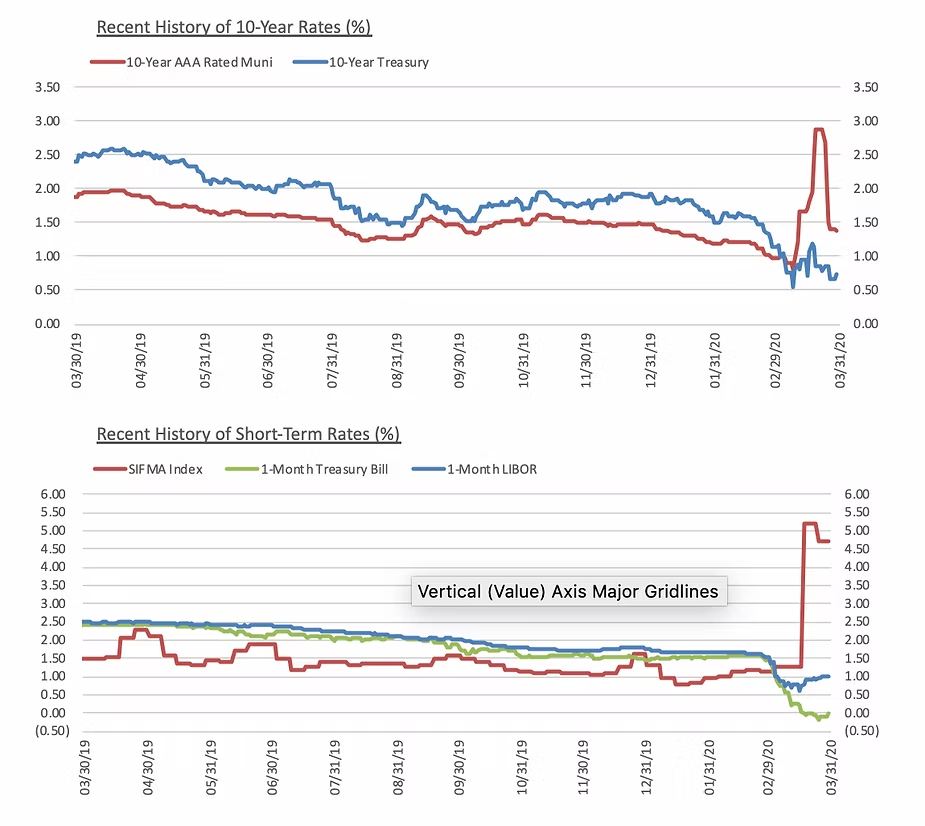

Interest Rates