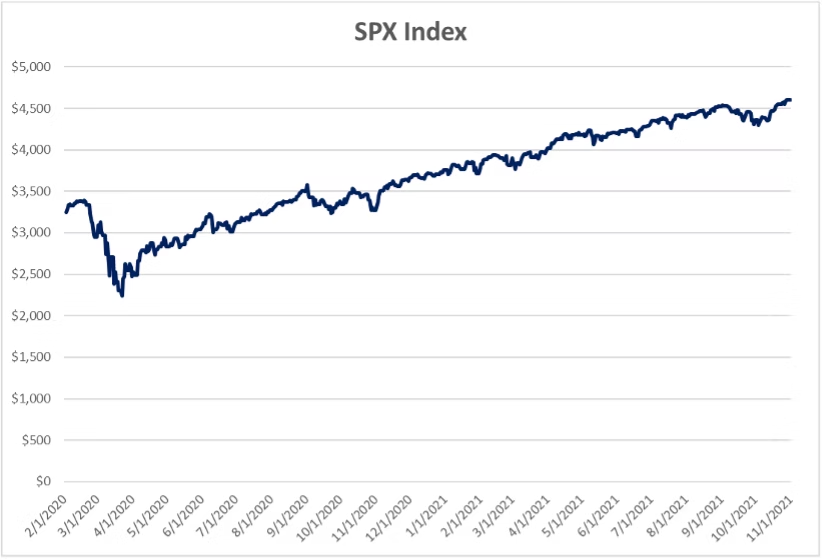

In the last year and a half, the strong stock market performance has been a boon for higher education institutions despite the turbulent operating environment. For example, the S&P 500 is up 35% from its pre-pandemic high.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvin

This strong market performance is now filtering through higher education institutions’ balance sheets as they begin reporting fiscal year end results for 2021. In fact, endowments have seen record-setting returns during the pandemic, with overall endowment returns estimated at approximately 27% for 2021 [1]. Here at Blue Rose, we have begun to assess the resulting implications for an institution’s capital planning. Endowment growth, especially when classified as an unrestricted asset, leaves management with the flexibility to either maintain those dollars in long-term investments or reinvest those funds into the institution in other ways. Some of these potential applications for reinvestment could include student discounting, improving or building out academic programming, capital additions, and/or capital maintenance. This endowment usage decision ultimately comes down to both the short-term priorities and long-term goals of the institution’s management and Board. As a financial advisor, we have been asked by many institutions to speak to how growth in investments could impact decisions from a capital planning perspective. The approach on how to use these funds isn’t a “one size fits all”, but we have identified three broad categories an institution may fall into in light of endowment growth and growing capital needs:

Spending cash.

Preserving liquidity while incurring additional debt.

Hybrid combination of spending and incurring additional debt.

1. Spending Cash

The first category primarily relates to an institution with one or more of the following characteristics: rising or stable enrollment, growing or steady operating performance, a cash surplus (possibly as a result of pandemic-related government aid), a large pool of unrestricted net assets, or an already sizeable endowment when compared to peers. For institutions in this category, the net impact of spending cash quickly to reinvest seems to outweigh any gains from potential additional investment performance it could garner should it leave more funds in its endowment. In fact, often these funds, if they were left in an endowment, would be allocated to a more liquid investment and, if so, in the current market wouldn’t yield a significant return. In these cases, it would make sense to assess how the dollars would be utilized if they weren’t spent down immediately, potentially by issuing debt instead, though the ultimate solution will likely involve some spending of cash. Another aspect of this approach that should be assessed is the pace at which cash is spent down. Some institutions will opt to use cash as an immediate one-time draw, while others will look to develop a cash spending program that distributes disbursements over a longer period.

2. Preserving Liquidity and Incurring Additional Debt

The second category relates to an institution with one or more of the following characteristics: declining enrollment, declining operating performance, low cash balances (potentially exhibiting a heavy reliance on government aid throughout the pandemic), low unrestricted net asset balance, or a small endowment when compared to peers. For such an institution, the increase in liquidity provided by its endowment growth seems to outweigh potential advantages from spending down that liquidity in the near term. This excess liquidity benefits its financial covenants, rating indications, and general credit marketability. The benefit of this liquidity, however, doesn’t mean that these institutions don’t have capital reinvestment needs. Therefore, in this category we would look primarily towards the current low-cost debt markets as a solution to campus reinvestment needs, while keeping as many funds as possible in an endowment. This allows an institution not only to continue to grow its endowment, but also increase the marketability of the institution’s credit through a larger endowment, improving the ultimate cost of capital that is achievable.

3. Hybrid approach

The last category we’ve identified is a mixture of the first two categories. Most institutions will likely fall in this category, experiencing varying operating and/or balance sheet performance throughout the pandemic. For institutions in this category, the net impact of reinvesting funds versus leaving those funds in an endowment to garner returns is relatively nebulous. In these cases, an assessment should be done on the cost of capital that is achievable to borrow for institutional initiatives compared to the benefit of maintaining a larger endowment. In this case, stakeholders must carefully consider the priorities and qualitative long-term considerations of the institution. Whatever an institution’s characteristics, significant investment and/or endowment growth opens a variety of capital reinvestment doors. To help you identify what your institution can achieve, we encourage you to reach out to a Blue Rose advisor to assist in evaluating these options and determining what approach may be most beneficial.

[1] Wilshire Trust Universe Comparison Service

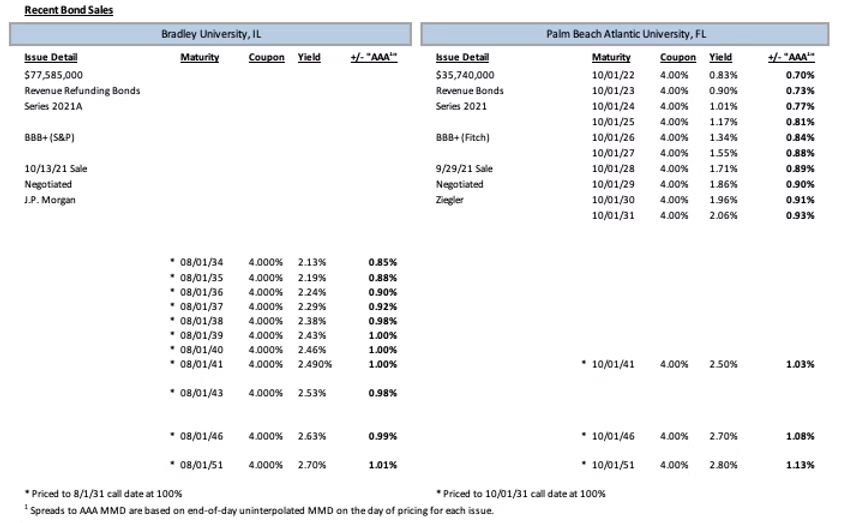

Comparable Issues Commentary

Shown below are the results of two negotiated, tax-exempt higher education issues from private universities which sold in September and October, respectively. Palm Beach Atlantic University priced its tax-exempt bond issue on September 29th and Bradley University priced a tax-exempt issue on October 13th. Palm Beach Atlantic’s Series 2021 Bonds were issued as a combined new money and refinancing issue. The new money portion of the issue financed renovations and capital improvements to various buildings on campus including residence halls, the student center, and various offices, classroom buildings, and administrative facilities. Additionally, the Series 2021 Bonds will serve to refinance the University’s Series 2012 Bonds as well as debt that was used for the purchase of an apartment building contiguous to the campus. Bradley University’s 2021A Bonds were issued exclusively for refinancing purposes and refunded the University’s 2008A, 2017A, and 2017B Bonds. Bradley also issued a concurrent 2021B tax-exempt series as a variable rate direct purchase transaction which was used to refinance its 2008B bonds. The refinancings of the University’s outstanding debt served in part to smooth out future balloon payments and reduce Bradley’s variable interest rate exposure.

Palm Beach Atlantic University’s bonds were rated “BBB+” by Fitch, while Bradley’s carried a “BBB+” rating from S&P. The two transactions had slightly differing amortization structures. Palm Beach Atlantic’s bond issue amortized over a full 30-year period, with serial maturities from 2022-2031 followed by term bonds in 2041, 2046, and 2051. In contrast, Bradley’s 2021A series did not begin to amortize until 2034, and maintained serial maturities from 2034 through 2041 before shifting to term bonds maturing in 2043, 2046, and 2051. Some of the difference in structure can be attributed to Bradley’s concurrent 2021B series, which as a direct purchase loan amortizes earlier on the yield curve, prompting a more deferred principal amortization of the University’s 2021A series. Both deals used 4% coupons on all serial and term maturities and featured standard 10-year call options. The issues varied substantially in total par amount, with Palm Beach’s $35.7M deal less than half the size of Bradley’s $77.6M transaction.

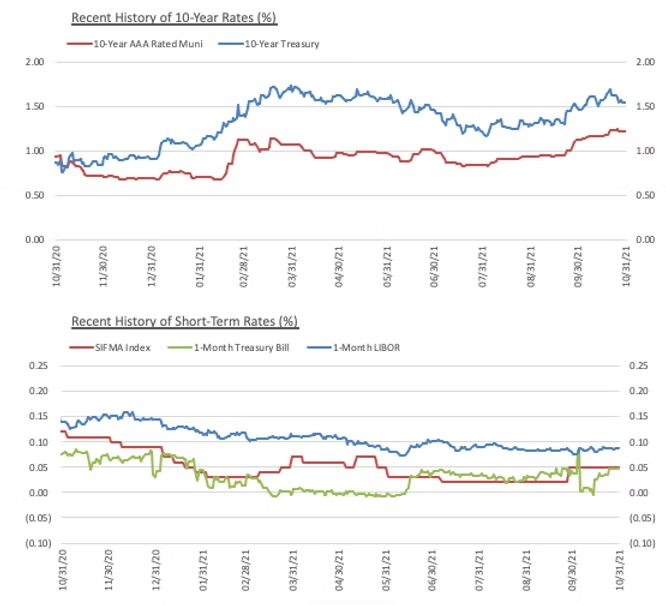

The two universities priced during somewhat choppy market conditions, with tax-exempt yields rising by anywhere from 6-24 bps from September 17th through October 8th due in part to concerns over inflationary pressures. On Palm Beach Atlantic’s pricing date of September 29th, the MMD curve increased by two basis points on maturities from 2029-2051. This followed on the heels of four consecutive days of rate increases between 0-7 bps across the curve per day leading up to the pricing. Bradley entered a slightly calmer market a couple weeks later on October 13th, with rates unchanged across the curve on the date of its pricing. Credit spreads on comparable 4%-coupon callable maturities (from 2041-2051) ranged from 103-113 bps for Palm Beach Atlantic and from 98-101 bps for Bradley.

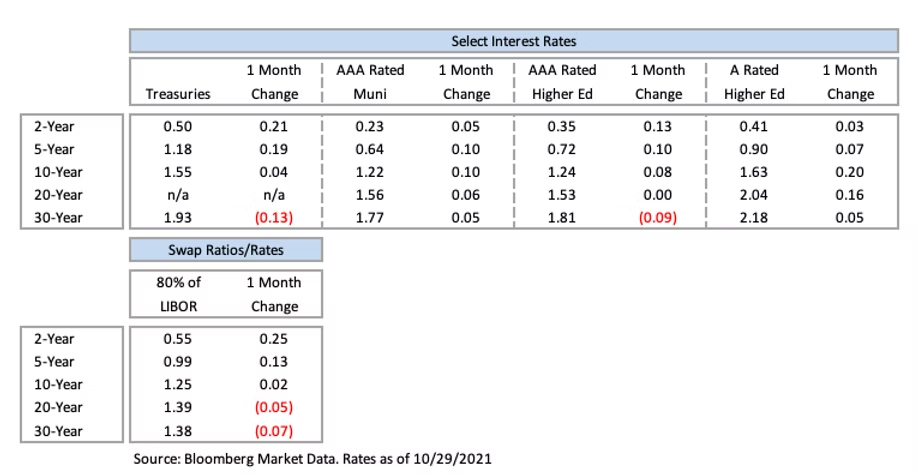

Interest Rates

Meet the Author

Brandon Lippold, Assistant Vice President | [email protected] | 952-746-6054

Brandon Lippold joined Blue Rose in 2018 as a Quantitative Analyst, providing modeling, analytics, market data, and research in support of the delivery of capital planning, debt and derivatives advisory, and reinvestment services to our clients. In the role of Associate, he utilized his experience as a Quantitative Analyst in a more client-facing role, while still performing much of the analysis utilized in this capacity. In his role of Assistant Vice President, he will be tasked with growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing.

Media Contact:

Megan Roth, Marketing Generalist

952-746-6056