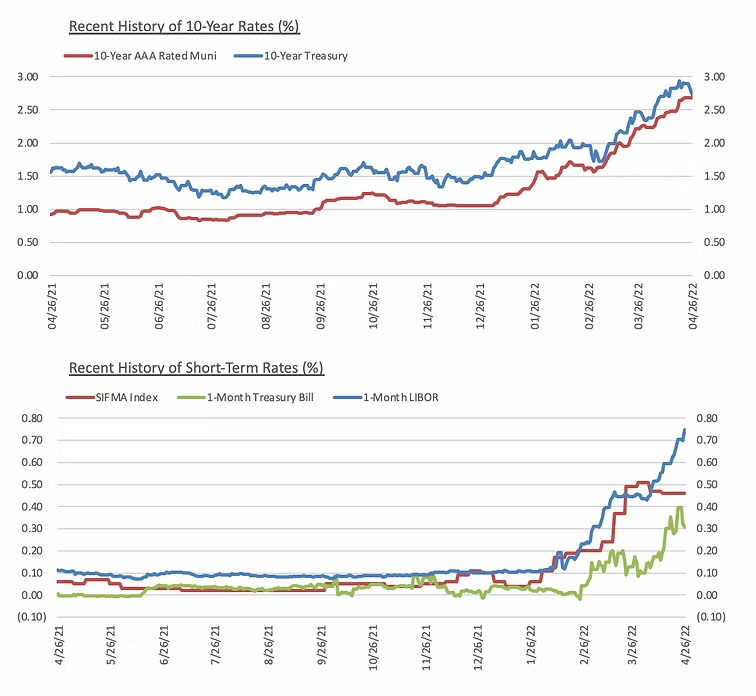

There is no question that the rapid rise of interest rates in 2022 has come much more quickly than nearly anyone anticipated. During the second half of 2021, there was growing evidence that the mounting inflationary pressures once thought to be transitory were, in fact, a bigger problem. Indeed, the perspective that inflation was temporarily high was a common stance. Many believed inflation was a short-term phenomenon, driven by COVID pandemic-related causes, including the often discussed supply chain issues that led to delays in the delivery of many consumer products. In fact, during much of calendar year 2021 even the Federal Reserve believed significant inflation pressures were temporary and, by virtue of their more recent policy change on long-term inflation, were willing to let inflation run higher than its 2% target for some time. However, the Consumer Price Index (CPI), a measure of price changes over time for a common basket of consumer goods and services, has since revealed inflation has been running at or above 5% for every month since May 2021 except December 2021, a month in which the CPI was 4.7%. Moreover, save for the December 2021 outlier, CPI has been at or above 7% for four of the last five months, including a whopping 8.5% level in March 2022. It is no wonder that we are now seeing the Federal Reserve taking decisive action to combat these inflationary pressures, and looking to do so quickly.

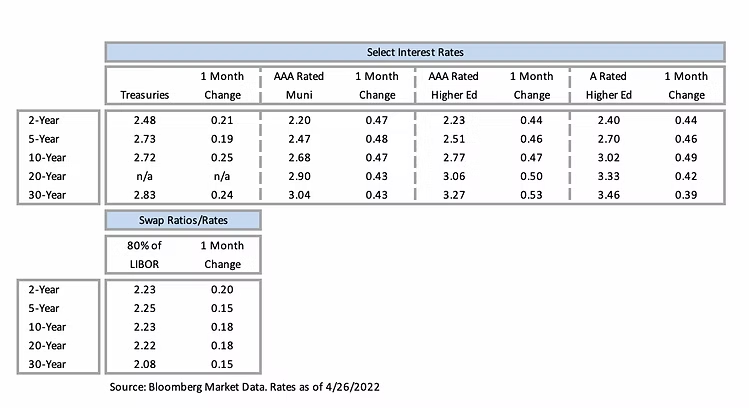

As a result of these market dynamics and the Federal Reserve’s recent and anticipated actions, both borrowing and investment rates have increased substantially in 2022. The 20-year MMD and treasury rates are up 160 and 118 basis points since the beginning of the year, respectively, and as of April 27thmarket close are 2.90% and 3.11%, respectively. Similarly, on the short end of the yield curve, 2-year MMD and treasury rates are up 196 and 186 basis points in 2022 with yields now at 2.20% and 2.59%, respectively. Of course, acknowledging that we need to thoughtfully plan around higher interest rates as we gear up capital plans for new money borrowings is an obvious – and sometimes uncomfortable – discussion topic. But other considerations and implications of this market environment should also be recognized.

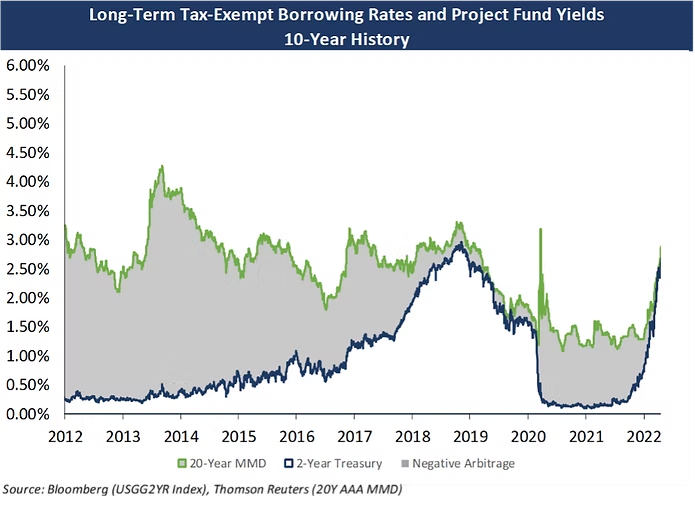

For starters, higher short-term interest rates may be causing higher borrowing costs, but they are also creating the opportunity for borrowers to minimize negative arbitrage. Most often considered in the context of a refunding transaction, negative arbitrage is the dollar cost difference (or interest rate difference) between an issuer’s borrowing rate and its refunding escrow investment rate. In recent years, advance refundings have included a substantial amount of negative arbitrage due to the low short-term investment rates available with SLGS or open market securities. Now, however, the amount of negative arbitrage has been substantially reduced. Just as important, this negative arbitrage concept carries over to new money transactions as well. The ability for issuers to actually earn a meaningful investment return on project funds is upon us once again. Consider the difference in the chart below on the 20-year borrowing cost to the 2-year investment rate. The amount of negative arbitrage on a refunding escrow is substantially reduced and, similarly, so too would be the negative carry of an issuer’s new money borrowing rate compared to a project fund investment rate. In short, the sharp increase in short-term rates means interest earnings on a new money project fund should now be factored into a new money plan of finance. Furthermore, in light of these higher short-term investment rates, consideration for the timing of bond pricing – notably whether a transaction should be accelerated – should also consider the short-term investment earnings and lower carry cost of the debt.

There is no shortage of additional financing-related strategies to be considered as we enter this rising rate environment. Listed here are a few questions that we continue to discuss and solve with our clients that may need additional consideration for your particular capital planning situation.

Is the historically low interest rate environment that we’ve enjoyed since 2008 gone?

How much of a higher cost of capital should we consider for our financing plans looking ahead?

Should we accelerate our borrowing plans with the expectation of additional Fed rate hikes that are anticipated in 2022 and beyond?

Should we consider variable rate instruments in the future to combat the higher fixed rate cost in today’s market?

Should we consider the use of forward rate locks or derivative products to hedge future borrowing costs?

Do we need to factor in higher future interest expense into our operating budget?

How much higher debt service can we afford under various interest rate assumptions, and might this impact the amount of borrowing we can undertake?

Should we consider an alternative debt structure or amortization schedule in light of rising rates?

How will the current and forecasted inflationary pressures impact the cost of project materials or labor costs, and might those higher costs also impact financing timing?

There are cycles to interest rate markets, and it is evident that we have entered into a new rising interest rate cycle in 2022. Your Blue Rose advisor would be pleased to discuss these questions with you as well as how we are working with other borrowers to address the issues and concerns that higher interest rates are having on capital plans. We look forward to continuing the dialogue with you.

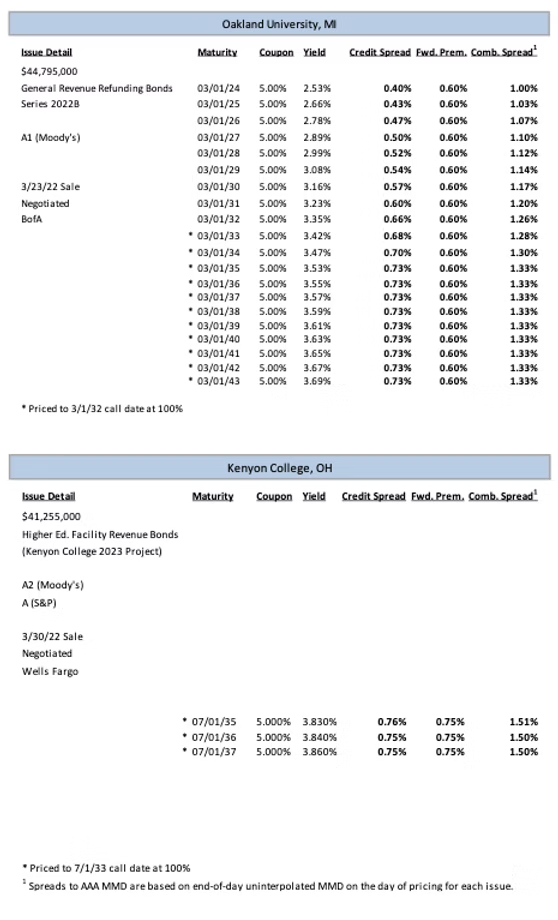

Comparable Issues Commentary:

Shown below are the results of two higher education issues that sold at the end of March. Oakland University (“Oakland”) priced its tax-exempt Series 2022B bonds on March 23rd. The following week on March 30th, Kenyon College (“Kenyon”) priced its tax-exempt Series 2023 bonds. Both issues were sold as forward delivery bonds and will serve to current refund outstanding bonds. Kenyon’s Series 2023 was issued to refund its 2013 bonds, which will become callable on June 1, 2023. Oakland’s Series 2022B was issued to refund all of its callable Series 2013A bonds, which will become callable on March 1, 2023. Oakland also issued a concurrent tax-exempt Series 2022A without a forward premium, which was issued to current refund the University’s Series 2012 bonds.

Both schools’ bonds were rated by Moody’s and Kenyon’s bonds also carried a rating from S&P. Oakland’s bonds were rated one notch higher by Moody’s, carrying an A1 rating. Kenyon’s bonds were rated A2 by Moody’s and A by S&P, and Kenyon’s A2 rating did come with a positive outlook. . In terms of structuring, the forward delivery feature was the most notable similarity between the two transactions. Kenyon’s Series 2023 was issued with a ~12-month forward delivery period (closing in early April 2023), which carried a total forward premium of 75 bps, or ~6.25 bps per month. Oakland’s Series 2022B was issued with an ~8.5-month forward delivery (closing in early December of 2022) and a total forward premium of 60 bps, or ~7 bps per month. Both deals used exclusively 5% coupons and were quite similar in total size, but the maturity structures of the two deals varied significantly. Kenyon’s bonds cover only 3 maturities from 2035-2037 but feature larger block sizes ranging from ~$9 million to over $16 million. On the other hand, Oakland’s maturities cover much more of the yield curve, featuring 20 years of serial maturities from 2024-2043, and carried correspondingly smaller block sizes ranging from $900K to $3.7M.

Both transactions priced into a relatively challenging market in late March, with taxable and tax-exempt interest rates continuing on their upward trajectory and credit spreads continuing to widen relative to the beginning of the year. Evidencing this, on the day before Oakland’s pricing, MMD had increased 12 bps across the curve, following up on further net increases of 8-13 bps during the prior week. Though the index was relatively stable on Oakland’s March 23rd pricing date (increasing by 0-2 bps across the curve), over the next four business days ahead of Kenyon’s pricing MMD increased by an additional 10-24 bps across the curve. Kenyon was also fortunate to price on a more stable day, with the index unchanged on the day of pricing, but these sizeable movements in interest rates are demonstrative of the difficult market environment that issuers are facing in 2022. Kenyon’s Series 2023 achieved spreads of ~75 bps on its three maturities, net of the 75 bps forward premium for a 12-month forward delivery. Spreads on Oakland’s callable Series 2022B bonds ranged from 68-73 bps, net of the 60 bps forward premium for an ~8.5-month forward delivery.

Interest Rates:

Meet the Author:

Erik Kelly, President | [email protected] | 952-746-6055

Erik Kelly serves as President of Blue Rose, providing leadership, coordination, and oversight of the firm’s advisory services since 2011. He also serves as the lead advisor to many of the firm’s clients, including advising higher education, non-profit, and other borrowing entities on the planning for and execution of all types of debt and debt-related derivative transactions. In managing the firm’s various advisory service areas, Mr. Kelly oversees both compliance with the changing regulatory environment and the delivery of professional advice to the firm’s clients.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056