Updated: May 15

Credit Ratings in Bond Transactions

As institutions advance bond transactions to the market, a common step for many borrowers is to obtain a long-term bond rating for the issue. This rating is a signal to investors of an institution’s creditworthiness, i.e., its ability to repay its debt obligations. The “Big Three” bond rating agencies are Moody’s, S&P, and Fitch, which control most of the global bond rating market.

Investment Grade vs. Speculative Grade Credits

To indicate an entity’s creditworthiness, each of these rating agencies uses a slightly different scale of broad categories broken down into smaller notches. We will explore these scales in more detail below, but at a high level there are investment grade credits and speculative grade credits. Investment grade credits are viewed by the rating agencies as suitable investments, having a good probability of repaying their debt. Speculative grade credits essentially signal to investors to “invest at your own risk,” as borrowers with these ratings have a lower likelihood of repaying their obligations and may have questionable liquidity or solvency positions.

How Rating Agencies Assign Credit Ratings

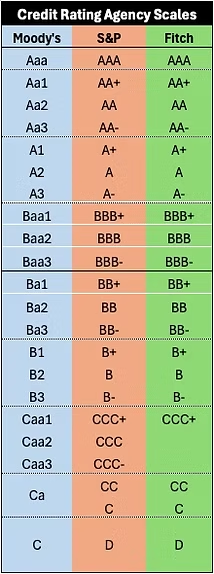

The scales used by the three main rating agencies employ a combination of A’s and B’s for investment grade credits. The Moody’s scale features “Aaa” as the highest rating followed by “Aa1”, “Aa2”, and “Aa3”, in descending order. Moody’s uses numbers to delineate notches in its ratings. Following the “Aa” category, which is considered “high grade”, is the “A” category (“upper medium grade”) and the “Baa” category (“lower medium grade”). The scales used by S&P and Fitch are identical for investment grade credits, but unlike Moody’s, these agencies use “+” and “-“ to break down each rating notch. Their scales are also topped by the “AAA” rating, followed by “AA+”, “AA”, and “AA-”, in descending order. This pattern then continues to the “A” rating level and “BBB” rating level.

Each of the three scales continues its respective pattern into the speculative grade range of the credit spectrum with “Ba/BB”, “B”, and “Caa/CCC” ratings. These ratings indicate various degrees of increasing credit distress. The lowest rating from each agency (“C” for Moody’s, “D” for S&P and Fitch) reflect an institution that is in default.

Meet the Author:

Ben Pietrek | [email protected] | 952-460-5776

In his role of Associate, Ben Pietrek provides analytical and research support to the lead advisory team for Blue Rose’s debt, derivative, and reinvestment transactions for higher education, non-profit, and government clients. He is also responsible for executing pricing opinions and credit and debt capacity analyses.

About Blue Rose Capital Advisors:

Blue Rose Capital Advisors is an independent financial advisory firm that serves the higher education, healthcare, non-profit, government, and corporate sectors. Blue Rose provides debt, derivatives, reinvestment, strategic and financial consulting services, and other specialized services to help clients achieve their goals. Blue Rose is registered as a Municipal Advisor with the Securities and Exchange Commission (SEC) and Municipal Securities Rulemaking Board (MSRB).

Blue Rose brings expert guidance and transparency to the often complex and opaque sectors of the capital markets. We embrace a client-first approach and work tirelessly to strengthen their debt transactions, governance, and balance sheets. With our wealth of real-time data, sophisticated modeling capability, and deep industry relationships, we can deliver solutions to almost any financing challenge.

Contact Blue Rose today:

Media Contact:

Laura Klingelhutz, Marketing Coordinator

952-208-5710