A little over a year ago, the transition from the London Interbank Offered Rate (“LIBOR”) to the Secured Overnight Financing Rate (“SOFR”) occurred. This transition had been in the works for several years and officially concluded in June of 2023. Below, we summarize some important milestones that have transpired since the transition.

There has been widespread adoption of SOFR. An excess of $2 trillion of new financial instruments including loans, bonds, and derivatives have been issued and are currently outstanding.

In the past 12 months there has been a significant increase of nearly 50% in trading volumes and liquidity in SOFR-based products.

The development and adoption of SOFR term rates, which provide forward-looking term structures similar to those of LIBOR, have gained traction.

Financial institutions have had to upgrade their systems and processes to accommodate SOFR, including risk management, valuation models, and accounting systems.

Regulators have provided guidance and support to facilitate the transition, including the endorsement of SOFR by the Federal Reserve.

Market participants have developed new hedging strategies to manage exposure to SOFR. This includes SOFR futures and options, Eris swap futures, and various over-the-counter derivatives.

Credit spread adjustments have been widely used to bridge the gap between SOFR and LIBOR, ensuring that the overall interest rate remains comparable.

Financial models have been recalibrated to price SOFR-based instruments accurately. This includes adjustments to yield curves and discounting methodologies.

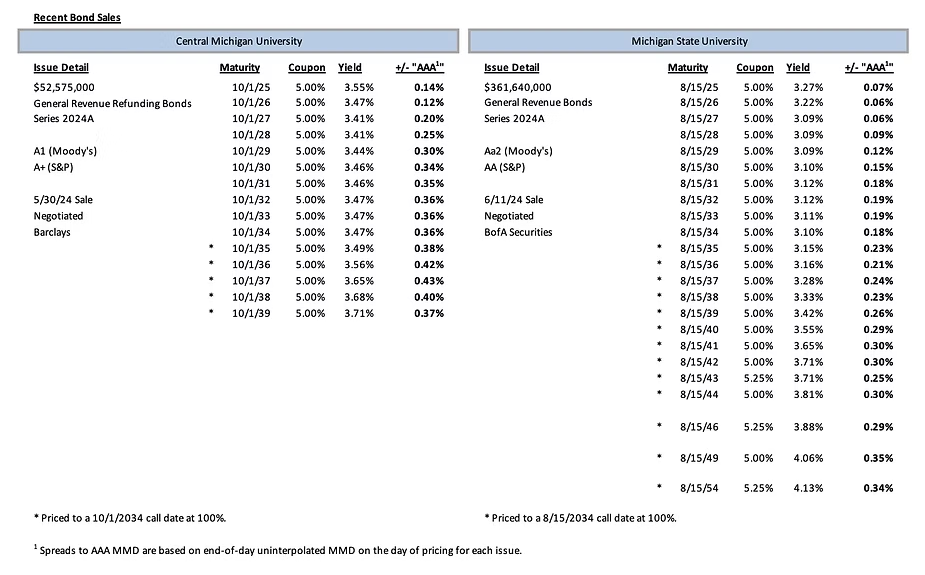

Comparable Issues Commentary

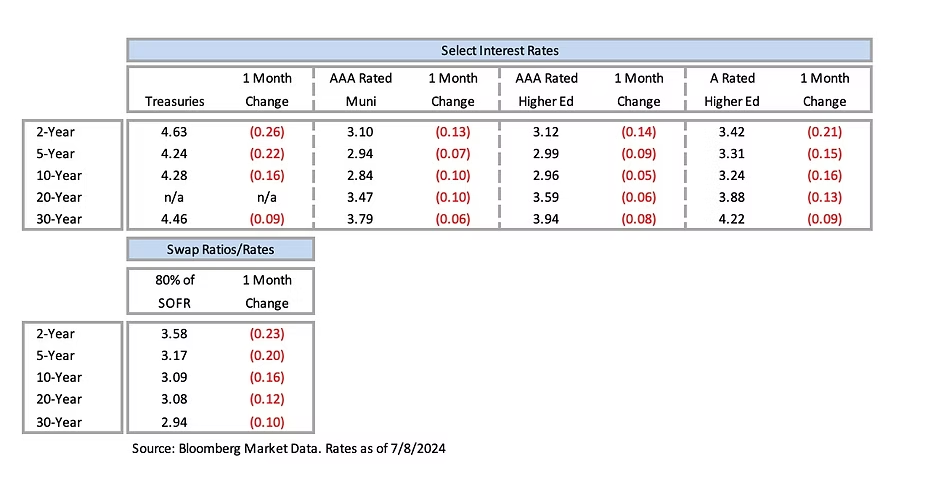

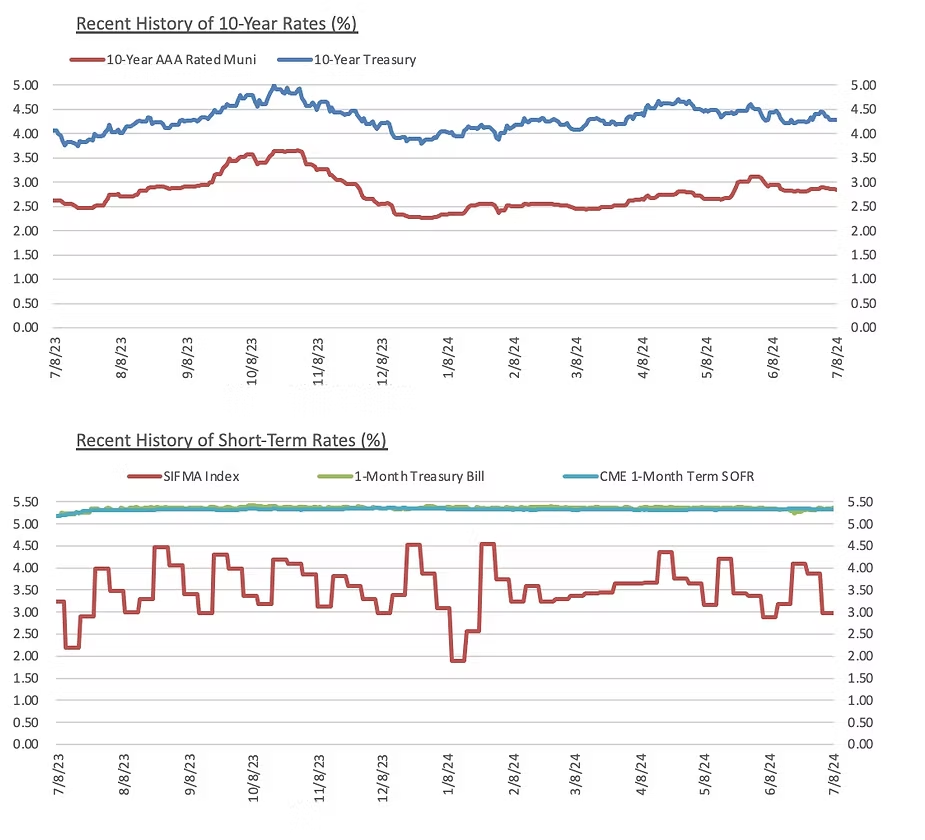

Interest Rates

Meet the Author:

Brandon Lippold | [email protected] | 952-476-6054

In his role of Vice President, Brandon Lippold is focused on growing client management responsibilities, in particular ensuring that our clients’ transactions run smoothly through closing. He has significant expertise in direct purchase bonds and derivative products and is experienced with the pricing and execution of fixed rate bond transactions and reinvestment products. Mr. Lippold is closely involved in every step of the financing process for clients, from initial capital planning stages all the way through closing. He joined Blue Rose in 2018 as a Quantitative Analyst.

Prior to Blue Rose, Mr. Lippold worked at HedgeStar (formerly DerivActiv) where he most recently held the title of Senior Quantitative Analyst and Valuations Team Lead. His professional experience also includes time in the fields of mergers and acquisitions and private equity. Mr. Lippold has also held the position of Co-President for the national volunteer organization Students Today Leaders Forever.

Media Contact:

Laura Klingelhutz, Marketing Coordinator

952-208-5710