As the summer winds down, we can reflect on the unusual amount of market-moving events and volatility across equity, fixed income, and derivatives markets. April saw the largest interest rate upticks since the onset of the COVID-19 pandemic in 2020, and stocks have fluctuated at times between all-time highs and bear market territory. Market participants have had much to ponder as they navigate through this period – how many rate cuts (if any) are coming this year? How will government policy, particularly tax reform, impact markets? The story is still unfolding; it will take some time for markets to digest the Administration’s policy changes and priorities and their resulting impacts.

Interest Rate Movements and Impact

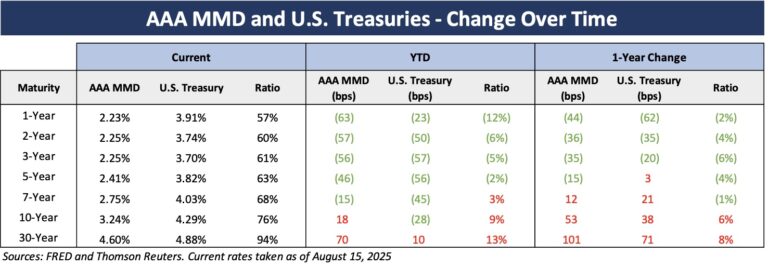

Both taxable and tax-exempt rates were volatile in the first half of the year. At the same time, the yield curve began to normalize and un-invert itself. From January 1st to August 15th, the tax-exempt MMD benchmark fell on the front end of the curve (tenors 1-8 years) anywhere from 7-63 bps. At the 9-year tenor and beyond, rates jumped up 6-77 bps. Treasury rates exhibited a similar pattern, with the 20-year Treasury and 30-year treasury up by 5 and 14 bps, respectively, with the shorter tenors decreasing by 23-54 bps. The calmer market tone at the end of the summer is a welcome change from the extreme volatility that rocked the bond market in April. Since April 9th, the day that tax-exempt rates peaked after “Liberation Day,” tenors within 10 years dropped 77-124 bps and tenors 10-years and beyond saw decreases of 20-65 bps. A summary of rate movements this year is shown below:

This year the higher education and non-profit sector is on pace to comfortably surpass the issuance levels of the last two years. As of August 6, total year-to-date supply of new higher education and non-profit issuance is nearly $33 billion compared to just over $23 billion at this time in 2024, and well above roughly $12 billion in 2023. Some of this elevated issuance can be attributed to institutions that have brought forth large transactions or upsized existing transactions to provide cushion and extra liquidity as higher education has come under fire on the national stage.

Economic Developments

The Federal Reserve has come a long way in its battle with inflation. Inflation in July came in at 2.7%, less than economists’ expectations, yet concerns remain that inflation could increase yet again due to tariff policy. Additionally, the administration has publicly applied pressure on the Fed to cut interest rates. Data from the CME FedWatch tool (as of 8/18/2025) suggests that there will be two rate cuts by year end; the tool reports an ~83% probability the Fed will cut rates at its September meeting with a roughly 48% probability of another cut coming by the December meeting. Chair Jerome Powell and others on the Board of Governors have offered that cuts might have already begun if not for the market turmoil in April following tariff announcements. As the impacts of trade policy will not be apparent for some time, the uncertainties around administration policy will likely take some time to ease. One example of this is in the below-expectations inflation read in July. Some analysts have argued that this shows a muted impact from tariffs on consumer prices, while others have argued that the inflationary impacts of tariffs haven’t truly flowed through to the consumer yet, given pauses and extensions in negotiations.

As we progress into the second half of the year, the market outlook remains uncertain. We have seen how quickly policy announcements and economic data can induce volatility and shift expectations, and this trend may continue for the balance of the year.

If you have questions or would like to discuss capital plans in the context of these market conditions, please schedule some time to connect with your Blue Rose Advisor.

Meet the Author:

Benjamin Pietrek | [email protected] | 952-460-5776

In his role of Associate, Ben Pietrek provides analytical and research support to the lead advisory team for Blue Rose’s debt, derivative, and reinvestment transactions for higher education, non-profit, and government clients. He is also responsible for executing pricing opinions and credit and debt capacity analyses.

Prior to Blue Rose, Mr. Pietrek worked for Altra Federal Credit Union where he drafted and filed various mortgage-related legal documents, along with preparing quarterly reports for management and assisted in creating annual reports for FHLB auditors. He has also held internships with Rockaway Capital and the Idea Fund of La Crosse where he assisted with various financial and analytical projects. Mr. Pietrek joined Blue Rose in 2021 as an Analyst.

Media Contact:

Laura Klingelhutz, Marketing Coordinator

952-208-5710