We are now four months into the year and various credit and market developments continue to unfold, many of which are favorable to the borrower and issuer community. In case you missed them, highlighted here are some tidbits that you may find of interest as your organization establishes or advances its 2021 and/or longer-term capital plans.

LIBOR Transition Continues

The long-anticipated LIBOR transition continues with further developments over the last few months. The target end date for the most heavily used U.S. dollar denominated LIBOR indices (e.g., USD 1-month and 3-month LIBOR, among others) continues to be June 30, 2023. Advancement on the transition continues with the following two new announcements:

Secured Overnight Financing Rate (SOFR) Term Structure – It has been long- understood that a term structure to any LIBOR replacement index would need to be established for greater acceptance and utilization of a LIBOR replacement index. CME Group recently announced forward-looking Term SOFR rates for 1-month, 3-month, and 6-month tenors, a positive development in our view.

Bloomberg Short-Term Bank Yield Index (BSBY) – Bloomberg has begun to publish a short-term taxable index (BSBY) that is a credit sensitive index, a key differential to SOFR. The index, which is published each morning, is anticipated to become another alternative reference rate for LIBOR.

Fixed Rate and Direct Purchase Bond Credit Spreads As evidenced through recent capital markets fixed rate bond issuance, direct purchase bond financings, and the IG Corporate Bond Spreads, bond credit spreads continue to tighten as uncertainty about the COVID-19 pandemic eases and investors clamor for yield. In many instances, bond pricings are reaching pre–COVID-19 spread levels for most of the investment grade categories, a favorable market development, as borrowers that continue to pursue financings in the current low absolute rate environment are also finding lower credit spreads than anticipated. Century Bond Issuance

A less common financing structure that has been absent in the marketplace altogether and with fewer evaluations of the structure since the onset of the COVID-19 health pandemic is the Century Bond. This ultra long-dated fixed rate financing vehicle, often thought of as pseudo-equity, has made its return to the marketplace in the corporate market. Specifically, Norfolk Southern’s (Baa1/BBB+ by Moody’s and S&P, respectively) issuance of a $600 million century bond earlier this week resulted in a fixed rate of 4.10%, the lowest rate of any corporate Century bond. The execution of this issuance alone, in addition to the tremendously low rate for such duration and credit profile, is likely to re-open the dialogue about Century bonds in the public finance market. Moody’s Methodology Credit rating processes are not immune to change. Notably, and following in line with their rating methodology changes in other public sector industries, Moody’s has announced proposed changes to their higher education rating methodology. Currently, the proposed changes are in a request for comment period, with comments due to Moody’s by May 17th. If the proposed methodology is adopted, it is expected that less than 5% of Moody’s current higher education ratings would change(1). Blockchain Financing Developments in blockchain financing, which utilizes distributed ledger technology and has been used by the likes of the World Bank, European Investment Bank, and Bank of Thailand, among others, are beginning to make headway in the U.S. markets. Various governmental entities, including the City of Berkeley, have explored blockchain micro-bonds, and an Oregon small issuer recently executed such a transaction(2). Although often associated with cryptocurrencies, blockchain financing has been and can be issued using traditional currencies including Euros and U.S. dollars.

Should you have any questions above these or other market developments, please reach out to me or any of our Blue Rose advisors.

(1) Moody’s Request for Comment – Higher Education: Proposed Methodology Update, March 31, 2021.

(2) Bond Buyer, May 5, 2021.

About the Author:

Erik Kelly, President | [email protected] | 952-746-6055

Erik Kelly serves as President of Blue Rose, providing leadership, coordination, and oversight of the firm’s advisory services since 2011. He also serves as the lead advisor to many of the firm’s clients, including advising higher education, non-profit, and other borrowing entities on the planning for and execution of all types of debt and debt-related derivative transactions. In managing the firm’s various advisory service areas, Mr. Kelly oversees both compliance with the changing regulatory environment and the delivery of professional advice to the firm’s clients.

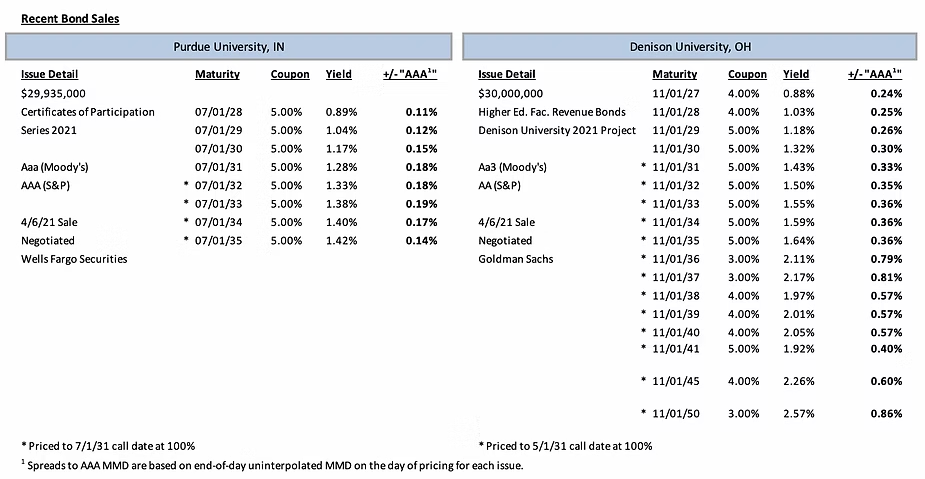

Comparable Issues Commentary

Shown below are the results of two negotiated, tax-exempt higher education issues that sold in the month of April. Purdue University and Denison University each priced tax-exempt bond issues on April 6th, 2021. Purdue’s Series 2021A Certificates of Participation were issued entirely for refunding purposes, refinancing the entirety of the University’s Series 2011A Certificates while also refunding 7/1/2021 principal payments for the 2006, 2014A, and 2016A Certificates of Participation. A small corresponding taxable Series 2021B issue was sold concurrently to fund the 7/1/2021 interest payments on the remaining Series 2006, 2014A, and 2016A Certificates. In contrast, Denison’s financing was issued solely for new money purposes, with bond proceeds financing multiple campus projects including a student wellness center, a new University heating plant, and other facilities on campus. Purdue’s bonds carried “Aaa” and “AAA” ratings from Moody’s and S&P, respectively, while Denison’s issuance was rated “Aa3” by Moody’s and “AA” by S&P (all outlooks were stable).

The two transactions were somewhat similar in amortization structure, with principal payments beginning in 2027 for Purdue and 2028 for Denison, though as a new money issuance Denison’s 2050 final maturity exceeded the 2035 final maturity of the Purdue transaction. The two deals each utilized a standard 10-year par call option and opted for 5% coupons on their comparable callable maturities from 2032-2035. However, in the years after Purdue’s final 2035 maturity Denison chose to primarily sell lower 3% and 4% coupons, except for a solitary 5% maturity in 2041. The security of the deals was meaningfully different as well, with Denison selling general revenue bonds while Purdue’s bonds were issued as certificates of participation under its related athletics credit indenture rather than under one of its other revenue bond structures, such as student fee bonds or student facilities system revenue bonds.

Both universities priced into a strong tax-exempt market, with tax-exempt interest rates remaining stable in the weeks preceding their April 6th pricings and credit spreads continuing to gradually tighten for higher education borrowers. On the pricing date itself the market was relatively quiet, with MMD unchanged early on the yield curve from 2022-2029, and down 1 bp on all remaining maturities (2030-2051). Spreads on comparable 5% callable maturities averaged out to approximately 17 bps above AAA MMD for Purdue and approximately 36 bps above AAA MMD for Denison, respectively.

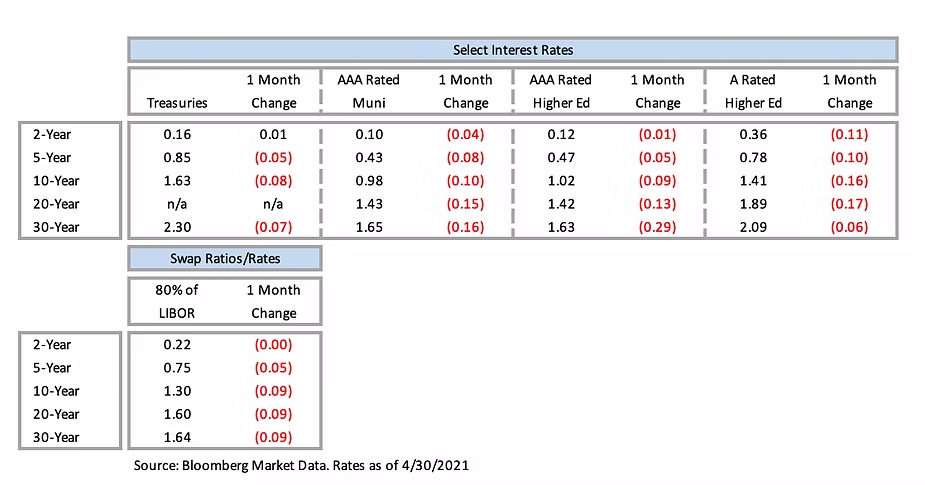

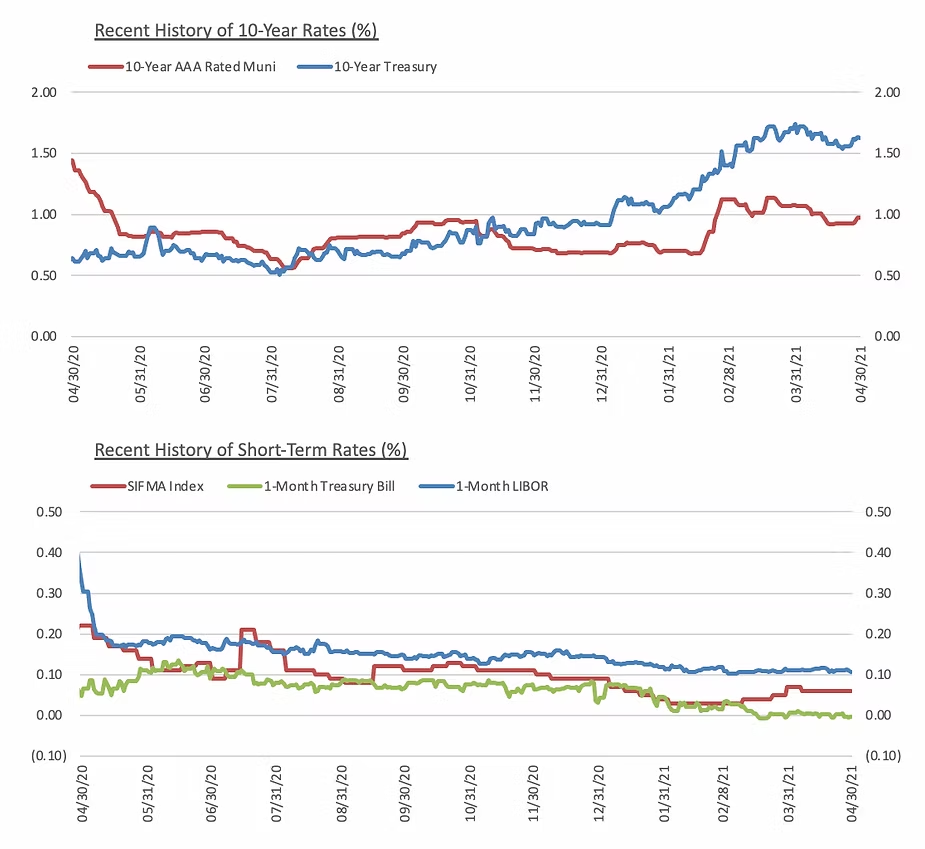

Interest Rates