Key Public Finance Themes for 2021

LIBOR Transition

The anticipated LIBOR transition is undoubtedly one of the most important topics in public finance in 2021, and perhaps in all of the financial markets. In mid-January, our team had the opportunity to present at the Wisconsin Health & Educational Facilities Authority virtual annual meeting on the topic of the LIBOR transition, and we are advising clients every week about considerations to make and actions to take in preparation for the LIBOR cessation. We re-present here a summary of the critical do’s and don’ts for issuers and borrowers at this stage of the LIBOR transition process.

Do’s

- Recognize the LIBOR will away…eventually!

- Inventory your institution’s LIBOR exposure.

- Understand that various market participants are impacted differently as a result of the LIBOR transition.

- Recognize there are different implications for financial instruments with a market valuation (derivatives) versus those without (variable rate loans / bonds).

- Rely on your financial and legal advisors to ensure proper transition occurs for your institution.

Dont’s

- Assume that LIBOR transition will occur at the same time for all financial instruments.

- Assume that SOFR as a replacement index for LIBOR, even with a spread adjustment will make your institution whole as value transfer risk remains a legitimate concern.

- Assume that adopting “standard” LIBOR replacement language or ISDA fallback protocols is automatically the best approach.

- Assume the LIBOR transition process is solved as many market and regulatory developments are expected during 2021.

Credit Ratings

The COVID-19 health pandemic has created business disruptions in just about every U.S. public sector. Few are unscathed, and many face daunting challenges in the year ahead. These challenges have been highlighted as each of the three major rating agencies have published their credit outlooks for 2021. Not surprisingly, most U.S. public finance sectors are on negative outlook. Key credit themes for these outlooks include the persistence of weakened revenue streams, rising expenses, weak economic conditions, and the ongoing operational challenges resulting from the health pandemic. There are pockets of optimism and certainly hope for a more robust economic environment as the COVID-19 vaccines roll out, but the rating agencies have signaled the credit challenges may persist longer than desired.

2021 Sector Outlooks

|

Rating Agency*

|

Higher Education

|

Healthcare

|

Non-Profits

|

State & Local Governments

|

|---|---|---|---|---|

|

Moody's (1)

|

Negative

|

Negative

|

Negative

|

Negative

|

|

S&P (2)

|

Negative

|

Negative

|

N/A

|

Negative

|

|

Fitch Ratings (3)

|

Negative

|

Stable

|

N/A

|

Stable

|

* None of Moody’s, S&P, or Fitch Ratings have any U.S. public finance sectors on positive outlook

(1) Within Moody’s rated U.S. public finance sectors, only state housing finance agencies and municipal water and sewer utility sectors are on stable outlook.

(2) For S&P, six of 10 public finance sectors are on negative outlook.

(3) For Fitch Ratings, three of eight public finance sectors (higher education, housing and transportation sectors) have negative rating outlooks in 2021.

Potential Tax-Exempt Market Changes & Volatility

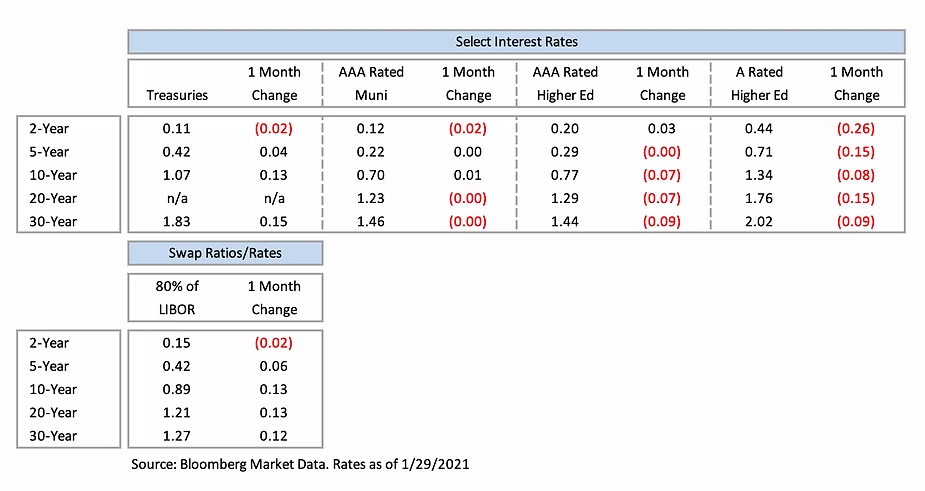

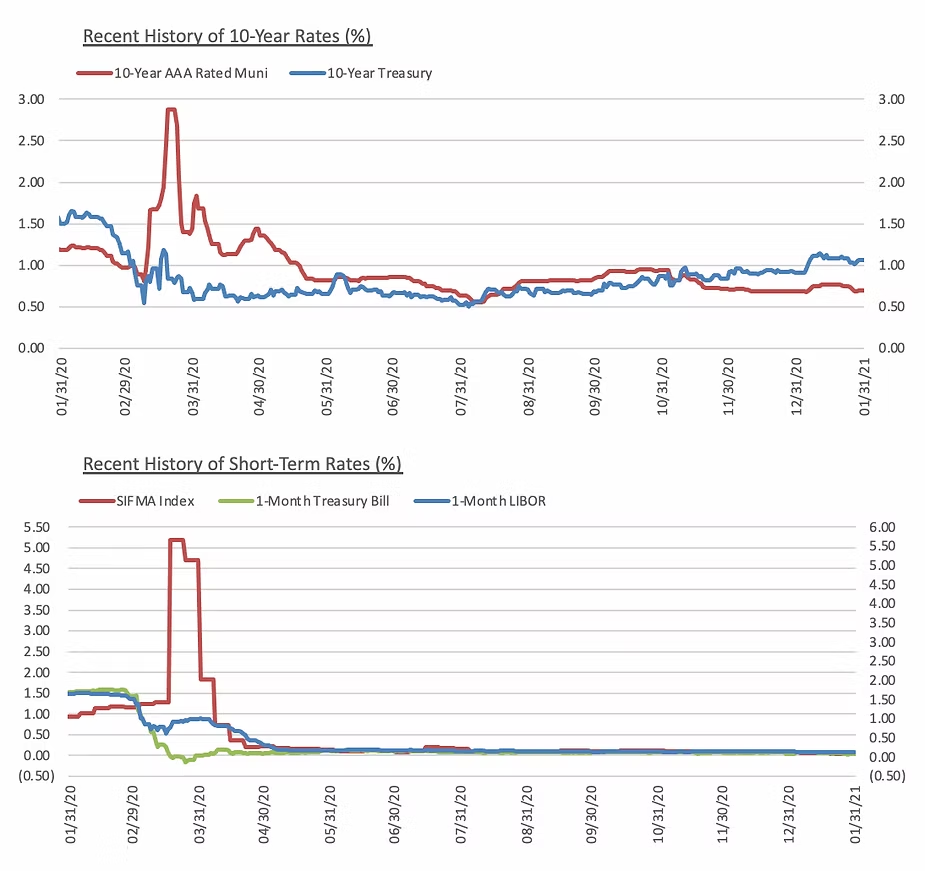

While every year brings new possibilities for the markets as a whole and the tax-exempt markets in particular, there could be meaningful changes that come about in 2021. Of course, we are kicking off the year with interest rates up off their all-time historical lows, but not by much. Borrowing costs remain extraordinarily favorable, with the 30-year tax-exempt MMD benchmark rate at 1.38% and long-term taxable rates remaining below 2% at the end of January. Besides favorable borrowing costs, what more could 2021 bring?

Will market interest rate volatility persist?

Likely, yes. While the Federal Reserve continues to hold the federal funds rate near zero and expects to do so for some time due in part to its revamped inflation framework, longer-term rates will be impacted by many more factors including supply and demand.

Early indications suggest yes, and perhaps meaningfully, especially for lower-rated credits that experienced significant credit spread increases in 2020.

Major tax law changes take time, but a Democratic pursuit of this legislative action should not come as a surprise.

Conclusion

While 2020 brought many unexpected challenges, we are hopeful for a brighter 2021. We trust that as the new year begins to unfold for you and your organization, your preparation and resiliency will lead to favorable outcomes in the year ahead. We look forward to assisting you along the way.

About the Author

Mr. Kelly holds a bachelor’s degree in economics from Amherst College and a master’s degree in theological studies from Bethel University. Mr. Kelly passed the MSRB Series 50 Examination to become a qualified municipal advisor representative and the MSRB Series 54 Examination to become a qualified municipal advisor principal.

Blue Rose Announcement: Blue Rose’s Max Wilkinson promoted to Assistant Vice President

“Max continues to go above and beyond for our clients. He understands the market and our clients’ needs, is proactive, and delivers valuable advice with clarity and confidence. We couldn’t be more pleased with Max’s performance and congratulate him on a well-deserved promotion,” says Scott Talcott, Senior Vice President.

Please join us in celebrating Mr. Wilkinson’s accomplishments!

Max Wilkinson, Associate

Office: 952-746-6048

Email: [email protected]

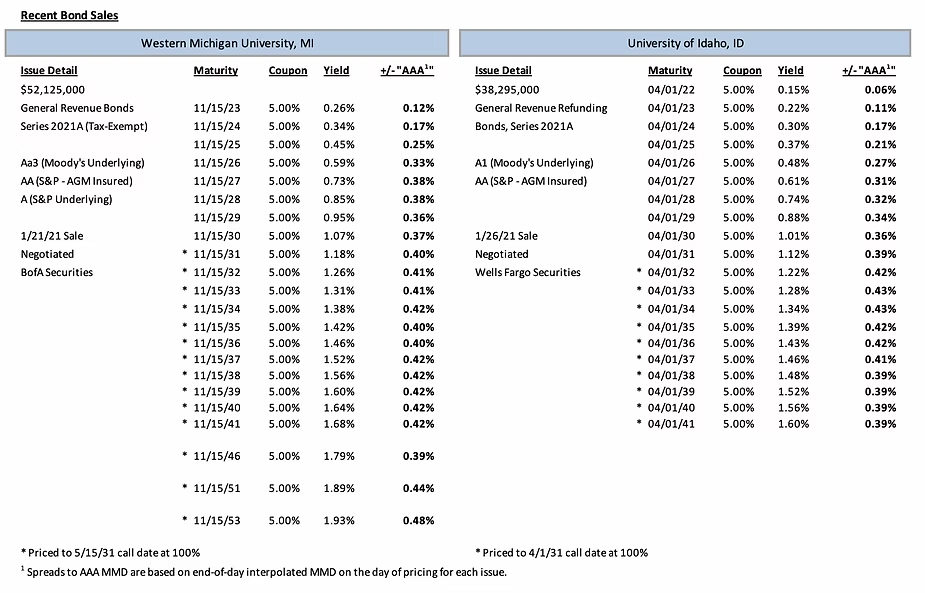

Comparable Issues Commentary

Interest Rates