In fiscal 2021, private universities saw major positive developments that buoyed their credit positions in the wake of the COVID-19 pandemic. In particular, strong investment returns across the many asset classes provided for significant growth in cash and investments for most universities, and pandemic-related government aid provided support for operations. These trends were among the key factors that prompted all three major rating agencies to assign or maintain “stable” outlooks on the higher education sector as a whole. However, looming future challenges for private universities are evidenced in the 2021 median results. [1] Operating revenue declined for nearly 60% of Moody’s-rated privates by a median of 1.4%, even after factoring in federal aid. While universities budgeted prudently for this decline, it does raise concerns for the future, particularly given a repeat of the extraordinary additional federal aid for the sector is not expected. Net tuition revenue also saw a decline for more than half of private institutions rated by Moody’s, driven largely by increased tuition discounting. Overall, while credit conditions have unquestionably stabilized from the uncertain environment that we saw in 2020, certain positive “outlier” factors in fiscal 2021 such as federal aid and record investment growth are unlikely to persist, and future credit conditions for private universities may look different as a result.

Strong Investment Returns Drive Balance Sheet Improvements Across Sector

Perhaps the most dramatic positive impact on the creditworthiness of private universities in fiscal 2021 was the extraordinarily strong investment returns seen across the sector. Importantly, this phenomenon held true across all rating categories, with near-universal positive returns for low and high-rated universities alike. Though the highest-rated “Aaa” universities (with the largest, and by extension most flexible, endowments) saw the largest endowment returns (with median gains of 36.6%, compared to just 23.3% for “Baa” rated universities), schools in all rating categories saw sharp improvements in wealth ratios. Spendable Cash and Investments to Operating Expenses ratios increased by anywhere from 37% – 50%, with “Aaa” schools actually improving the least among the four investment-grade rating categories in terms of percentage growth. Sector wide, Spendable Cash and Investments to Operating Expenses increased from 1.41x to 1.95x in 2021 – a 35.2% increase after remaining within a narrow range of 1.41x – 1.44x for the four preceding fiscal years. Likewise, Spendable Cash & Investments to Total Debt rose from 1.99x to 2.76x, a 38.7% increase after ranging from 1.99x – 2.15x for the last four fiscal years. These large investment returns dramatically bolstered reserves for private universities and provided a meaningful increase to financial stability and security, particularly in the challenging operating environment brought on by the COVID-19 pandemic.

Federal Aid and Solid Expense Management Improve Operations, but Revenue Pressures Persist

More mixed, however, were trends observed in operating performance for private universities in fiscal 2021. The median operating (EBIDA) margin in the sector increased from 13.7% to 15.7%, a solid bottom line improvement primarily driven by “A” and “Baa” rated institutions (with “Aaa” and “Aa” rated private universities holding relatively steady or slightly declining overall). However, this sector-wide improvement in operating margin occurred in spite of an overall decline in median operating revenues for private universities. While to some extent this decline may have resulted from lost auxiliary revenues from remote learning during a portion of the year, the fact that significant federal aid was insufficient to offset the lost revenue (and is not likely to recur in the future) highlights the pressure these universities face to maintain revenue growth. Furthermore, tuition discounting continued to increase, with the sector-wide median exceeding 40% for the first time as it rose from 39.8% to 41.2%. The increase in the discount rate in FY21 furthers an uninterrupted trend of increasing discounts that has persisted for over a decade. While increasing tuition discounting is a practical strategy for private universities to meet enrollment objectives, it also makes it more difficult to grow net tuition revenue; enrollment growth becomes a necessity for net tuition revenue to increase if tuition discounting rises. In fiscal 2021, conservative budgeting and concerted efforts to reduce expenses by university management allowed the sector to absorb lower operating revenues without overall margins suffering. However, absent additional federal aid, it may prove difficult to continue to preserve strong operating results without finding new ways to grow revenue in the future.

FY 2023 and Beyond: Expense Pressures and Revenue Uncertainty Loom as Potential Challenges

While fiscal 2022 has shown signs of stabilization for higher education as the year nears its conclusion, Moody’s views the potential for heightened budget stress on the horizon. In a research piece published in April shortly before the private university medians were released, the rating agency highlighted several pressures on expenses that it feels are likely to drive meaningful expense growth in future fiscal years. [2] Foremost among these is wage growth, with labor costs increasing materially and competition for staff, thereby forcing universities to increase salaries to attract and retain talented employees. In particular, payroll freezes or cuts that may have been implemented during the early stages of the pandemic now stand among factors that might contribute to acceleration of the rate of wage increases beyond the common 2%-3% growth seen over the past five years. Additionally, with students (and staff) back on campus after two disrupted years, the return to more normal business operations means many expense areas where costs were cut most recently (such as food, utilities, supplies, travel, etc.) are likely to increase in cost going forward, either back to pre-pandemic levels or even to an elevated level for some expense classifications. Inflationary and supply-chain-based pressures add yet another variable to the potential expense pressures looming for universities going forward.

Furthermore, there is no certainty that revenues will rise at a comparable rate to expenses in the years to come. Several factors make the revenue environment for higher education a murky one to project, particularly enrollment uncertainty that is driven by a variety of root causes ranging from labor market conditions to demographic trends. Waning federal pandemic aid and the increasing volatility in investment returns that have followed the exceptional returns of fiscal 2021 stand out as other factors that will challenge university budgets in fiscal 2023 and beyond. As they have done in the past, Moody’s highlights small private colleges as institutions that are particularly at risk: high tuition dependence, challenges in attracting students in a competitive environment, and relatively more limited wealth are all significant stress factors that could pressure their operations. However, despite these pressures and recent investment market volatility, Moody’s points to the aforementioned fiscal 2021 investment gains as a significant mitigating factor for the credit pressures on the horizon. Given the outsized growth in liquidity and endowment values, universities possess heightened financial flexibility to respond to future budget challenges they will face.

Overall, the operating environment has brightened for many private universities since the onset of the COVID-19 pandemic in 2020, but disciplined management and prudent budgeting strategies to manage expenses and increase revenues will remain critical to enable institutions in the sector to maintain their credit quality going forward.

[1] For additional information, see “Higher Education – US: Medians – Private universities helped by federal aid, investment returns in fiscal 2021,” published May 4, 2022, by Moody’s.

[2] See “Higher Education – US: Converging Forces Will Squeeze Budgets for Many Colleges and Universities,” published April 11, 2022, by Moody’s.

May 2022 LIBOR Update

Over the first half of 2022, SOFR has continued to emerge as the likely successor for financial instruments that traditionally referenced LIBOR. Liquidity has increased for most SOFR-referenced instruments, including derivatives commonly used to synthetically fix variable rate debt. A popular transition strategy taken by borrower entities has been to proactively address their legacy LIBOR exposure while rates remain low. However, this opportunity has become less attractive from a pure rate perspective over the last few months. More specifics regarding terms related to “auto transitions” of legacy LIBOR contracts are scheduled to release at the end of June 2022.

If you have LIBOR exposure or would like to discuss capital plans in the context of these market conditions, then please reach out to your Blue Rose advisor to schedule some time to chat.

Comparable Issues Commentary

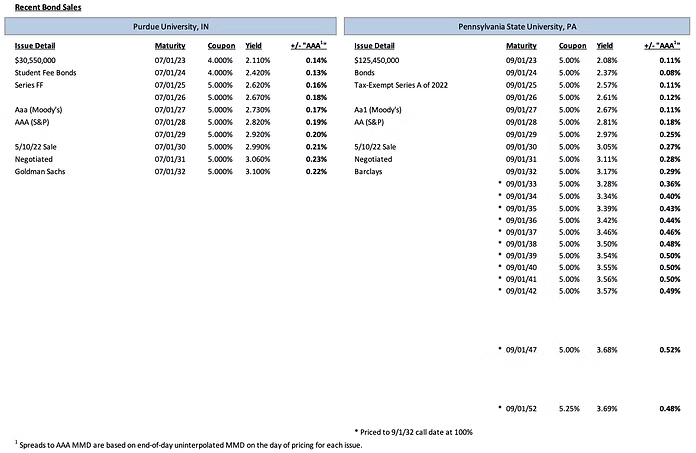

Both schools’ bonds were of strong credit quality. Purdue’s bonds carried “Aaa/AAA” ratings from Moody’s and S&P, while Penn State’s bonds were rated slightly lower at “Aa1” and “AA” from Moody’s and S&P, respectively. As a pure refunding with no new money components, Purdue’s Series FF only consisted of maturities from 2023-2032, which were fully serialized. With only a 10-year final maturity, the bonds were not sold with a call feature. In contrast, Penn State’s transaction stretched a full 30 years along the yield curve with serial maturities from 2023-2042 and two term bonds in 2047 and 2052. Penn State’s tax-exempt issue was sold with a standard 10-year call date and all maturities used 5% coupons, except for the 2052 term bond, which had a coupon of 5.25%. Additionally, the two transactions differed in size – Purdue’s Series FF was $30.55 million in total par amount, compared to Penn State’s larger $125.45 million Series A of 2022.

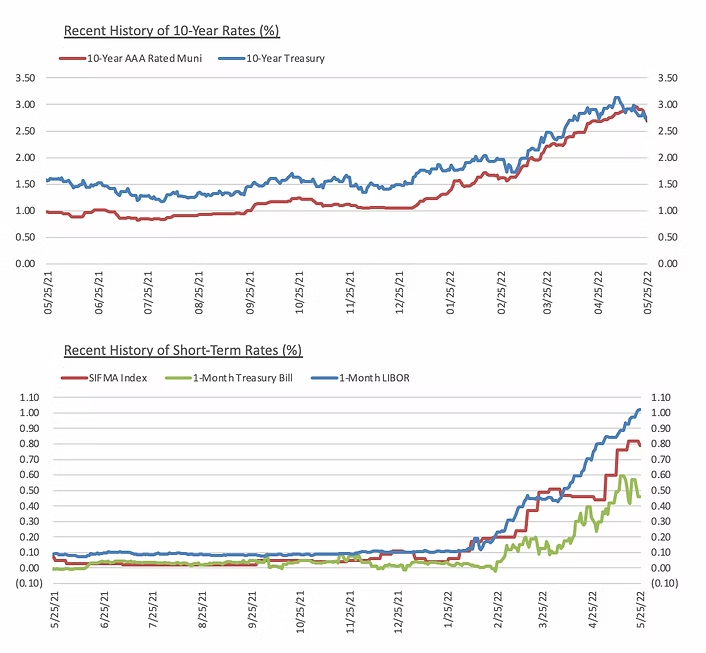

Both issues priced into a highly challenging market environment in early May. Taxable and tax-exempt interest rates, which increased throughout the first four months of 2022, continued to rise in early May ahead of Purdue and Penn State’s bond pricings. Credit spreads also widened further, driven by market volatility and consistent outflows from municipal bonds. MMD rose between 2 and 4 bps across the curve on the day ahead of the bond sales. This slight increase followed a week where MMD had net increases of 3-12 bps. On May 10th, the date that both deals priced, the index was stable with no changes in rates across the curve. Purdue’s Series FF achieved spreads of 13-23 bps. Penn State’s Series A of 2022 achieved spreads of 8-29 bps on its comparable noncallable maturities, before widening out to 46-52 bps on the majority of its longer-dated callable bonds (in 2037 and thereafter).

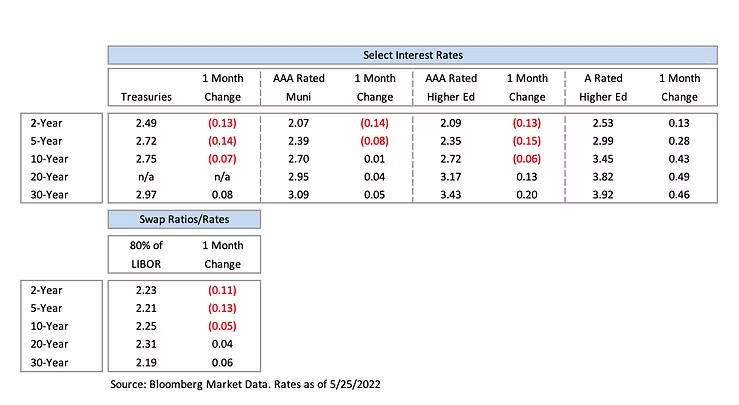

Interest Rates

Meet the Author:

Max Wilkinson | [email protected] | 952-746-6048

Max Wilkinson joined Blue Rose Capital Advisors in 2016. In his role of Assistant Vice President, he is tasked with growing client management responsibilities, in particular ensuring that our clients’ transactions progress smoothly and effectively throughout the financing process. He has significant expertise in the preparation of credit and debt capacity analysis and is experienced with the pricing and execution of fixed rate bond transactions, direct purchase bonds, and derivative and reinvestment products. Mr. Wilkinson is closely involved in every step of the financing process for clients, from initial capital planning stages all the way through closing.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056