Today’s popular economic narrative says to expect a strong recovery, with rising inflation at the same time. However, if we go into a recovery and inflation takes off, it is likely we would have a truncated recovery. With a weaker dollar comes a bigger trade deficit, and then inflation would push up interest rates, which will work against the recovery. And since prices generally rise faster than wages, real income would decrease. So, if we have a major acceleration in inflation, it also means an expansion would not hold. Therein lies the tension that has been created by today’s set of economic circumstances.

Due to the unprecedented amount of pandemic stimulus funds coupled with a jaw-dropping proposed infrastructure bill, many believe money supply has increased too much. But money supply is less important than the speed with which it circulates, or “velocity,” which is at the lowest level ever. As long as excess debt is pushing velocity lower, aggregate demand will keep falling. Sustained, broad inflation under these conditions is impossible.

During the last two months, we have all experienced anecdotal inflation: at the gas pump, in trying to buy a new computer (semi-conductors), in food prices or in buying a house (new home inventory has never been lower, and lumber prices are way up). Amazon bought up all the steel in the “whole country” for their Whole Foods expansion, and job openings are going unfilled. The idea is that rising prices – commodity and labor – will drive inflation. But historically, you’d be surprised to learn, commodities have no correlation with inflation. Aside from restaurants and hotels, many workers remain at home, with frothy, work-disincentivizing stimulus checks not ending until September, but they will probably want to work thereafter. These effects should limit wage pressure, and that does not count the many ways businesses have become much more efficient and automated during the pandemic.

The anecdotal evidence may not be real inflation; instead, it could be tremendous distortions and disturbances caused by the lingering effects of the pandemic. Everybody knows that after a big fast we tend to overeat, so maybe that is why we see sky-high car rental prices and surging airline travel, and with the price of oil embedded in all raw foods due to transport costs, the grocery store credit card charge is that much higher.

What may be going on, in the supply side of the equation, is that businesses panicked and stopped buying, inventories got low, and now they’re scrambling to catch up to meet surge demand, ordering two to three times more than usual, which will set up for a massive inventory glut in the fall. That sets the stage for deflation in the near–term future, perhaps even next year, or at the very least not scary inflation. After this supply chain–influenced bounce in inflation, many of the companies in the S&P 500 may be disintermediated or disrupted by technologically enabled innovation such as DNA sequencing, robotics, energy storage, artificial intelligence, and blockchain technology. Who needs Uber, DoorDash, and semi-truck drivers when swarms of autonomous drone fleets deliver everything our hearts desire in less than an hour, the cooking robot makes a better, more consistent Big Mac with fries, and the robo-butcher cuts up a perfect pork chop 24/7, laying off millions working in the meat processing plants? And maybe healthcare costs are about to plummet in a few years, as your entire genome will be sequenced for preventive care action at every doctor’s visit, using a $10 nasal swab.

So, is the inflation concern real? When, is the probably the right question to ask. Consider these answers.

In the near term (until about Q3-Q4 2021), as we are already seeing, there could be significant inflationary pressures. In fact, recently released CPI measures for May exceeded forecasts, up 0.6% – this after a 0.8% posting in April, which was the largest increase since 2009.

In the medium term (2022-2023), if the economy falters after stimulus fades, inflation could move lower.

In the long run (after 2022), monetary excess (about $19 trillion, plus maybe $6 trillion more) and the need to liquidate debt by inflating out of it could send inflation sharply higher, possibly to the point of hyperinflation. Perhaps unlikely, at least from a historical U.S. market perspective, but it’s tough to grasp paradigms that no currently living 25- to 65-year-old administrator in the U.S. has ever dealt with.

Lastly, there seems to be little to no inflation pressure elsewhere across the globe, and, in China, the economy is slowing down.

So, what to do?

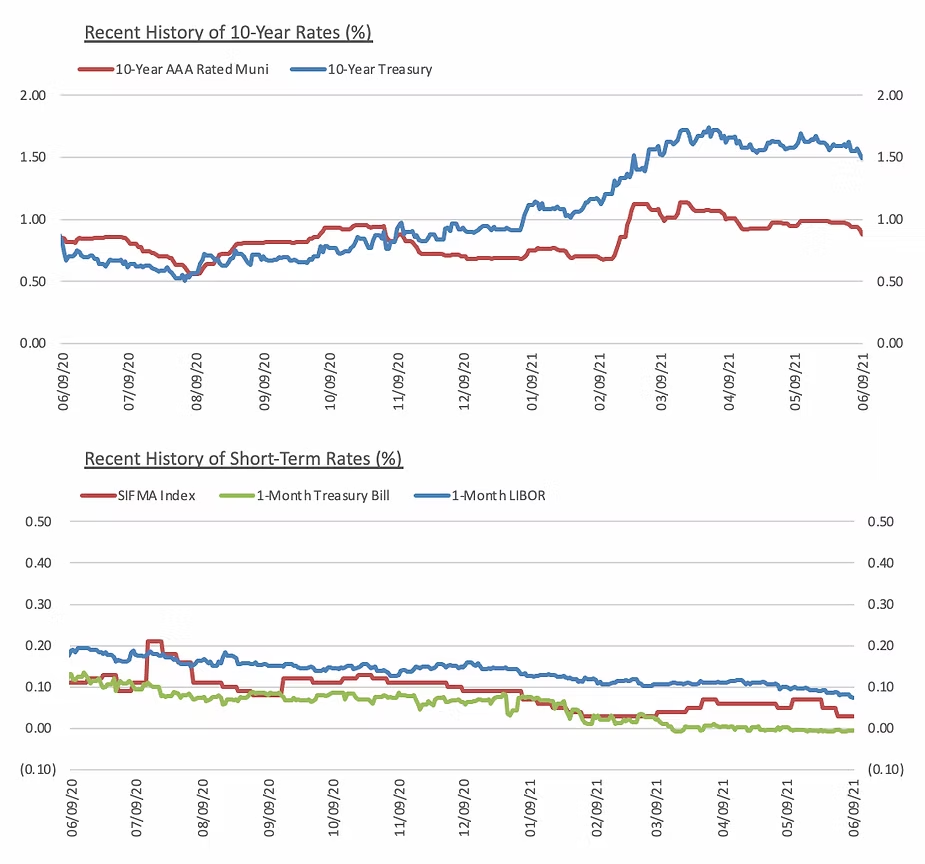

Rates remain quite low, and muni ratios are super low, so consider locking in rates now, potentially with an upcoming or forward issuance, pending other considerations and breakeven analysis.

If you miss the window to lock in a fixed rate or forward hedge, don’t fret – there are cycles, and stimulus unwind and economic growth stagnation could produce less inflation in the medium term.

In the meantime, perform 5- to 10-year proformas to see what your institution’s revenues and expenses look like with both lower and higher inflation assumptions versus a standard 3.00% escalator, and prepare your leadership to deal with an environment not seen in a couple of generations.

If you would like assistance evaluating your institution’s position heading into uncertain times, please contact your Blue Rose advisor.

About the Author:

Johan Rosenberg | [email protected] | 952-746-6030

Johan Rosenberg is a visionary leader with nearly three decades of financial advisory experience, first at a national nonprofit organization providing funding to community developers in disadvantaged communities and then at two national advisory firms. With a vast network of contacts in the financial services domain, Mr. Rosenberg monitors new products and trends in other sectors, exploring their application to the needs of his clients. He also follows legal and regulatory changes, developing innovative products and services in anticipation of his clients’ evolving requirements.

Comparable Issues Commentary

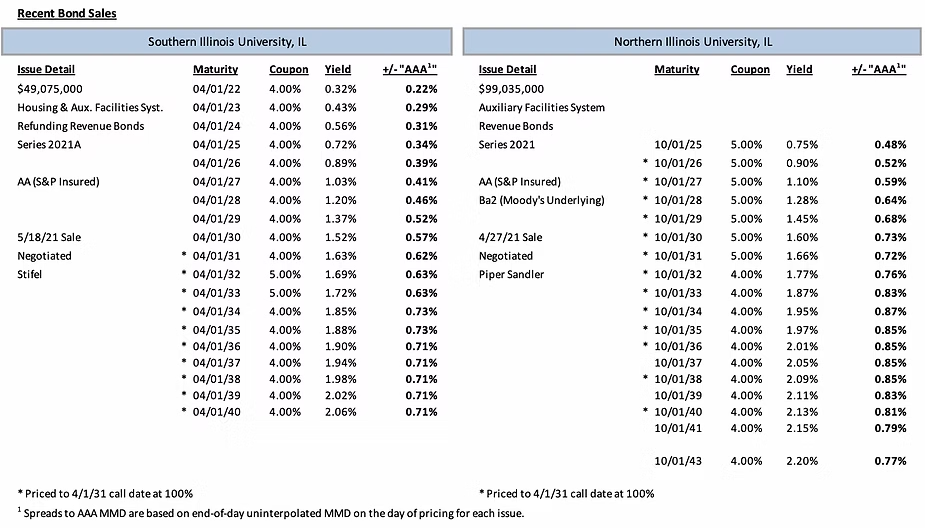

Shown below are the results of negotiated, tax-exempt higher education issues from two public universities in the state of Illinois which sold in April and May. Northern Illinois University (“NIU”) and Southern Illinois University (“SIU”) priced tax-exempt bond issues on April 27th and May 18th, respectively. Northern Illinois’s Series 2021 Bonds were issued entirely for a single purpose – the defeasance of the CHF-Dekalb II, L.L.C. – Northern Illinois University Project Series 2011 Student Housing Revenue Bonds (the “CHF Series 2011 Bonds”). This defeasance was part of NIU’s acquisition of the Northern View Community and New Residence Hall P3 student housing projects financed by those original CHF Series 2011 Bonds. Southern Illinois’s Series 2021A bonds were also issued exclusively for refinancing purposes, refunding the University’s callable Series 2008A, 2009A, and 2012A Bonds. Both issues carried insured ratings of “AA” from S&P backed by bond insurance policies from Build America Mutual, with NIU’s Series 2021 bonds also bearing the University’s underlying “Ba2” rating from Moody’s.

The two transactions were relatively similar in tenor, with maturities ranging from 2025-2043 for NIU and 2022-2040 for SIU. All maturities were serialized except for a short 2-year term in 2043 used by Northern Illinois. Both deals utilized a standard 10-year par call option and primarily opted for 4% coupons on their callable maturities, though SIU did opt to issue 5% coupons in its first two callable maturities (2032-2033). The security of the bond issues was quite similar as well, with each university selling its bonds backed by their respective auxiliary facilities system revenue credits.

Both universities priced into a strong tax-exempt market, with tax-exempt interest rates reaching fairly stable, low levels in late April and May. Additionally, both NIU and SIU were able to achieve exceptional pricing outcomes, with credit spreads significantly tighter than market conditions would have warranted in prior months. Meaningful yield reductions during repricing for each school also followed strong order periods. Spreads on callable 4% coupons ranged from 76-87 bps for NIU and between 71-73 bps for SIU. For NIU’s pricing on April 27th, the market was fairly quiet, with MMD increasing 1 bp from 2024-2032 and unchanged in all other maturities. Rates were similarly stable for SIU’s pricing on May 18th, with MMD unchanged early on the yield curve from 2022-2028, and down 1 bp on all remaining maturities (2029-2051).

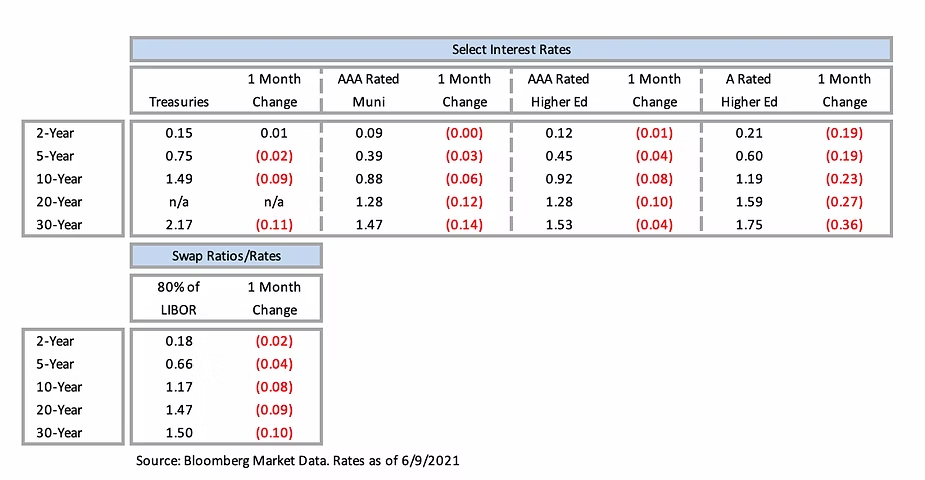

Interest Rates

Note from Author:

Thank you to Mauldin Economics this article reflects my take-aways from the 2021 Strategic Investment Conference. Great presentations by John Mauldin, Lacy Hunt, David Rosenberg, Katherine Wood, Louis Gave, and Danielle DiMartino Booth.

Blue Rose Capital Advisors

Erik Kelly, President

[email protected] | 952-746-6055

HedgeStar

Craig Haymaker, Chief Operating Officer

Media Contact:

Megan Roth, Marketing Generalist

[email protected] | 952-746-6056