Blue Rose Remains a Steady, Trusted Advisor Amid Potential Significant Changes Ahead in 2025

Will the 2017 Tax Cuts and Jobs Act be extended?

The extension of tax reductions is welcomed by many, but it would come at a cost the offsets of which may not be welcomed.

Will private activity bonds – namely, tax-exempt bonds for non-municipal organizations such as non-profits – be eliminated?

This concept is one of many off-setting cost proposals to the extension of tax cuts that will impact a great many organizations that provide a public service but are not a governmental entity. Advocacy for the continuation of private activity bonds is imperative.

Will the tax-exempt bond issue as we know it be eliminated in its entirety?

With a new Congress coming to Washington, D.C., the foundational element of the public finance sector’s tax-exempt funding is coming under as much scrutiny as ever.¹ One cannot know for sure the outcome of this possibility, so early preparations are worth considering.

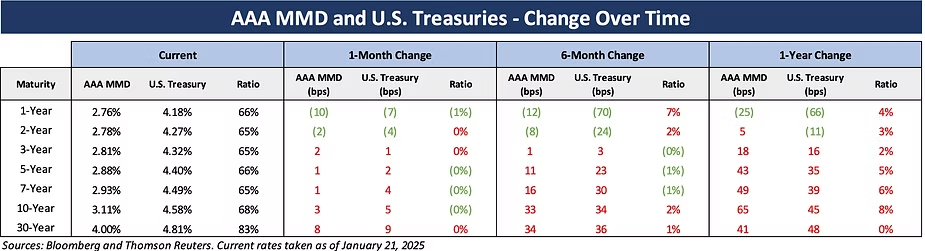

Has the inversion of the yield curve reached its end point?

With the tax-exempt MMD yield curve now reaching a fully upward sloping yield curve in early 2025 and the taxable yield curve largely upward sloping, the markets have nearly corrected to the “normal” slope with lower short-term rates and higher long-term rates.

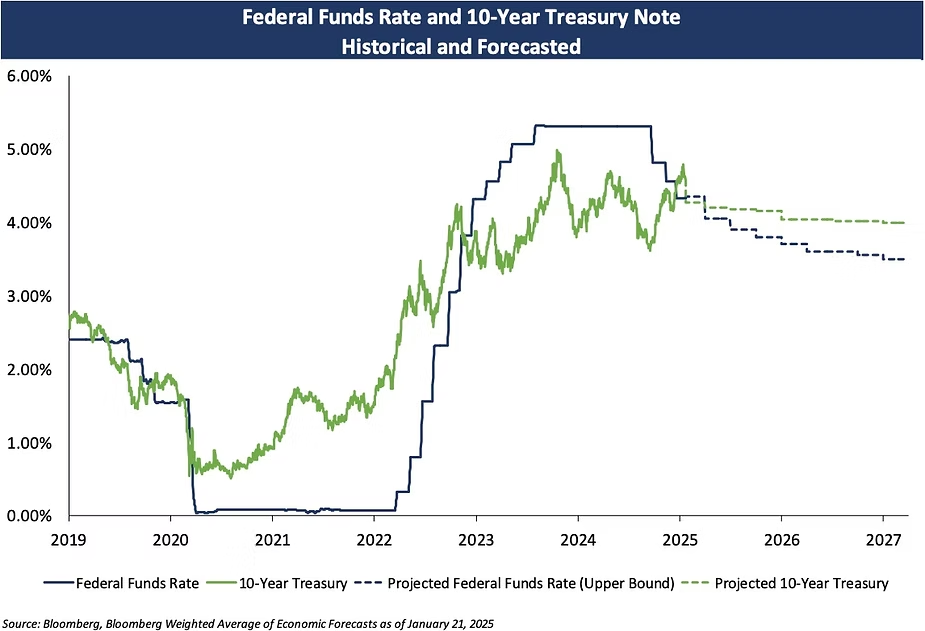

Will the Federal Reserve cut the Fed Funds rate at all in 2025?

Diverting from expectations of just a few months ago, the current economic forecast consensus shows a diminished expectation of larger reductions in the Federal target rate, with the greatest likelihood now at just one 25 bps cut in 2025,² demonstrating among other things that inflationary concerns are real and likely to stick around.

Our advisors are prepared to discuss each of these market-related questions with you, recognizing the significant implications the answers might have on an organization’s short-, medium-, and long-term capital plans. It is truly a time to be prepared.

In conclusion, I am grateful for my Blue Rose colleagues who have remained steadfast to our mission to improve organizations by providing advice, services, advocacy, and transparency on complex financial matters. We remain a committed group as we move into 2025, ready to tackle both old and new challenges and deliver on our mission to provide expert advice to organizations across the credit spectrum. We look forward to serving your organization and working with you to keep you apprised of market developments, assist in your financial forecasting, and execute capital plans that will benefit your organization for years if not decades to come. Thank you to those who have entrusted to us the wisdom of capital planning and debt execution. We look forward to serving you in 2025.

(1) “Tax-exempt bonds axed in menu of options floated by Ways and Means.” Bond Buyer, January 17, 2025.

(2) CME Group’s FedWatch, accessed January 21, 2025. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Meet the Author:

Erik Kelly | [email protected] | 952-746-6055

Media Contact:

952-208-5710