Interest rates have never been lower. Yes, participants in the fixed income and public finance markets have said this before; many times, in fact, over the last 20 years. I was reminded of this again as we recently priced a taxable bond issue for a long-time client. Yet, we have had the opportunity to say these very words nearly each day over the last two weeks. It is incredible.

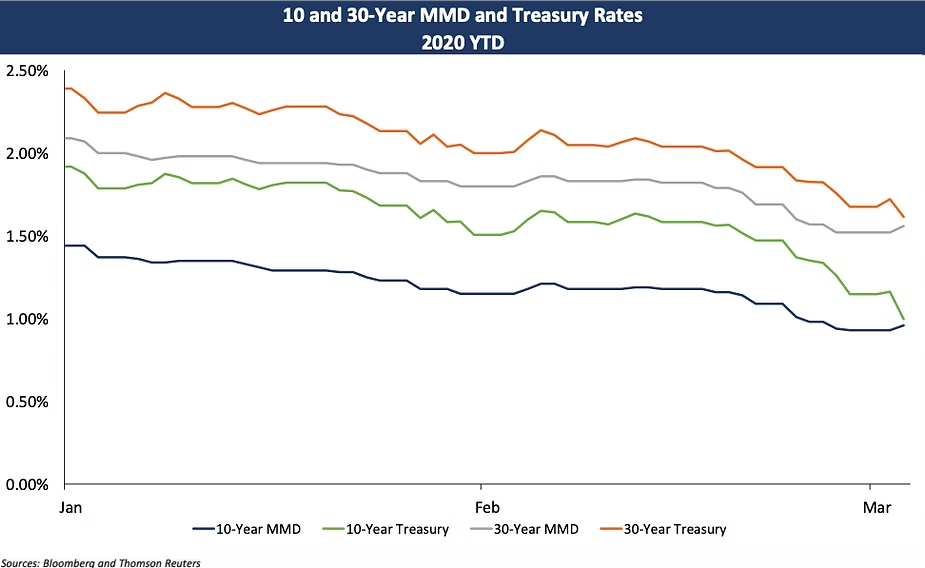

As of market close on March 3rd, the 10-year treasury yield was 1.00%, while the 30-year treasury was at 1.61%. Similarly, in the tax-exempt markets, benchmark MMD rates were also close to all-time lows, with the 10-year at 0.96% and the 30-year at 1.56% (up 3 and 4 bps, respectively, from their all-time lows reached the day before). The COVID-19 outbreak (i.e. the coronavirus) has been a major headline contributor that has led to a “flight to quality” towards fixed income securities, including both tax-exempt bonds and taxable U.S. Treasuries. Some of the trading activity is undoubtedly fear-driven, but a good portion of the market rally is also a recognition of the real and potential world economic slowdown that is arising due to the coronavirus. In fact, for the first time since the economic crisis in 2008, the Federal Reserve has taken an emergency action of cutting the Fed Funds rate by 50 bps, which occurred yesterday. The reason cited: economic slowdown due to COVID-19. The impact is real.

For borrowers, the opportunities arising as a result of these market conditions are substantial. With rates this low, new money and refinancing bond transactions are being priced at unprecedented levels, despite the unsurprising increase in credit spreads against benchmark indices as investors begin to push back on the absolute low levels of investment return. Accessing the market – either the private or public markets – and capturing the opportunity that is available is not necessarily as straightforward as in previous low interest rate cycles, however. To demonstrate, here are examples of financing strategies (some more complicated than others) that our team is analyzing and, in certain situations, beginning to execute for many of the organizations that we proudly serve:

1. Taxable advance refundings

- While tax-exempt advance refundings may be a thing of the past, the historically low levels of current interest rates are causing taxable advance refundings to generate significant savings

- Optimizing the call feature of a bond transaction continues to be important – hence, not all refundable bonds should necessarily be refinanced. However, many outstanding bonds are now unexpectedly meaningfully “in the money.”

2. Forward tax-exempt refunding bonds

- Alternatively, rather than advance refund an outstanding bond that is callable in the future, an institution could lock in a fixed rate now and close on the financing closer to the call date (i.e. a forward current refunding).

- The economics of this strategy depend on the duration of the forward period to the call date and whether it is executed as a bank loan or through a capital markets bond issue.

3. Cinderella Bonds

- A taxable bond that converts to a tax-exempt bond at midnight (i.e. at the call date) may be a somewhat elusive financing mode but it is executable in the current market depending on the structure of the issue.

4. Interest Rate Hedges

- For borrowers with variable rate debt, securing a fixed interest rate through an interest rate swap or limiting upside exposure through an interest rate cap can be an optimal solution.

5. Rate Locks

- If there is an anticipated bond issuance in the near- to medium term, a rate lock can be an effective way to quickly capture today’s market rates for a future issuance.

- For borrowers pursuing a taxable issuance, which is likely to price off the Treasury yield curve, a Treasury Rate Lock will likely be the best option, particularly if the bonds are scheduled to price within the next six months.

Once again, the market environment we are currently experiencing is incredible. There are financing strategies, including but not limited to those listed above, that should be explored to help your organization secure the all-time low, long-term fixed interest rates that are currently available in the marketplace. Please be in touch with us or contact your Blue Rose advisor to evaluate if these or other strategies are the right fit for your institution.