Last week on August 4th, Moody’s released the final version of their revised rating methodology for the higher education sector. This new methodology applies to all higher education institutions globally, including both public and private colleges and universities, technical schools, and community colleges.

The finalized revised methodology is consistent with Moody’s Proposed Methodology Update and their Request for Comment (RFC), published March 31, 2021. Moody’s received 29 comments in response to the RFC, including from Blue Rose. However, no material changes were made between the proposed methodology and the final version.

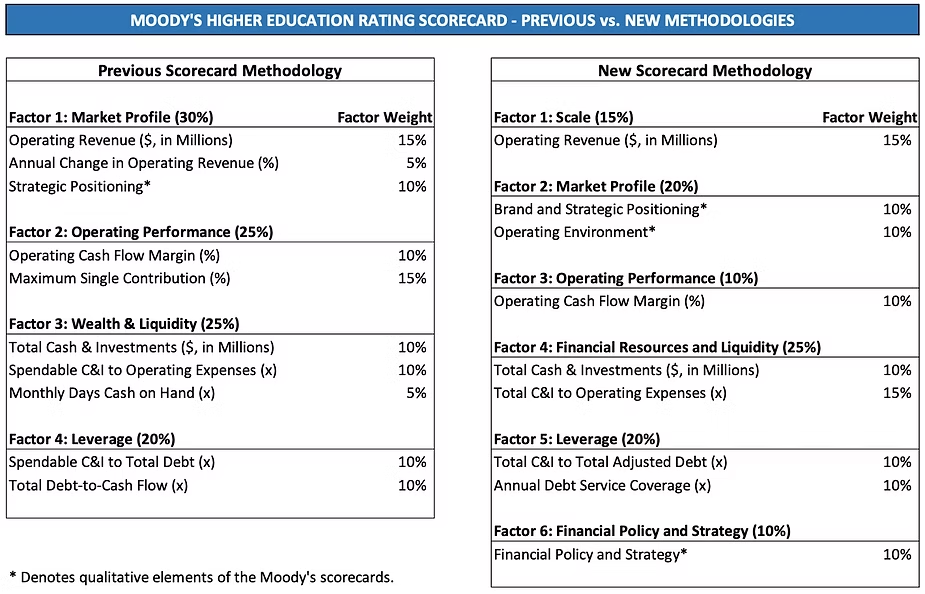

While there are many key elements to the revised methodology, some of the most impactful are reflected by the modifications to the “scorecard” valuation that Moody’s generates for each rated institution. As shown below, there are now nine sub-factors that lead to a scorecard assessment, with three of them – totaling 30% of the total score – being of qualitative nature. Previously, only one factor totaling 10% of the score assessment was qualitative in nature.

Additionally, both leverage factors have been replaced with new statistics – Total Cash & Investments to Total Adjusted Debt and Annual Debt Service Coverage are new additions to the scorecard, replacing Spendable Cash & Investments to Total Debt and Total Debt to Cash Flow. Nuances to these debt-related statistics are impacting the new score assessments, sometimes favorably and other times to the detriment of an institution’s rating evaluation. Furthermore, an institution’s strategies regarding debt structure and utilization of public-private partnerships may be impacted as a result.

Given the implementation of substantially more qualitative elements into Moody’s scorecard outcomes, and since Moody’s has yet to publish the qualitative scores for each institution upon release of the new methodology, there is likely more transparency to come. It is anticipated such transparency will become available as each higher education institution undergoes its subsequent formal credit rating review, at which time Moody’s will publish a scorecard for each institution that reflects the revised methodology.

Blue Rose’s extensive experience in accurately modeling Moody’s scorecard assessments can bring added transparency to your institution now, ahead of the next rating review, including sensitivity around the qualitative metrics. Preparations for the next rating meeting will become extraordinarily important, both in light of the revised rating methodology and also due to the difficult operating environment facing higher education institutions in recent years.

We welcome any questions that you may have on Moody’s new higher education methodology as there is much to discuss on this topic. We look forward to engaging with you in the days and weeks to come.

Webinar Recording: LIBOR and SOFR Transition for Tax-Exempt Transactions: The current state of affairs including tax consequences.

Last week Blue Rose joined Chapman and Cutler LLP, and our affiliate company, HedgeStar, for a webinar to discuss the LIBOR transition. If you missed the webinar, but still want to learn more on this topic, we have provided you with a free recording of the training. If you still have questions or would like to discuss this topic further, please reach out to a Blue Rose advisor today.

About the Author:

Erik Kelly, President | [email protected] | 952-746-6055

Erik Kelly serves as President of Blue Rose, providing leadership, coordination, and oversight of the firm’s advisory services since 2011. He also serves as the lead advisor to many of the firm’s clients, including advising higher education, non-profit, and other borrowing entities on the planning for and execution of all types of debt and debt-related derivative transactions. In managing the firm’s various advisory service areas, Mr. Kelly oversees both compliance with the changing regulatory environment and the delivery of professional advice to the firm’s clients.

Media Contact:

Megan Roth, Marketing Generalist

952-746-6056