LIBOR cessation is now just three months away (June 30, 2023), and most of the transition process appears to be going to plan. SOFR continues to be the primary index utilized for the transition of variable rate loans, especially in cases where a synthetic fixed rate structure exists. Some potential issues that persist in the process include: basis mismatch (fallback SOFR versus daily simple SOFR or Term SOFR), increased reporting burden/complication following cessation, value transfer not properly mitigated by fallbacks, bank fees moving outside of acceptable levels, and confusion with how instruments will be documented following fallback effective dates.

If you haven’t already eliminated LIBOR exposure or put a plan in place, then now is the time to do so. Waiting any longer could result in future headaches and suboptimal economic outcomes.

INVESTMENT CONSULTING SEARCH SERVICES

Following recent poor market performance, organizations are increasingly scrutinizing their investment returns and the performance of their investment consultant providers. As a result, we have seen an uptick in demand for assistance for executing a new RFP, to either select a new provider or incentivize a current provider to “sharpen their pencils” and improve their performance. We certainly advocate doing this on a regular basis, though with how strong the market has performed over the past ten or so years, we think many would admit an RFP hasn’t been a priority.

If you are beginning to question the performance of your investment advisor, or if there’s simply a desire to refresh your relationship and assess other options available, then our Investment Consulting Search Services can help streamline the RFP process and provide your organization’s decision-makers with the guidance and information they need. Our team learns your organization’s goals and helps to develop an RFP document, distribution list, and schedule that helps achieve those aims. We carry out the administrative work and documentation to ensure you and other stakeholders have the information necessary to select the best investment consulting provider for your organization. If you are considering a new RFP for your investment consultant, reach out to Blue Rose today.

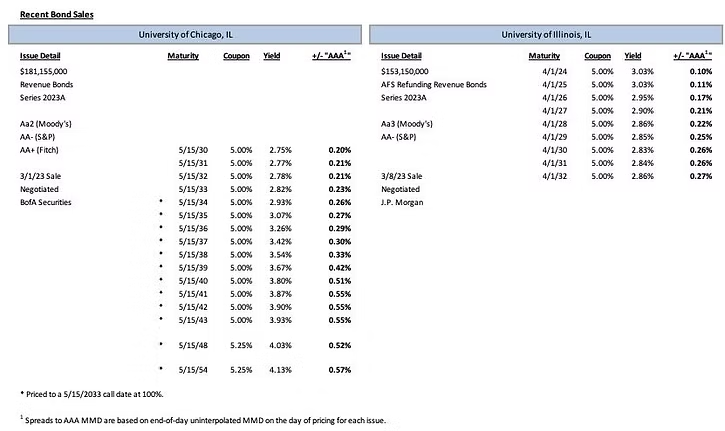

Comparable Issues Commentary

Shown below are the results of two higher education financings from the State of Illinois that priced earlier this month. On March 1st, the University of Chicago (“UChicago”) priced its tax-exempt Series 2023A Revenue Bonds. One week later on March 8th, the University of Illinois (“U of I”) priced its tax-exempt Series 2023A Auxiliary Facilities System Refunding Revenue Bonds. UChicago’s transaction was a multi-purpose issuance that financed various new projects on its Hyde Park campus and at the Gleacher Center, a conference and event center at the University. The deal also refinanced outstanding commercial paper. U of I’s financing was a pure refunding issuance, which served to current refund its outstanding Series 2013A bonds.

Both schools’ bonds carried ratings from Moody’s Investors Service (“Moody’s”) and S&P Global Ratings (“S&P”). UChicago’s bonds also carried a rating from Fitch Ratings. Its bonds were rated “Aa2,” “AA-,” and “AA+” by Moody’s, S&P, and Fitch, respectively. U of I’s bonds were rated one notch lower (“Aa3”) by Moody’s and at the same “AA-” level by S&P. Both series were sizeable deals totaling over $100 million in total par amount. UChicago’s transaction was the larger of the two at $181.155 million, while U of I’s deal was $153.150 million in total par. The most notable differences between these two transactions are in their structuring. UChicago’s Series 2023A was serialized from 2030-2043 and featured two term bonds in 2048 and 2054, with no principal amortizing before 2030. U of I’s Series 2023A, on the other hand, was fully serialized from 2024 until its final maturity in 2032. This different maturity structure is likely due in large part to the differing uses of bond proceeds from the two issuances, with the shorter final maturity of the U of I transaction resulting from the lack of a new money financing component. The result is that only three maturities overlap between the two deals. UChicago’s bonds carry a standard ten-year par call feature while U of I’s bonds, with a final maturity of just 9 years, have no early redemption option. The coupons used in both transactions are almost exclusively 5% coupons with the exception of UChicago’s two term bonds, which carry 5.25% coupons.

The week prior to UChicago’s pricing, MMD decreased by 2 bps at the 1-year tenor, but all other tenors saw increases of between 6 and 18 bps with the largest increases coming in years 2-5. The following week ahead of UChicago’s Wednesday pricing, MMD remained mostly flat across the curve except for a couple slight increases of 2-3 bps in the 2028-2032 maturities. On the University’s pricing date of March 1st, the index remained mostly unchanged except for the 2034-2036 maturities, which saw a modest 1 bp uptick. UChicago was ultimately able to achieve spreads of 20-55 bps on its serial maturities and 52 and 57 bps on its 2048 and 2054 term bonds, respectively.

In the ensuing days prior to U of I’s pricing, MMD dropped on the first two tenors by 8 and 1 bps but increased by 2 bps in all other tenors. This period of relative market calm continued on into U of I’s pricing date of March 8th, where MMD fell by 2 bps on the 2024-2028 maturities at the front end of the curve and remained unchanged in all later maturities. The University was ultimately able to achieve spreads of 10-27 bps on its bonds. On the three overlapping maturities between the two transactions in 2030-2032, UChicago priced 5-6 bps tighter than U of I, an unsurprising result given its stronger Moody’s rating and “AA+” Fitch rating.

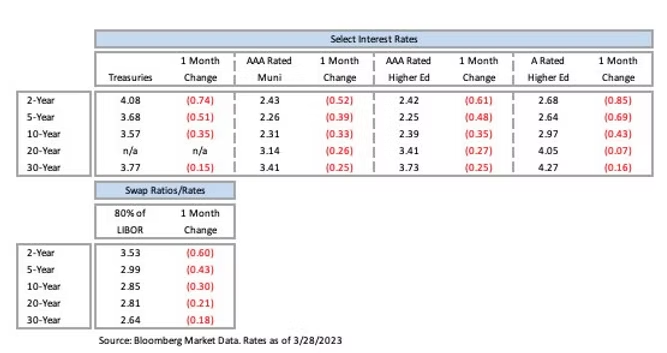

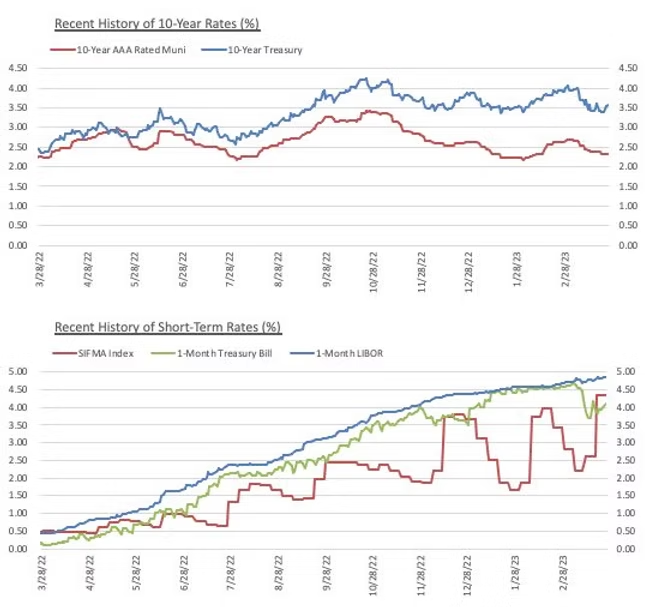

Interest Rates

Meet the Author:

Brandon Lippold | [email protected] | 952-746-6054

Brandon Lippold joined Blue Rose in 2018 as a Quantitative Analyst, now in his role of Vice President, he is focused on growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing. He has significant expertise in direct purchase bonds, and derivative products and is experienced with the pricing and execution of fixed rate bond transactions, and reinvestment products. Mr. Lippold is closely involved in every step of the financing process for clients, from initial capital planning stages all the way through closing.

Media Contact:

Megan Roth, Marketing Manager

952-746-6056