Blue Rose Presented at the WHEFA Lunch & Learn Webinar

The recorded version of the webinar is available here. Additionally, WHEFA announced plans for their annual in-person Workshop on Tuesday, October 1st, along with a golf outing scheduled for Monday, September 30th. More information on the workshop can be found here.

Blue Rose Announces a Partnership with Excelsior Capital Advisors

As a trusted municipal advisor to many higher education and non-profit institutions, particularly in the state of New York and the Northeast, Excelsior has many long-standing client relationships to which Blue Rose, jointly with Excelsior, will provide value-additive services. Tom Cullinan, Principal at Excelsior, brings a wealth of industry experience to the partnership, with over 30 years of experience in higher education and non-profit public finance, including previously serving as a Managing Director at RBC Capital Markets before starting Excelsior in 2014.

Read more about our partnership here.

Blue Rose Will Present at the MHEFA Conference

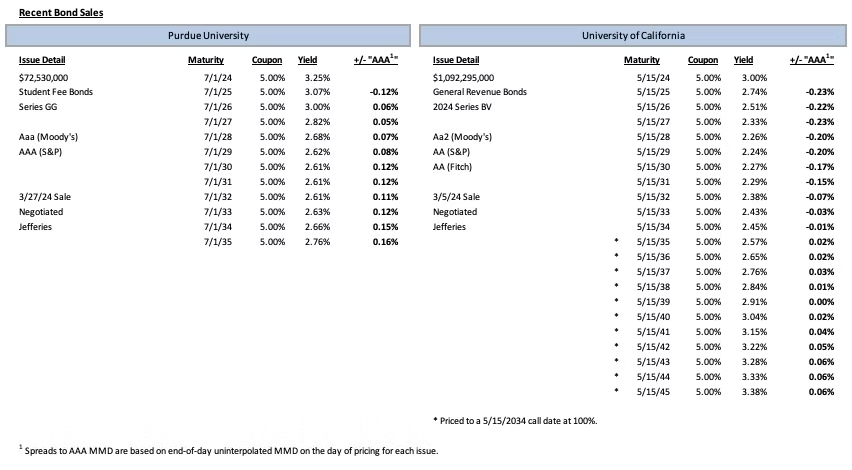

Comparable Issues Commentary

ⁱ In an interesting turn of events, bondholders of the refunded Build America Bonds in the University of California transaction have threatened a lawsuit challenging the University’s ability to redeem the bonds via an extraordinary redemption provision (“ERP”) . The argument centers on UC’s ability to trigger the ERP due to cuts to the Build America Bonds subsidies, which were reduced starting in 2013 through government sequestration.

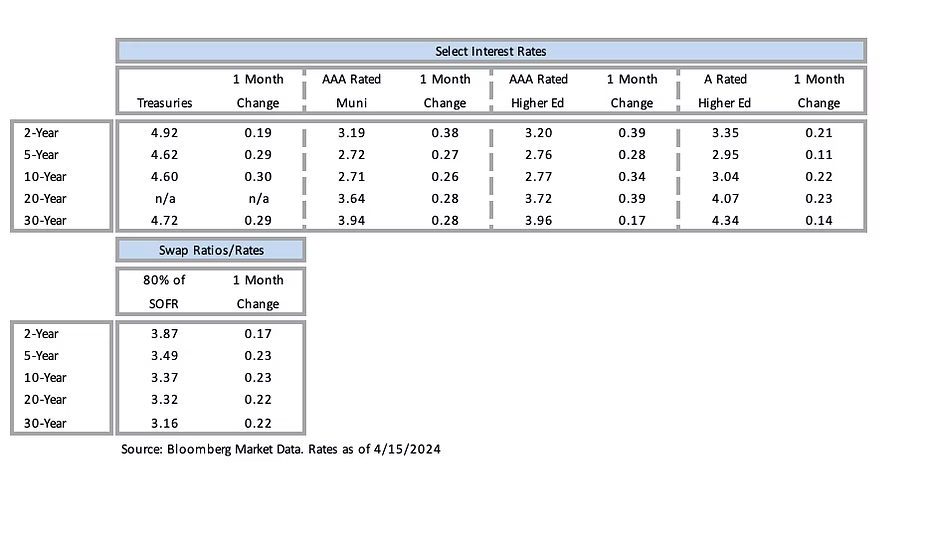

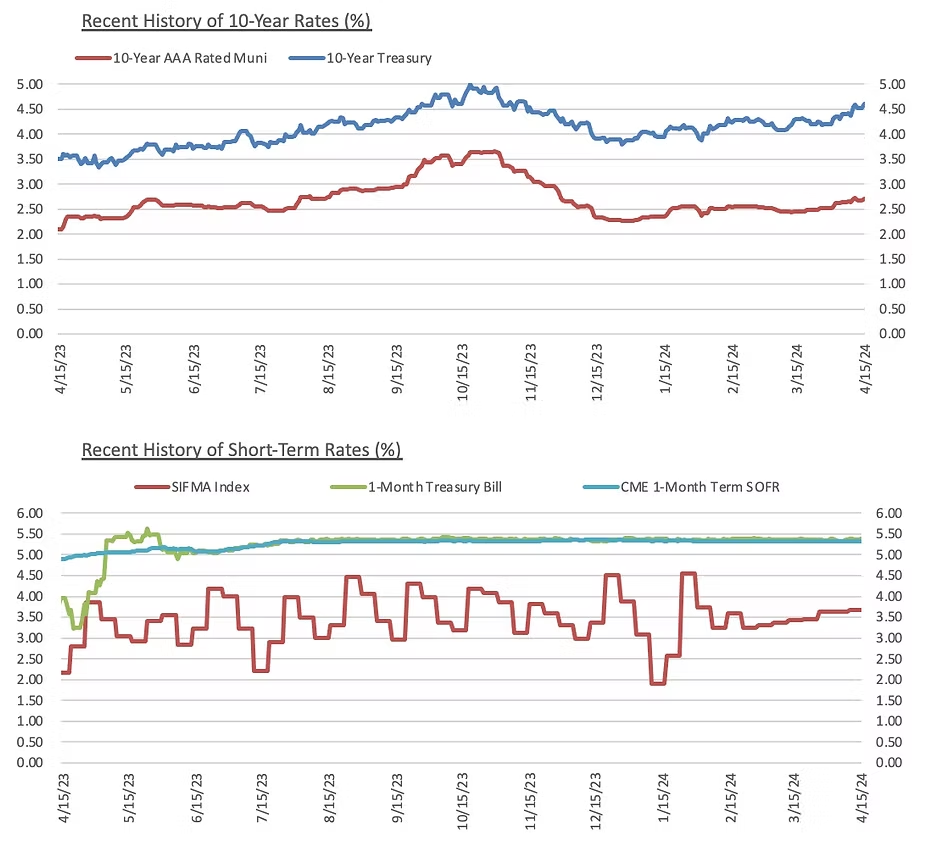

Interest Rates

Meet the Author:

Brandon Lippold | [email protected] | 952-746-6054

In his role of Vice President, Brandon Lippold is focused on growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing. He has significant expertise in direct purchase bonds and derivative products and is experienced with the pricing and execution of fixed rate bond transactions and reinvestment products. Mr. Lippold is closely involved in every step of the financing process for clients, from initial capital planning stages all the way through closing. He joined Blue Rose in 2018 as a Quantitative Analyst.

Media Contact:

Laura Klingelhutz, Marketing Coordinator

952-208-5710