Effective July 17, 2020, through September 30, 2020, Nonprofit entities can obtain federal loan dollars through two different Main Street Lending Program facilities (NONLF [1], & NOELF [2]). These facilities were added on top of the three existing lending facilities (MSNLF [3], MSPLF [4], MSELF [5]) meant to aid small and medium sized businesses. The different facilities utilize similar criteria and debt features but differ in how they interact with the borrower’s existing outstanding debt and the uses of proceeds. The NONLF is meant to originate new loans, while the NOELF is meant to help increase an existing term loan or revolving credit facility. Eligible borrowers utilize eligible lenders to access funds, of which 95% may be participated by the lender to an SPV [6]. Through these facilities an eligible borrower may be able to obtain at least $250 thousand and up to $300 million (depending on the use) in short-term loan proceeds at LIBOR + 300 bps, with up to 200 bps in additional up-front one-time fees. The loans have a 5-year maturity, principal deferral of two years, interest deferral of one year (capitalized), and are prepayable at any time. Unlike the Paycheck Protection Program (PPP), these funds are not forgivable. Eligible Borrowers: Term sheets for each of the facilities more specifically lay out these items [7,8]. Some general qualifying criteria for non-profit entities:

In continuous operation since January 1, 2015.

Is not an ineligible business as defined by the SBA.

Meets at least one of the following two conditions (a) has 15,000 employees or fewer, or (b) has 2019 annual revenues of $5 billion or less.

Has at least 10 employees.

Endowment value of less than $3 billion.

Total non-donation revenues equal to or greater than 60% of expenses for the period from 2017 through 2019.

Ratio of adjusted 2019 earnings before interest, depreciation, and amortization to unrestricted 2019 operating revenue, greater than or equal to 2%.

Ratio of (i) liquid assets at the time of origination of the loan or upsized tranche to (ii) average daily expenses over the previous year, equal to or greater than 60 days.

At time of origination of the loan or upsized tranche, must have a ratio of (i) unrestricted cash and investments to (ii) existing outstanding and undrawn available debt, plus the amount of any loan under the facility, plus the amount of any CMS accelerated and advance payments, that is greater than 55%.

Organized under the laws of the United States.

May only participate in one of the Main Street facilities and must not also participate in the PMCCF.

Must not have received specific support pursuant to the Coronavirus Economic Stabilization Act of 2020.

Must be able to make all the certifications and covenants required under the program.

Eligible Lenders:

The Federal Reserve of Boston has posted a list of lenders participating in the program ordered by state. [9] Uses of the Program:

So far, the uses of this program appear to be as a last resort solution to short term liquidity needs. Currently, the general sentiment in the nonprofit sector seems to be that this lending program is difficult to qualify for if an institution needs it, and will not be needed by the institutions that do qualify due to the cost and availability of better options [10, 11]. However, if your institution is interested in further deferring principal or needs an interim financial solution, then this program could be a short-term solution and our advisory team would be happy to speak to its applicability.

[1] NONLF = Nonprofit Organization New Loan Facility

[2] NOELF = Nonprofit Organization Expanded Loan Facility

[3] MSNLF = Main Street New Loan Facility

[4] MSPLF = Main Street Priority Loan Facility

[5] MSELF = Main Street Expanded Loan Facility

[6] SPV = Special Purpose Vehicle

[7]https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200728a10.pdf

[8]https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200728a11.pdf

[9] https://www.bostonfed.org/supervision-and-regulation/supervision/special-facilities/main-street-lending-program/information-for-borrowers.aspx#map

[10] https://www.bondbuyer.com/news/nonprofits-disappointed-by-changes-to-fed-lending-program

[11] Moody’s Investor Service, July 22, 2020 “Higher Education, Healthcare & Nonprofit Organizations – US: Fed adds liquidity source for nonprofits, but terms may limit use”

Meet the Author

Mr. Lippold holds a bachelor’s degree in financial management from the University of St. Thomas and is a member of their chapter of the Delta Epsilon Sigma honors society. Mr. Lippold passed the MSRB Series 50 Examination to become a qualified municipal advisor representative and also is currently pursuing his Chartered Alternative Investment Analyst (CAIA) designation, for which he has passed the level 1 exam.

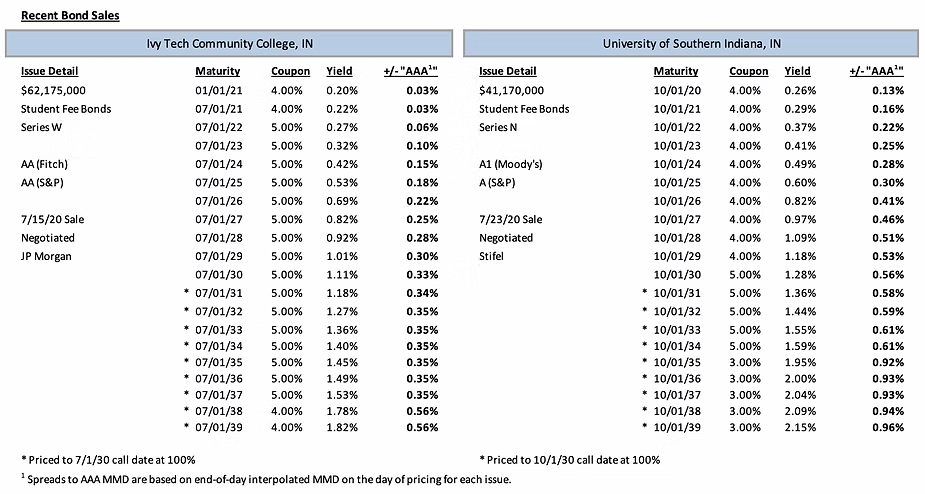

Comparable Issues Commentary

Both institutions benefitted from a rallying tax-exempt market, with MMD rates either declining or remaining unchanged each day throughout the month of July. However, higher education yields were buoyed by increasing investor concerns over campuses reopening in the fall amid the COVID-19 pandemic. Ivy Tech’s bonds priced on July 15th during a flat day in the market, with MMD unchanged across all maturities. Southern Indiana priced its issue on July 23rd during a similarly stable day, with modest reductions to MMD of 1 bp from 2026-2031 and 2 bps from 2032-2050 (unchanged from 2021-2025). Both institutions utilized similar bond structures, with the same 2039 final maturity as well as a standard 10-year par call option. Additionally, both Ivy Tech and USI utilized a short principal payment (1/1/21 for Ivy Tech and 10/1/20 for USI) to take advantage of the annual state appropriation available to them from the State of Indiana in FY2021. Coupon structures between the two deals had some commonalities as well, with 5% coupons used by each institution for their earlier callable maturities (2031-2034). While Ivy Tech and Southern Indiana also used lower coupons on their later callable maturities, they did so to differing degrees – Ivy Tech only priced two callable 4% maturities in 2038 and 2039, while USI used lower 3% coupons beginning in 2035 all the way through 2039.

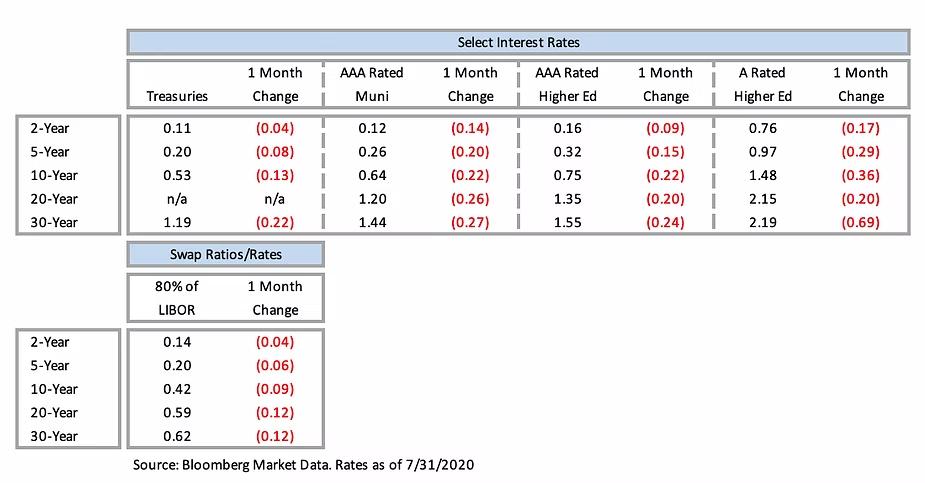

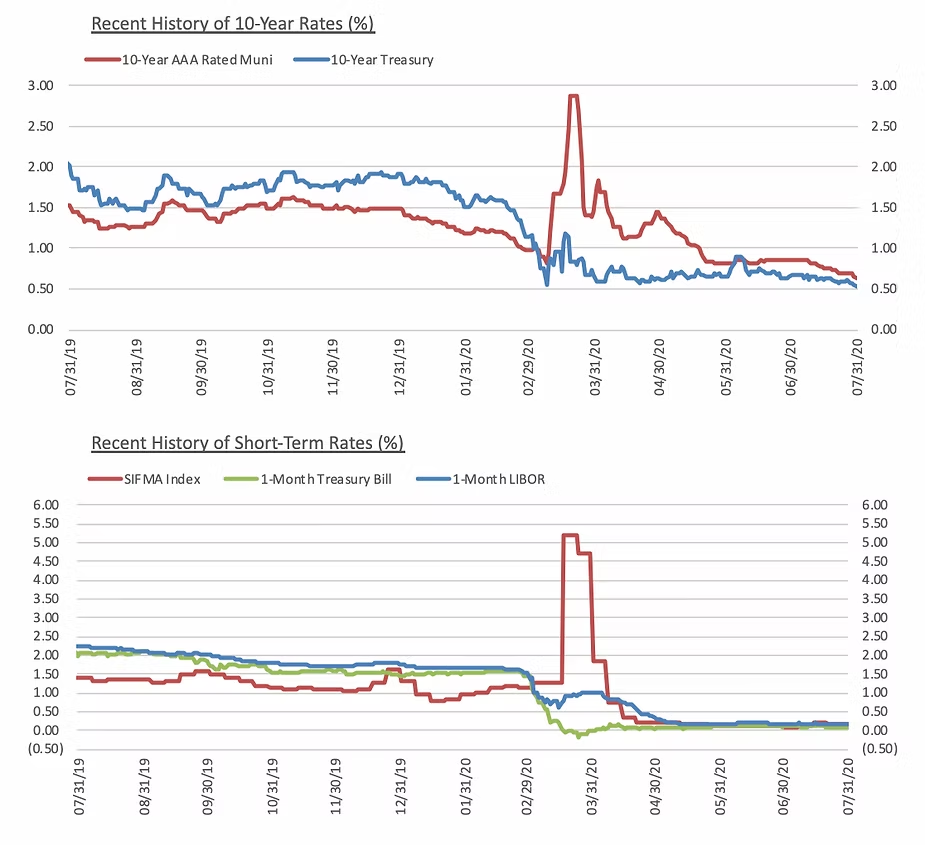

Interest Rates