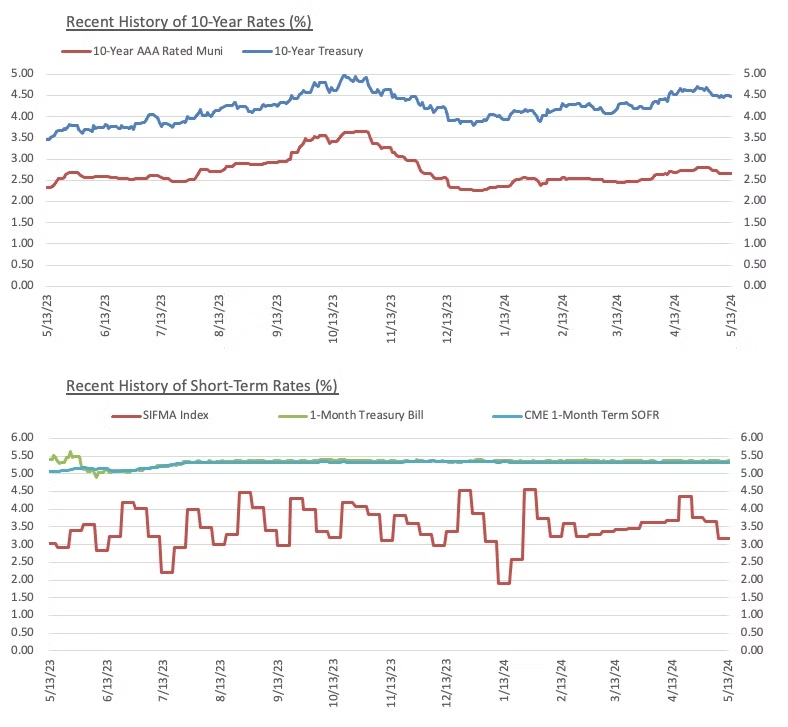

Markets have remained volatile through the first four months of 2024, continuing a theme that we observed at the end of last year. Rates have moved significantly higher and equity indexes sit near all-time highs. However, there is significant uncertainty around how the rest of the year will unfold. Much of that story will be determined by the actions of the Federal Reserve this year as it continues to battle high post-pandemic inflation levels. Below are several market developments that we at Blue Rose have observed in the markets through the first four months of 2024.

Interest Rate Movements and Impact

Economic Developments

In short, as we approach the mid-point of the year, the municipal market outlook remains mixed. Issuance volume has rebounded from lower levels in 2023 despite interest rate volatility through the first four months of the year, in a positive development for the municipal market. However, rates remain elevated – the Fed funds rate still sits at its highest level in more than two decades – and will almost certainly remain so until inflation softens further, or the labor market shows signs of weakness, providing the Fed with the data it needs to change course. In the meantime, if you would like to discuss capital plans in the context of these market conditions, please schedule some time to connect with your Blue Rose Advisor.

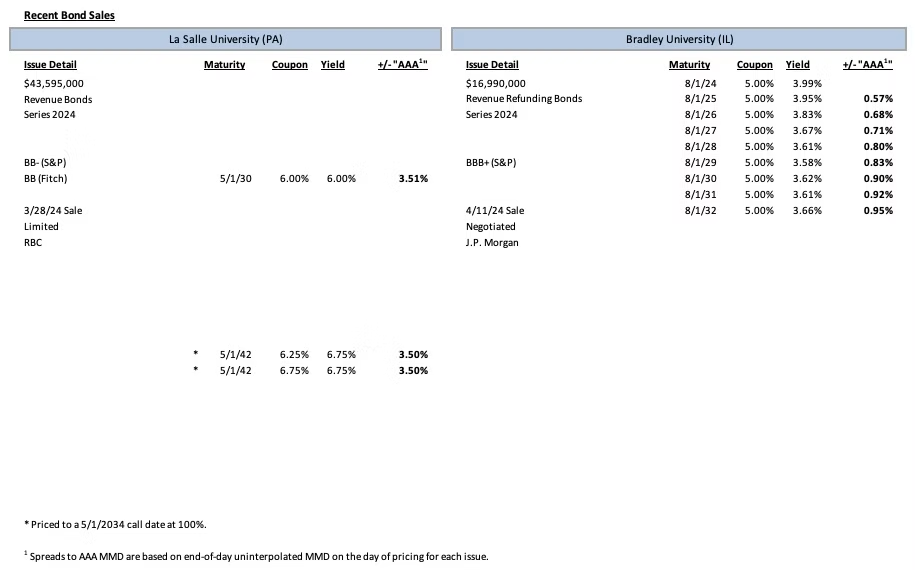

Comparable Issues Commentary

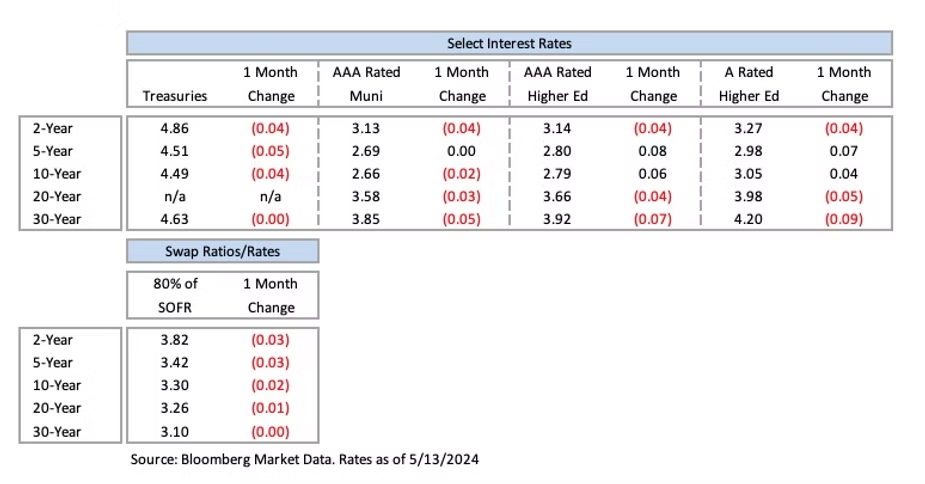

Interest Rates

Meet the Author:

Prior to Blue Rose, Mr. Pietrek worked for Altra Federal Credit Union where he drafted and filed various mortgage-related legal documents, along with preparing quarterly reports for management and assisted in creating annual reports for FHLB auditors. He has also held internships with Rockaway Capital and the Idea Fund of La Crosse where he assisted with various financial and analytical projects. Mr. Pietrek joined Blue Rose in 2021 as an Analyst.