Earlier this year we wrote an article about whether inflationary pressures were real. As articulated in June, we identified the popular economic narrative indicated a strong economic recovery. However, we also surmised that the pandemic recovery could be leading to tremendous distortions and disturbances in economic statistics, inflation included. Perhaps not surprisingly, at least not to us, both labor and inflationary statistics have been mixed over the last three months, with measures of labor market growth and inflation pressures both exceeding and failing to meet market expectations. These measures, of course, are the elements of the economy the Federal Reserve watches most closely in order to meet their objectives: to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The latter topic – inflation over the longer run – is one to which the Fed fundamentally changed its policy in 2020, to which we wrote about here.

At its most recent Fed policy meeting in late September, the Federal Reserve identified the impact of the COVID-19 virus on the economic recovery. As reported in their press release, “The path of the economy continues to depend on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.” One of those risks, of course, is that inflation quickly outpaces the 2 percent threshold, especially if near-term inflation is so dramatically higher that the average over an undefined longer historical period causes the Fed to begin increasing its short-term benchmark rate, which is now already anticipated to begin in 2022, sooner than expected.

With at least some concerns of higher-than-expected inflation beginning to materialize in the U.S., one element that may not be clearly captured within all inflationary statistics is the concept of “shrinkflation.” While the term may be new to many of us, the concept is far from new. Perhaps this is because shrinkflation is just beginning to become a more frequently utilized strategy in order for businesses to succeed in the midst of the more challenging market and supply chain operating environment that we currently face. The shrinkflation concept is simple: businesses don’t raise their prices, per se – they simply provide less product for the same price. This particular phenomenon can be most simply identified by looking at grocery store products, taking potato chips or cereal as examples. Packaging of these products can be quickly transitioned to providing lower quantities. If the packaging of such products looks similar and yet their prices haven’t increased, consumers are likely – at least producers hope – to continue purchasing the products. It is, perhaps, a deceptive way for retailers to avoid sticker price increases. As a result, consumers, especially those that do not shop based on weight of the products, are not suddenly shocked to find they are getting less product for the same price. Or, perhaps a worse scenario yet, the products that are purchased may not be lesser in quantity but rather lower in quality. This, too, is a form of shrinkflation.

Fortunately, as consumers, our out-of-pocket expense for relatively lower costing items such as chips and cereal do not change. Unfortunately, we are getting less for the same price and, therefore, the true cost of goods has increased. Sometimes, as I have learned, the price increase is significantly more than we would like to know, which is, of course, one of the main purposes of shrinkflation in most cases. Yet this shrinkflation concept, while not new or even entirely hidden (and in only some cases measured), is just one more factor to consider not only on our grocery lists but also into the turbulent economic statistics that we have seen in recent months. As we look for signs of where the Fed will take interest rates in the future inflationary statistics, including how they are measured, will be important to follow in order to effectively manage interest rate risk in a time of potential rate instability.

Comparable Issues Commentary

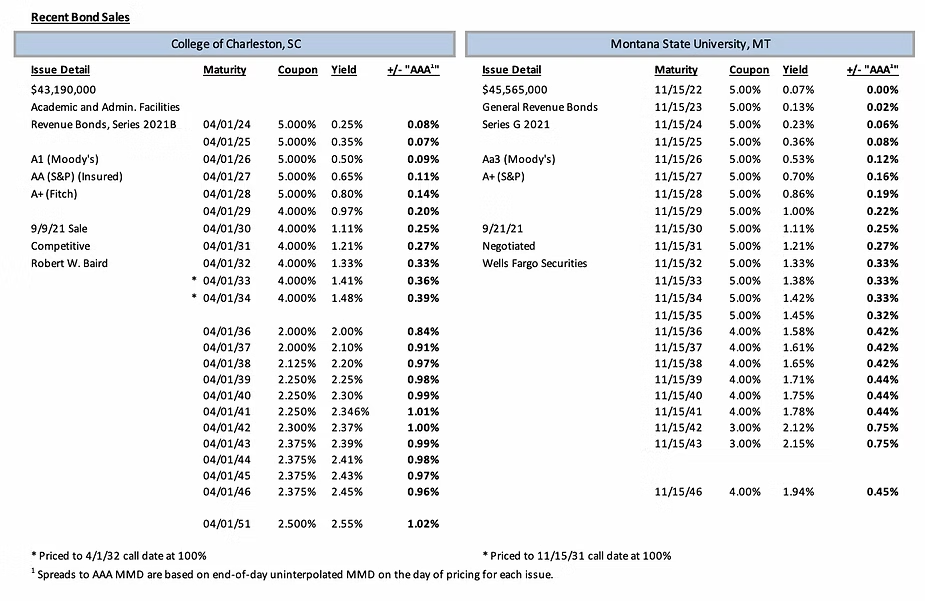

Shown below are the results of two tax-exempt public higher education issues which sold in the month of September. The College of Charleston and Montana State University priced their bond issues on September 9th and September 21st, respectively. Charleston’s Series 2021B bonds were a standalone new money issue serving to finance a portion of the costs of renovating and expanding the College’s Simons Center for the Arts. Montana State’s Series G 2021 bonds also carried a significant new money component for the financing of the design and construction of a Student Wellness Center, in addition to a refunding component for the refinancing of the University’s Series C 2016 bond. Notably, Montana State also sold a larger concurrent taxable issue in the form of its Series H 2021 bonds, which refunded a 3 additional series of the University’s outstanding debt. The College of Charleston’s bonds were sold on a competitive basis, while both of Montana State’s issues were sold through negotiated sales.

Charleston’s bonds were rated “A1” and “A+” by Moody’s and Fitch, respectively, and also carried a BAM-insured “AA” rating from S&P. Montana State’s taxable bonds also carried BAM insurance, but its tax-exempt bonds were uninsured, pricing solely off the University’s underlying ratings of “Aa3” and “A+” from Moody’s and S&P, respectively. Both schools had similar amortization structures for their tax-exempt issues, with serial maturities from 2022-2043 for Montana State and from 2024-2046 for the College of Charleston (except for one term bond in 2035-2036), along with a single longer-dated term bond on both issues. The tax-exempt issues were also nearly identical in overall size, each hovering close to $45M in total par amount. However, the couponing of the two deals varied more meaningfully, with Montana State opting for 5% coupons on its earliest callable maturities and using primarily 4% coupons with a pair of late 3% coupons on later maturities. Meanwhile, the competitive nature of Charleston’s bond sale resulted in lower coupons ranging from 2% – 2.50% on each of its callable maturities beginning in 2036, resulting in a lower cost to maturity but a higher yield to the call date.

The two schools priced into a stable market environment, with both selling their bonds before the sharp uptick in rates later in the month of September. Tax-exempt interest rates were completely unchanged across the curve on both institutions’ pricing dates of September 9th and September 21st. Credit spreads for the College of Charleston ranged from 84-102 bps on its callable 2%-handle coupons, while callable spreads for Montana State were 75 bps for 3% coupons and approximately 42-45 bps for 4% coupons.

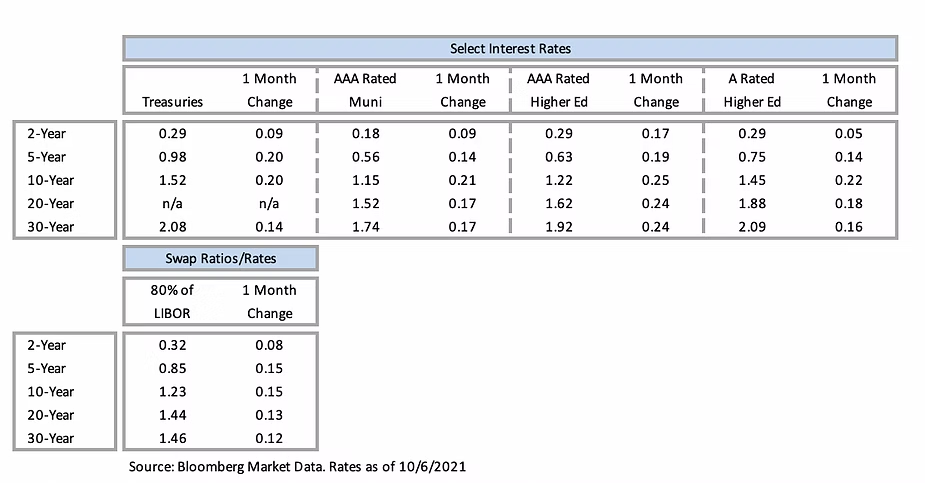

Interest Rates

Blue Rose Announcements

Meet the Author

Media Contact:

Megan Roth, Marketing Generalist

952-746-6056