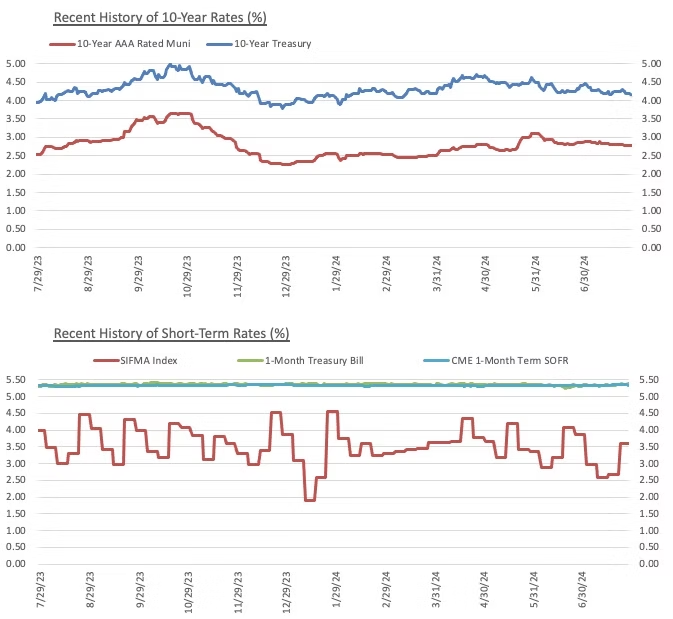

In our previous market update published in mid-May, we focused on interest rate volatility and signaling from the Fed on its rate outlook for the remainder of the year. While rate volatility has somewhat calmed, the interest rate environment is still elevated relative to the last several years. As volatility has cooled, speculation around Fed rate cuts has heated up due to recent positive reads on inflation and unemployment. Additionally, there is considerable uncertainty around how markets will react to the upcoming election. Below are several market developments that we at Blue Rose have observed in the markets through the first half of 2024.

Interest Rate Movements and Impact

Economic Developments

The Federal Reserve’s fight against inflation and its impact on markets and the broader economy remain key issues. In recent weeks, we have seen encouraging data suggesting that inflation is finally falling back toward the Fed’s long-term 2% target. In June, the core personal consumption expenditures price index, the Fed’s preferred inflation gauge, increased 0.2% and was up 2.6% from a year ago. A jobs report released earlier this month showed unemployment rising to 4.1%, slightly higher than the 4% target set by the Fed. Debt and equity markets have been reacting favorably to the news. According to the CME Group, as of July 30 there is now a 100% probability of a rate cut on or before the September 18th meeting. 85.8% of respondents believe there will be a 25 bps cut, while just under 14% of respondents believe it will be a 50 bps cut. Many of those respondents think further cuts will be in store before the end of the year. As of July 30, ~57% of those surveyed believe the fed funds rate will be in the 450-475 bps range following the December 18 meeting.

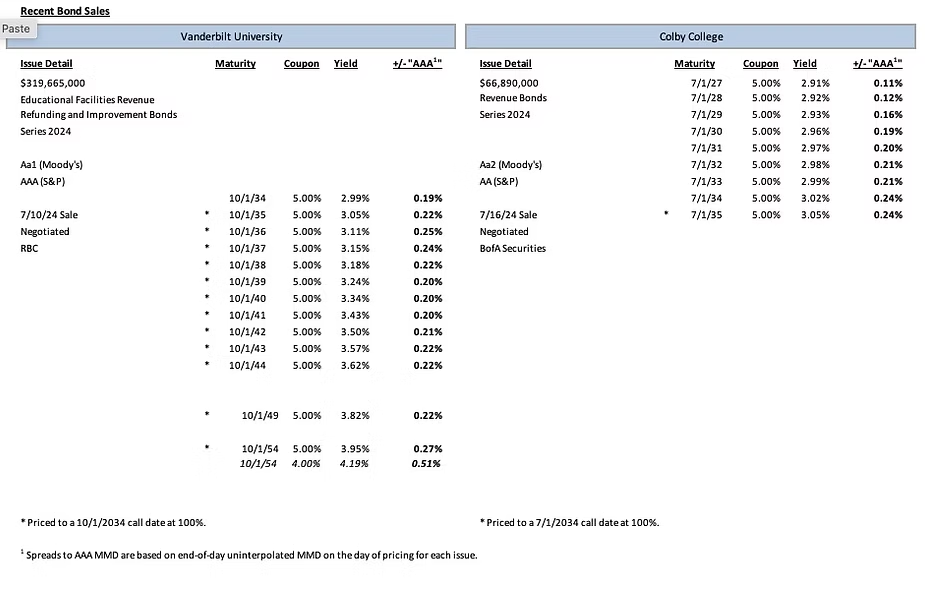

Comparable Issues Commentary

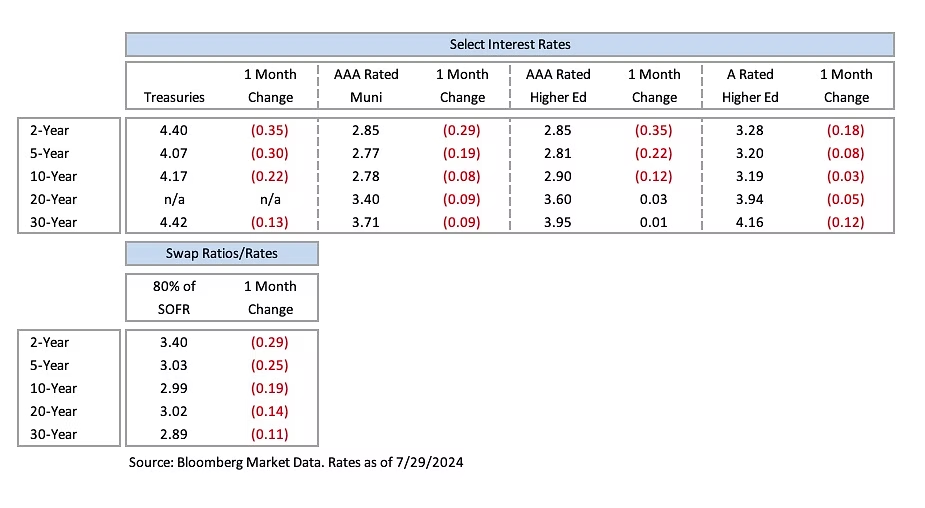

Interest Rates

Meet the Author:

Benjamin Pietrek | [email protected] | 952-460-5776

In his role of Associate, Ben Pietrek provides analytical and research support to the lead advisory team for Blue Rose’s debt, derivative, and reinvestment transactions for higher education, non-profit, and government clients. He is also responsible for executing pricing opinions and credit and debt capacity analyses.

Prior to Blue Rose, Mr. Pietrek worked for Altra Federal Credit Union where he drafted and filed various mortgage-related legal documents, along with preparing quarterly reports for management and assisted in creating annual reports for FHLB auditors. He has also held internships with Rockaway Capital and the Idea Fund of La Crosse where he assisted with various financial and analytical projects. Mr. Pietrek joined Blue Rose in 2021 as an Analyst.

Media Contact:

Laura Klingelhutz, Marketing Coordinator

952-208-5710