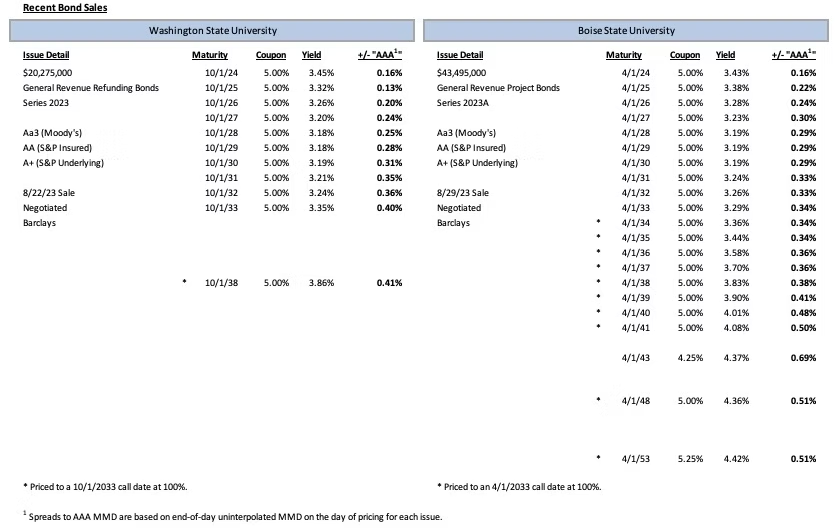

Shown below are the results of two higher education financings from the Pacific Northwest that priced near the end of August. On August 22nd, Washington State University (“WSU”) priced its tax-exempt General Revenue Refunding Bonds, Series 2023. Exactly one week later, Boise State University (“Boise State”) priced its tax-exempt General Revenue Project Bonds, Series 2023A. WSU’s transaction was purely a refunding and served to refinance a portion of the University’s outstanding General Revenue and Refunding Bonds, Series 2013. In contrast, Boise State’s transaction was solely issued for new money projects, with bond proceeds being used to finance a residence hall for new first-year students.

A primary similarity between the two deals is their ratings: both schools’ bonds carry a “Aa3” rating from Moody’s Investor’s Service and an “A+” rating from S&P Global Ratings, although WSU used bond insurance for its transaction, giving its bonds a “AA” insured rating from S&P. Boise State’s issuance was the larger of the two financings, coming in at $43.495 million in total par amount whereas WSU’s transaction was about half the size of Boise State’s, at $20.275 million of par amount. Both deals were sold with a standard 10-year par call option in 2033. As a new money issuance, Boise State’s bonds were structured with a fairly typical 30-year level debt service amortization, with serial maturities from 2024-2041 and three term bonds in 2043, 2048, and 2053. WSU’s refunding transaction featured serials from 2024-2033 with one additional serial maturity in 2038. The two deals were similar in coupon structure, with both utilizing exclusively 5% coupons, except for Boise State’s 2043 and 2053 term bonds, which used 4.25% and 5.25% coupons, respectively.

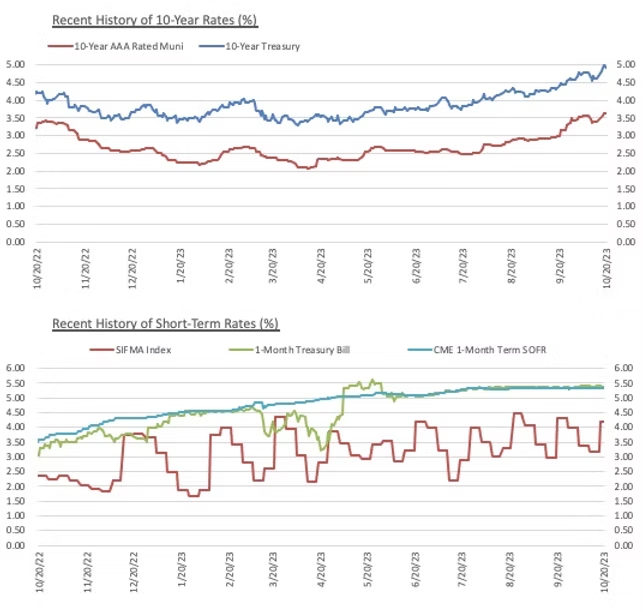

From the beginning of August to WSU’s pricing date, MMD jumped considerably across the curve. Excluding the 1-year tenor, which saw an 8 bp uptick, rates moved higher by 15-34 bps with the largest movements being concentrated at the 7-year point and beyond, where they increased by at least 30 bps. On pricing day, rates continued to climb by another 4-6 bps across the curve. Washington State was ultimately able to achieve spreads to MMD of 16-41 bps.

In the ensuing week, MMD remained relatively flat with the 1-year tenor decreasing by 2 bps and modest upticks of 2-5 bps in the 7-9-year tenors. Rates moved slightly lower in a few early tenors on pricing day but were otherwise largely unchanged. Boise State was ultimately able to achieve spreads to MMD of 16-50 bps on its serial bonds, with the 5% and 5.25% coupon term bonds pricing at a spread of 51 bps and the 4.25% coupon 2043 term pricing at a spread of 69 bps.