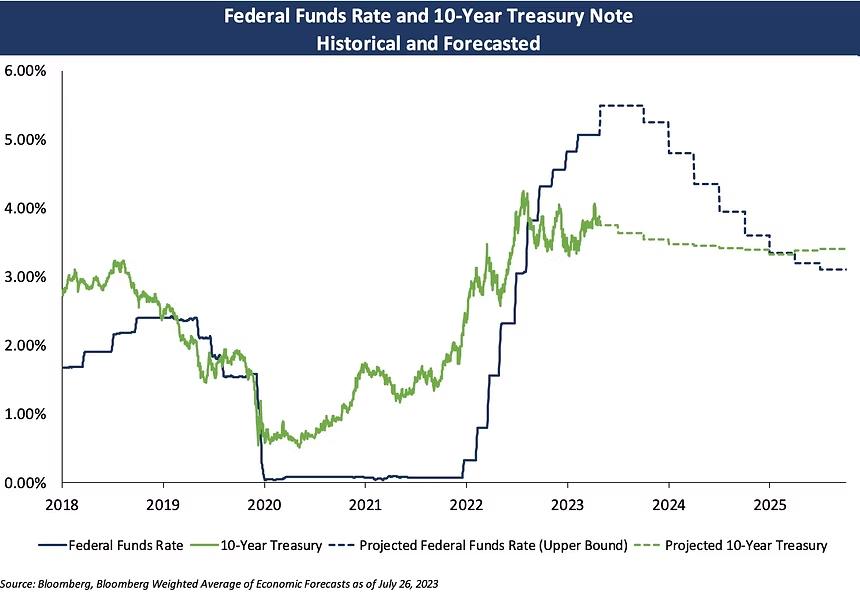

The Federal Reserve raised interest rates again this week by 0.25%, bringing borrowing costs to their highest levels in over 22 years. While it’s possible that rates could be increased again in the next Fed meeting in September, the current market census (according to the Bloomberg Weighted Average Fed Target Upper Bound economic forecast shown below) is that this rate hike may be the last increase in the near future.

What does this mean for issuers looking to benefit from reinvesting bond proceeds? Many issuers have elected to leave their funds invested in state investment pools or money market funds given that these funds offer them full flexibility to draw their funds. Further, the variable rate offered by these investments has been able to capture rate increases in the recent rising interest rate environment since March 2022. For example, in Texas the current TexPool 7 Day Net Yield is ~5.10%, compared to ~0.08% in March 2022. However, once the Fed begins cutting interest rates, which economists forecast will begin to occur in 2024, these types of investments will begin seeing rate declines.

An alternative approach for issuers is to reinvest their bond proceeds in structures that allow them to lock-in the current high short-term investment rates. For tax-exempt borrowers who are coming to market with new money issuances, or have outstanding unspent bond proceeds, we strongly encourage tax-exempt issuers and borrowers to consider the most efficient reinvestment options and to execute in a manner that secures a fixed investment rate while also meeting the IRS safe harbor provisions. If an issuer or borrower is going to purchase an investment, such as treasuries, they will want to demonstrate they meet the safe harbor requirements especially in a positive arbitrage situation.

Current reinvestment rate indications are shown below. For a more tailored reinvestment indication to your specific fund(s) and discussion of the risks and benefits to each type of reinvestment structure, reach out to Georgina Walleshauser at [email protected].

|

Average Life

|

GIC

|

Repo

|

Portfolio

|

|---|---|---|---|

|

1-year

|

5.40%

|

4.40%

|

5.30%

|

|

2-year

|

4.90%

|

4.10%

|

4.80%

|

|

3-year

|

4.60%

|

|

4.45%

|

Meet our Author of Basis Points: SLGS Window Reopened

Georgina Walleshauser, Vice President | 952-746-6036

Georgina Walleshauser joined Blue Rose in 2017 as an Analyst, providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. In the role of Associate, she utilized her experience as an Analyst in a more client-facing role, while still performing much of the analysis utilized in this capacity. In her role of Assistant Vice President, she will be tasked with growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056