Colleges and universities across the country are facing unprecedented pressures. Inflation and rising costs are the most recent factors that drive finance and business officers to pull their hair. Pressure from the recent job market has lured away some would-be students, as have online alternatives. Even before this year’s drop in endowment returns and the multi-faceted turmoil of the pandemic, many higher education institutions looked forward to a grim future thanks to the “demographic enrollment cliff.” [i] The cliff, of course, describes the coming decline in high school graduates across the country, starting around 2025-2026, though some the cliff’s effects have already begun. [ii] One data point includes rising tuition discounting at private colleges and universities for first-time undergraduates, which has increased from an average rate of 44.8% in 2012-13 to 54.5% in 2021-22. [iii] Some institutions will require stark strategic pivots to survive this host of challenges. Is it time, then, for your institution to consider a proactive strategy of preparing for a merger, acquisition, or some other form of collaboration?

The shrinking pool of first-year students will lead to increased competition, and with it, the shuttering of institutions that fail to find a solution in such a competitive environment. Elite, flagship, and large public colleges and universities can maintain their population by drawing a great number of students from in-state, thereby drawing from what would typically be other schools’ enrollment. Should The Ohio State University open its doors wider, for example, there is little that downstream Ohio colleges can do if they must compete in the same market as OSU. The smallest institutions will feel this competition all too keenly.

In fact, small private institutions that both lack scale and a particular niche are likely to suffer the most in the coming years. These have formed a sizeable portion of merger and acquisition activity; about 40% of mergers involve private, nonprofit schools, usually within the same state and with enrollment under 5,000. [iv] There are hundreds of such small schools that also exhibit risk factors, such as a lack of online programs, high tuition discounts, or deficit spending, among others. [v] And M&A activity is increasing at a rapid clip; between 2000 and 2009, there were only 34 mergers and/or consolidations; between 2010 and mid-2020, however, there were 105 – with over a third of those completed mergers/consolidations coming 2018-2020. [vi]

That doesn’t mean your institution will be the target of an acquisition, however. In fact, some have gone on the hunt. Northeastern University, for example, developed an aggressive stance by building an M&A team to comb through acquisition opportunities. Thanks to patient preparation, they were able to acquire Mills College near Silicon Valley in exchange for absorbing $21 million in liabilities and putting up $30 million to support feminist scholarship (the land alone is worth perhaps $1 billion). [vii] While other colleges wait until their strategic options are limited to “get acquired” or “shut our doors,” proactive planning can help schools pick their partners to survive the coming enrollment cliff and continue serving their missions. Years of financial stress had caught up with the Vermont State Colleges system, prompting a massive reorganization that merged Northern Vermont University, Vermont Technical College, and Castleton University into Vermont State University. For the new VSU, slashing programs and boosting online delivery will reduce operating costs while expanding the combined institutions’ reach to bring opportunities across the state. Other institutions look to merge with schools that have complementary offerings, allowing them to deliver to new students or expand current offerings, ensuring one plus one is more than two.

Options are not simply confined to merge, acquire, or die. These problems have given birth to creative solutions, including “synthetic mergers” designed to preserve collaborating institutions’ brands while merging back office to generate synergy. [viii] Otterbein and Antioch Universities have recently announced an affiliation agreement, emphasizing areas of collaboration like graduate education, degree completion, and workforce development, but still preserving their institutional identity. As the President of Otterbein asserts, the agreement was possible since they two universities came together from “positions of strength.” (Interested? The affiliated schools plan to grow, envisioning a national system.) But whether it is a merger, acquisition, or a different form of collaboration, all these strategies seek to either reduce costs, take advantage of complementary competitive advantages, and ultimately preserve enrollment. And that’s easier to do before entering a death spiral.

Not every attempt is successful. Recent failed mergers include Marymount California University, which failed to combine with Florida’s Saint Leo University after the latter’s accreditor rejected the plan. Five months of engagement failed to consummate the merger of San Francisco Art Institute and the University of San Francisco; it may have been that a complicated trust that underlay the donation of SFAI’s land scuttled the deal. [xi] And sometimes the acquired have reasons to gripe, as did many faculty and alumni of Mills College, who felt Northeastern gained the College for too good a deal. Of course, Mills College had few options by the end, as did Marymount and SFAI, which closed their doors when the mergers fell through.

Higher education institutions would do well to stave off these pitfalls and strategic dead-ends by pursuing due diligence and acting now to develop a forward-looking plan. Such a plan would take a hard look at a college or university’s competitive advantages, assets, and what the competitive landscape holds. They should look for complementary partners and determine if a regional or broader geographic reach will aid their mission. Finally, they should analyze the synergy to be found in a merger or acquisition (or another cooperative form). Concrete analyses of the operational savings – through common platforms or joint curriculum, or other savings – are necessary to put the partnership on a firm foundation.

What can Blue Rose do for you? We provide M&A advisory services, helping clients navigate through the evaluation, due diligence, and acquisition & financing execution phases. Our advisors can examine your existing debt portfolio and credit ratings to determine the impact of additional debt, or help you analyze how the incorporation of new assets and liabilities will affect your operations. We’re with you each step of the way, so you can be confident as you execute your strategy and prepare your institution to deliver its mission well into the future.

[i] The effect is not uniform across the United States, however; the Midwest is widely predicted to suffer far more than parts of the South and West. See https://www.cupahr.org/issue/feature/higher-ed-enrollment-cliff/.

[ii] “The demographic cliff is already here – and it’s about to get worse,” Megan Adams, EAB, May 28, 2020. https://eab.com/insights/expert-insight/enrollment/the-demographic-cliff-is-already-here-and-its-about-to-get-worse/

[iii] “Tuition Discount Rates at Private Colleges and Universities Hit All-Time Highs,” NACUBO.org, May 19, 2022. https://www.nacubo.org/Press-Releases/2022/Tuition-Discount-Rates-at-Private-Colleges-and-Universities-Hit-All-Time-Highs

[iv] “Broke Colleges Resort to Mergers for Survival,” Douglas Belkin, Wall Street Journal, July 19, 2022.

[v] “Strength in Numbers: Strategies for collaborating in a new era for higher education,” EY Parthenon, 2020.

[vi] “Quantifying the Impact of Excess Capacity in Higher Education,” EY Parthenon, December 2020.

[vii] “Broke Colleges Resort to Mergers for Survival,” Douglas Belkin, Wall Street Journal, July 19, 2022.

[viii] “Synthetic Merger: A Fine Elective for Higher Ed,” Grant Thornton, February 25, 2022.

[ix] “151-year-old S.F. Art Institute will shut down after USF backs out of acquisition deal,” Sam Whiting, San Francisco Chronicle, July 15, 2022. https://www.sfchronicle.com/sf/article/sf-art-institute-shut-down-17307973.php

Announcement: LIBOR Transition

The transition from LIBOR to alternative reference rates continues, and with the ARRC’s release of its LIBOR Legacy Playbook there’s now a central location to find up-to-date frameworks for transitioning legacy products. For a deeper examination, look out for registration information for Blue Rose’s upcoming LIBOR transition webinar on September 19th, which will further contextualize current approaches to proactively address LIBOR exposure, and those that are theorized to occur on June 30, 2023.

Comparable Issues Commentary

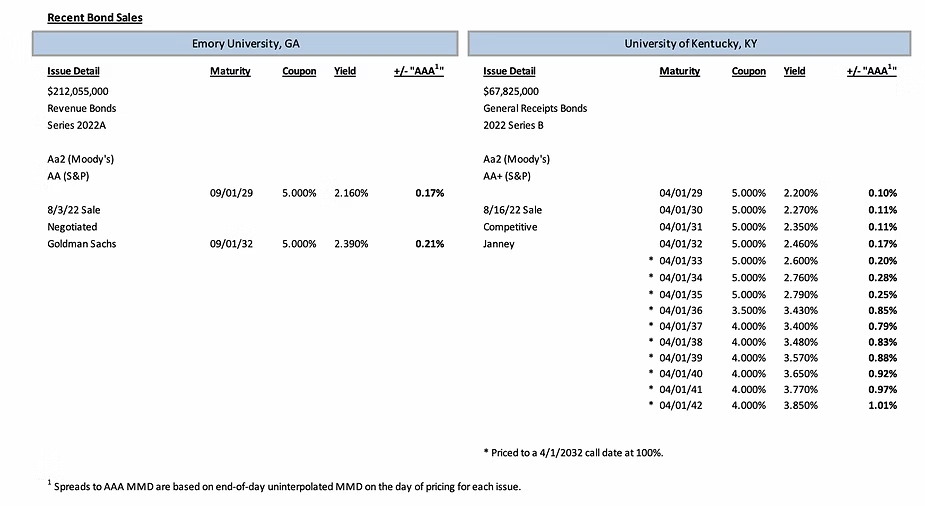

Shown below are the results of two higher education financings that priced in the month of August. On August 3rd, Emory University (“Emory”) in Georgia priced its tax-exempt Series 2022A. Just under two weeks later on August 16th, the University of Kentucky (“Kentucky”) priced its tax-exempt Series 2022B. Emory’s bonds were a dual-purpose issue, with $120 million used to construct and improve various projects around campus, including a new graduate student housing complex, a conference center, and several improvements to Emory Healthcare. Another $135 million from Series 2022A was used to refund Emory’s outstanding 2013B bonds. Kentucky’s 2022B bonds were a new money issue for the University’s Facilities Renewal and Modernization capital project, which seeks to modernize and develop several core campus buildings along with infrastructure for those facilities. Proceeds from Series 2022B were also allocated to Kentucky’s Asset Preservation initiative, which works to preserve existing campus buildings. Both universities also used multi-faceted plans of finance, each issuing a second series (a Series 2022B variable rate issuance for Emory, and a Series 2022C taxable issuance for Kentucky), which both served to contribute to the financing of the aforementioned new money projects.

Both schools’ bonds carried credit ratings from Moody’s Investors Service (“Moody’s”) and Standard & Poors (“S&P”). The universities were of very similar credit quality, with both series rated “Aa2” by Moody’s and Kentucky carrying a slightly higher “AA+” S&P rating compared to Emory’s rating of “AA”. The transactions differed substantially in size – Emory’s Series 2022A totaled $212.055 million in par, while Kentucky’s Series 2022B came in at $67.825 million. Emory’s 2022A transaction had a shorter amortization than that of Kentucky, stretching only 10 years and featuring two substantial (>$100M each) term bonds in 2029 and 2032. In contrast, Kentucky’s 2022B bonds had a longer amortization that featured fully serialized maturities from 2029-2042. Kentucky’s 2022B issuance also came with a standard 10-year call in 2032, while Emory’s bonds (with a final maturity of just 10 years) were noncallable. Emory’s two term bonds both featured a 5% coupon, where Kentucky had a blend of mostly 5% and 4% coupons with a lone 3.5% coupon in 2036. Finally, the method of sale for the two transactions differed, with Emory pursuing a negotiated sale while Kentucky sold its bonds via competitive sale.

Emory was fortunate to capture the tail end of a tax-exempt market rally in July, with MMD rates falling across the curve over the month, particularly on Emory’s bond maturities in 2029 and 2032 (for which MMD declined 47-52 bps from July 1st to August 2nd. Emory’s Series 2022A ultimately achieved spreads of 17 and 21 bps to uninterpolated MMD on its 2029 and 2032 term bonds, respectively. However, between the two pricings MMD begun to increase, though most dramatically on the short end of the curve (with rates up 48 and 30 bps in the first two maturities, but just 11-13 bps across the maturity range of Kentucky’s 2022B financing). Kentucky’s Series 2022B achieved spreads of 10-25 bps on its 5% coupon maturities (ranging from 2029-2035), and spreads of 79-101 bps on callable 4% maturities.

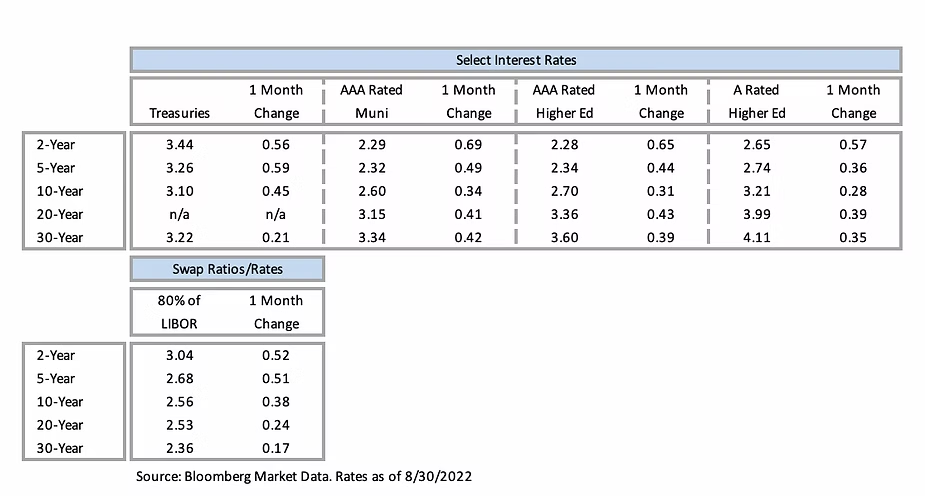

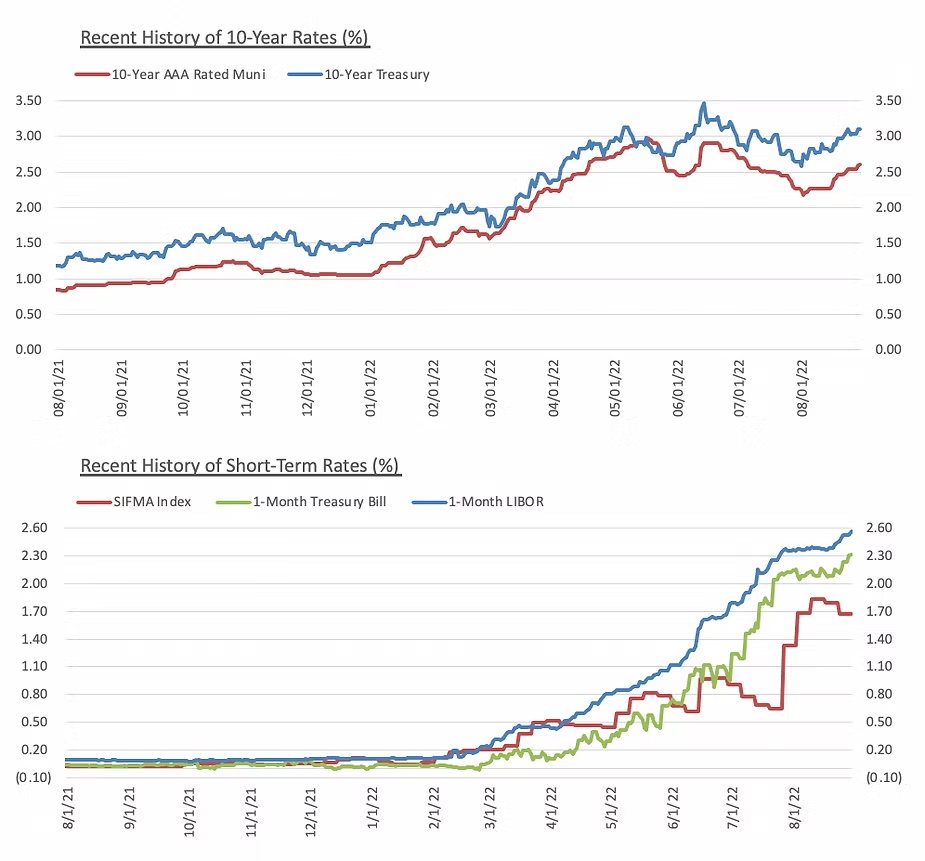

Interest Rates

Meet the Author:

John Elliott | [email protected] | 312-332-1336

Mr. Elliott joined Blue Rose’s California office as in 2021. In his role as Chief Compliance Officer, Mr. Elliott is tasked with maintaining responsibility for client contracts and disclosures. He also provides analytical and research support for Blue Rose’s P3 and debt advisory practice and will also serve on the project team by providing expertise in documentation review and legal requirements for many of the firm’s clients.

Contact Blue Rose:

Media Contacts:

Megan Roth, Marketing Manager

952-746-6056

Laura Klingelhutz, Marketing Generalist Intern

Email: [email protected]