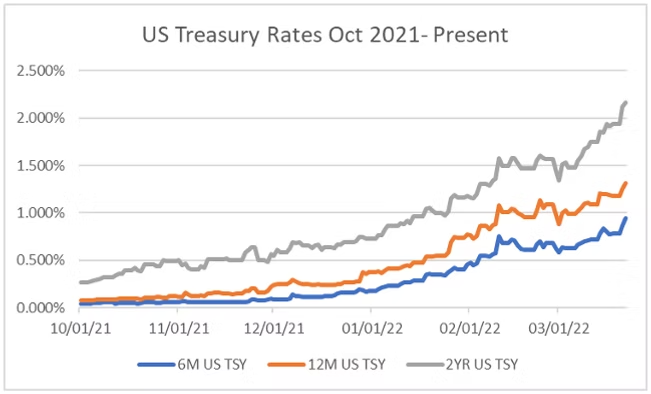

The first increase in the Fed Funds rate since 2018 was anticipated by the market months before it occurred. This, combined with signals of further rate hikes from the Fed and both the uncertainty and the economic impacts surrounding the war in Ukraine, have caused interest rates to increase significantly from the historically lows seen in recent years.

For perspective, from late February 2020 to late September 2021 the average two-year Treasury rate was under 20 basis points. On March 22nd, the two-year Treasury closed at over 2.00%. Shorter term Treasury rates have grown even more significantly, and the average growth rate of the six-month Treasury rate since January 1st was over 400%.

While higher interest rates are obviously concerning for issuers and borrowers, they also create an opportunity to decrease their borrowing amount of new money debt by locking in these higher interest rates on the reinvestment of their project funds.

Most project funds have an average life of two years or less (the Treasury rate for a term equal to the weighted average life of the project fund is a good proxy for a Treasury rate portfolio). We at Blue Rose recently closed a project fund with a final draw date of approximately five years with an average life of roughly two years that successfully resulted in an all-in rate of ~1.95% for a portfolio of containing only U.S. Treasury securities. This level is significantly higher than what we’ve seen in the recent past and provided a significant benefit to our client. Had this particular client been allowed to purchase a GIC or a Repo, the yield might have been even higher.

If you or your client has a project fund that won’t be spent immediately, we encourage you to reach out to your Blue Rose advisor to discuss the reinvestment opportunities in the current market.

Meet our Author:

Georgina Walleshauser, Assistant Vice President | 952-746-6036

Georgina Walleshauser joined Blue Rose in 2017 as an Analyst, providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. In the role of Associate, she utilized her experience as an Analyst in a more client-facing role, while still performing much of the analysis utilized in this capacity. In her role of Assistant Vice President, she will be tasked with growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing.

Media Contact: