Some issuers recently have started rethinking a choice they made a year ago to invest their bond proceeds for construction funds into money market mutual funds. The reason for this is twofold: both the changes we’re seeing in interest rates on one hand, and construction costs and timelines on the other.

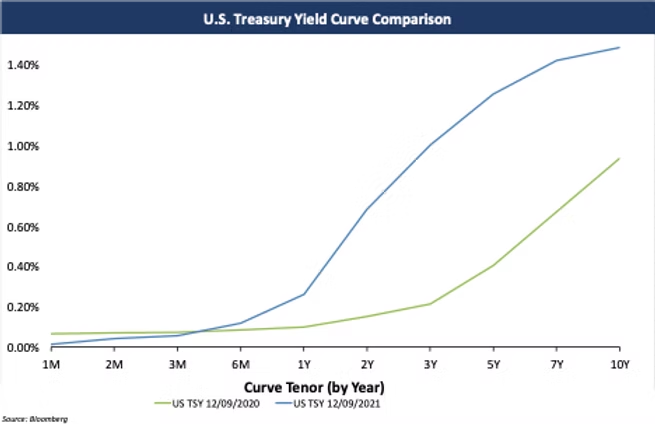

By their design, money market mutual funds utilize debt securities with very short-term maturities. Short-term rates (i.e., less than 3-month maturities) were very low a year ago, but the front end of the yield curve was relatively flat at that time and there wasn’t much benefit in investing in debt instruments with medium term securities. Today, the yields on short-term securities are even lower yielding while medium term securities’ rates have increased much more significantly. As a result, the relative return on reinvesting bond proceeds in products with underlying securities with medium-term maturities has improved.

Not only is this reason to consider alternative investment structures such as Repurchase Agreements and Guaranteed Investment Contracts (which, as we’ve written about before, allow issuers to preserve liquidity and a greater pickup in yield) for current construction project funds but also may be worthwhile to consider for year-old construction project funds. Due to cost increases in materials as well as labor and supply chain disruptions, many construction projects now suffer from extended or delayed timelines and/or cost overruns. The yield pickup on medium term rates may alleviate some of the damage to larger projects that is being caused by underestimated constructions costs; in particular, if there is a sizable amount of proceeds left and the issuer doesn’t expect to complete the project for more than a year from today.

If you or your issuer has a project fund of this type currently invested in a money market mutual fund and you’re interested in learning more about the estimated benefit of alternative reinvestment products, we encourage you to contact your Blue Rose Advisor.

About the Author

Georgina Walleshauser, Associate | 952-746-6036

Georgina Walleshauser joined Blue Rose in 2017. As an Associate, she is responsible for providing analytical, research, and transactional support to senior managers serving higher education, non-profit, and government clients with debt advisory, derivatives advisory, and reinvestment services. She also prepares debt capacity modeling, credit analysis, and market analysis to support the delivery of comprehensive, strategic, and resourceful capital planning tools to our clients.

Media Contact:

Megan Roth, Marketing Generalist

952-746-6056