The municipal market landscape in 2022 was a meaningful departure from what we experienced in 2021 and 2020, which were banner years for issuance of municipal debt. Municipal market issuance declined again from 2021 as rising interest rates and volatility were constant themes throughout much of the year. Taxable issuances were hit harder than tax-exempt transactions, but both showed notable declines, especially on the “BBB/Baa” and lower end of the credit spectrum. Both absolute yields and spreads widened considerably across the credit spectrum during the second and third quarters and – while they have somewhat stabilized in the fourth quarter – levels are much higher than in 2021 and 2020. The challenges of 2022 were not limited to higher borrowing rates and spreads. General declines in equity markets and other investments have negatively impacted endowments for higher education institutions and nonprofits, although the exceptionally strong performance of most endowments in 2021 has helped to cushion this year’s losses. Another interesting development in 2022 is how institutions’ operating performance changed as most COVID-19 related financial assistance ended, resulting in decreased operating revenue and income as well as thinning operating and cash flow margins. As we turn our attention to the coming year, some of the key market trends Blue Rose is focusing on include:

Interest Rate Movements

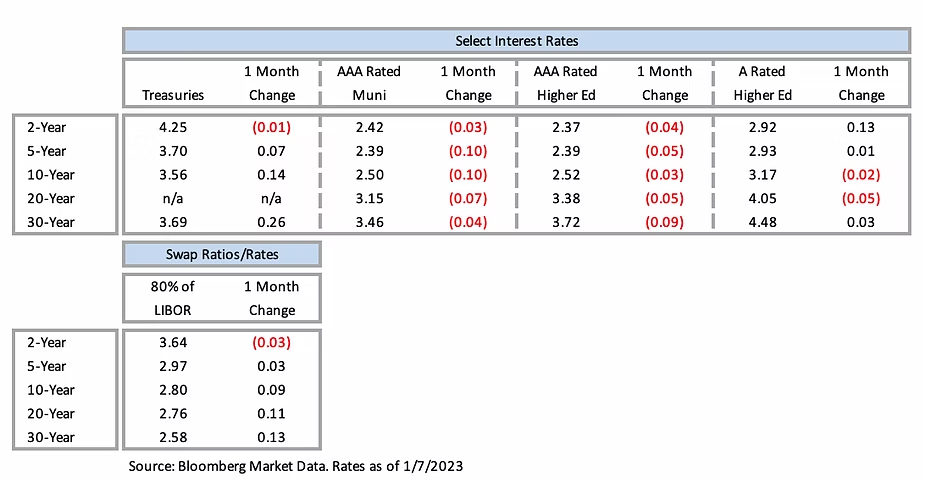

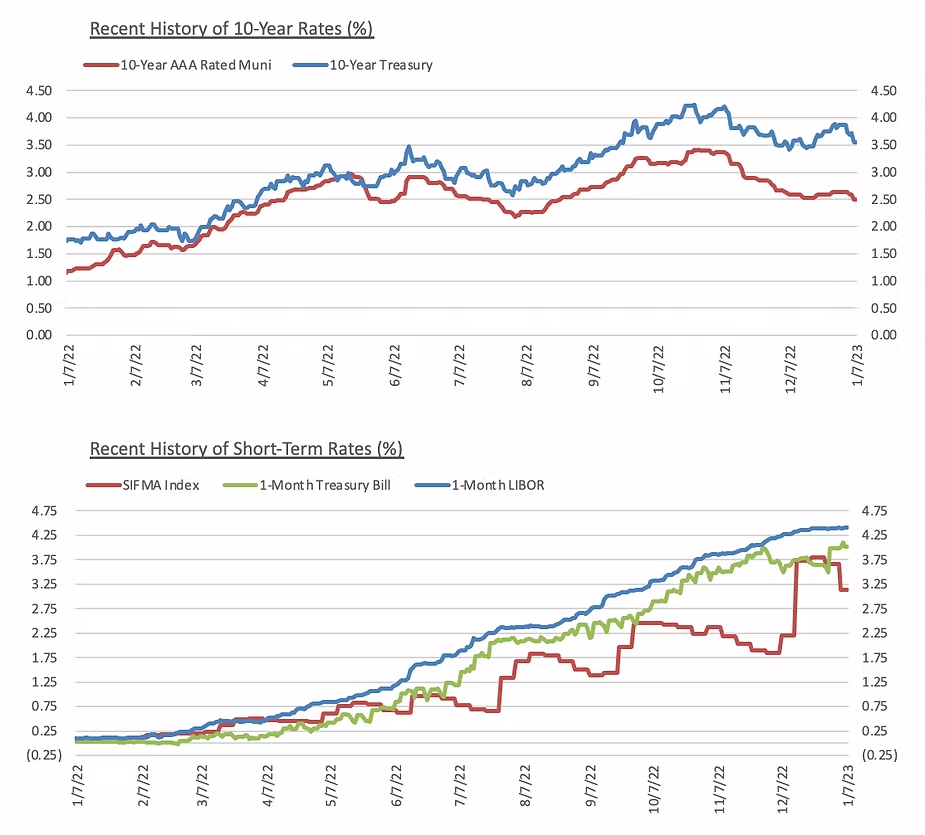

The Federal Reserve raised benchmark interest rates six times in 2022, moving the Fed Funds rate from 0.25% at the beginning of the year to the current 4.50%. These hikes have aimed squarely at reducing inflation from the decades-high levels. Long-term borrowing rates have followed suit, rising considerably over the course of the year causing refunding opportunities to evaporate for many institutions. The MMD benchmark rose approximately 160-270 basis points across the yield curve, while treasury rates faired worse, notching increases of between 207-434 bps on 1–30-year tenors. In both indices the largest increases came at the front end of the yield curve, indicating that the market is uncertain over where rates will go in the near term.

Inflation

The Consumer Price Index rose 6.5% in December from a year earlier. While this is the sixth straight month of declines since the index’s mid-2022 peak, high inflation has been prevalent in the national discussion throughout the year. Economists expect more moderate increases of approximately 4%[1] in 2023. While this would be a relief from the very elevated levels experienced in 2021 and 2022, it is still relatively high compared with the Fed’s target rate of 2%. Food, energy, and housing costs have been the hardest hit areas in the CPI index. While many factors will drive the overall outcome for the coming year, one key driver will be the possible escalation of the ongoing conflict in Ukraine, which has caused surges in commodity prices like fuel and food. The effects of high energy costs often cause ripple effects in other goods as they become more costly to transport. Another important metric will be the strength of the labor market, as rising wages have increased costs for businesses and thus, made their services more expensive to provide. The December jobs report which was released last week showed growth in non-farm payrolls exceeding projections. Wage growth, on the other hand, fell short of expectations, a possible sign that some inflationary pressure could be starting to ease. For the institutions that we serve, inflationary pressures primarily relate to budgetary considerations, but elevated inflation levels coupled with rate increases have dragged down new issuance volume in 2022, which could spill over to 2023.

LIBOR Transition

While many institutions have implemented a “soft” deadline of December 31st, 2022, to move away from the LIBOR index, many agreements that reference it are still outstanding. With the LIBOR cessation date of June 30th, 2023 quickly approaching, the final push to transition existing instruments is in full swing. 2022 saw the emergence of a clear preferred alternative rate for the transactions we advise on, with the regulatory preference, SOFR, proving easier to use and trade in both the lending and derivative markets.

If you have LIBOR exposure or would like to discuss capital plans in the context of these market conditions, please reach out to your Blue Rose advisor to schedule some time to connect.

From all of us at Blue Rose, we wish you a happy and healthy 2023!

[1] Bloomberg ECFC forecast

Comparable Issues Commentary

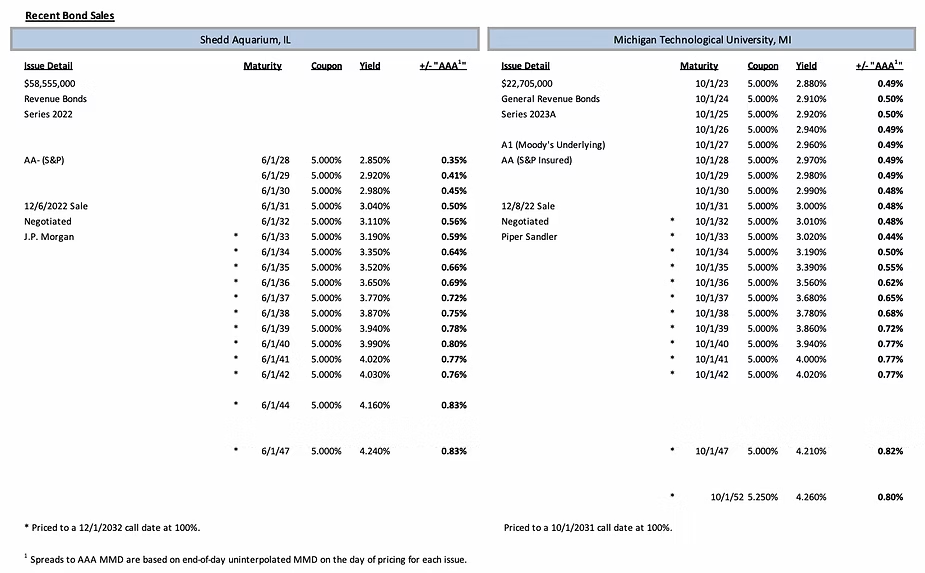

The week of December 5th was a busy one at Blue Rose. In addition to bringing our team together in Minneapolis for some winter activities, two of our borrower clients also priced capital markets transactions during the week. These transactions, while similar in timing, came from two very different institutions – one for a public university in the state of Michigan and the other for a nationally renowned non-profit institution located in Chicago. On December 6th, the Shedd Aquarium Society (“the Shedd”) priced its tax-exempt Series 2022 revenue bonds. Two days later, on December 8th, Michigan Technological University (“Michigan Tech” or “MTU”) priced its tax-exempt Series 2023A revenue bonds. The Shedd’s transaction was a new money issuance that served to finance various components of its Centennial Commitment, including a new facility dedicated to animal care as well as renovations to the main aquarium facility to optimize the flow of the exhibits and enhance the visitor experience. Michigan Tech’s issuance served to finance various aspects of its campus master plan, primarily including renovations to classrooms and lab spaces across campus, as well as the replacement of the HVAC system in its ice arena and the construction of a parking lot. MTU concurrently issued a smaller taxable Series 2023B, which financed the construction of a high bay building for its Keweenaw Research Center to provide additional storage space for ground vehicles in support of sponsored research projects.

Both institutions’ bonds carried ratings from S&P Global (“S&P”), with MTU also carrying a rating from Moody’s Investors Service (“Moody’s”). MTU’s underlying Moody’s rating was “A1” but its bonds also carried a “AA” S&P rating that was an insured rating from Assured Guaranty Municipal (“AGM”). The Shedd’s bonds carried a natural “AA-” rating, one notch above the underlying rating of MTU, and did not carry bond insurance. The two credits differed in several other material respects as well. The Shedd Aquarium had not issued debt since 2005, while Michigan Tech is a frequent issuer, meaning the market had relatively more familiarity with Michigan Tech’s credit. Additionally, the Shedd’s position as a cultural institution attracts somewhat of a different investor base in comparison to a public university such as MTU. Though both issues were sold as revenue bonds, the revenue streams supporting those bonds vary meaningfully. Michigan Tech’s primary revenues come from tuition, auxiliaries, and government grants/appropriations while the Shedd derives most of its revenue from admission fees, membership dues, and gifts.

The sizing of the two transactions was also a differentiator. The Shedd’s Series 2022 issuance totaled $58.6 million while MTU’s Series 2023A was smaller at $22.7 million (MTU’s taxable Series 2023B added another $5.5 million for a combined total par amount of $28.2 million). The structures of both transactions were fairly similar, as each had 15-20 years of serial maturities followed by two term bonds. MTU’s deal featured serials from 2023-2042 with term bonds in 2047 and 2052, while the Shedd utilized serial maturities from 2028-2042 with term bonds in 2044 and 2047. Notably, tax considerations drove MTU to structure the first 10 serial maturities (from 2023-2032) in small $50K blocks. These maturities were priced at wider spreads than otherwise would be expected due to the particularly small block sizes, which limited investor interest. Michigan Tech’s bonds also featured a slightly shorter 9-year call feature – becoming eligible for early redemption in October 2031 –to line up with the call date of the University’s prior Series 2021 bond issue and provide potential efficiency for a future refunding. The Shedd’s bonds, in contrast, used a more standard ~10-year call feature in December 2032. Couponing for the two deals was nearly identical, with both transactions exclusively utilizing 5% coupons on all maturities except Michigan Tech’s final term bond in 2052 (which featured a premium 5.25% coupon).

Priced only a couple of days apart, market conditions for the two transactions were very similar, and both borrowers benefitted from a year-end market rally that followed the peak of tax-exempt rates in late October. The week ahead of pricing, MMD decreased by 11-25 bps across the yield curve. The following Monday, the day before the Shedd priced, MMD fell another 2-4 bps on maturities from 2025-2036. On the day of pricing, MMD fell another 2 bps in the 2024-2034 maturities. The Shedd was able to achieve final spreads of 59-80 bps on its callable serial maturities and a spread of 83 bps on both term bonds. On Wednesday, MMD moved 2 bps lower on 3-30 year tenors. On the 8th, the day of MTU’s pricing, MMD remained unchanged. Michigan Tech was able to achieve final spreads of 44-77 bps on its callable serial maturities and spreads of 82 and 80 bps on the 2047 and 2052 term bonds, respectively.

Interest Rates

Ben Pietrek | [email protected] | 952-746-6055

Ben Pietrek joined Blue Rose in 2021 and works as an Analyst. In his role Mr. Pietrek is responsible for providing analytical, research, and transactional support to the lead advisory team serving higher education, non-profit, and government clients with debt advisory, derivatives advisory, and reinvestment advisory services. He is also responsible for credit and debt capacity analyses.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056