Recently, some of our clients have been utilizing a “rollover” laddered portfolio investment strategy for their debt service reserve funds (“DSRF”). Specifically, this approach is often attractive to small borrower clients because the total fees associated with structured investment products such as a repurchase agreement or guaranteed investment contract can reduce the earning yield more significantly on smaller DSRFs.

Rather than investing the entire reserve fund in a single longer-term security, clients are choosing to purchase a laddered portfolio of securities, scheduled to mature over several years. As each security matures, it can be rolled over and reinvested at then prevailing interest rates. As such, by dividing the investments among several maturities, borrowers will be investing some funds with longer maturing securities and others with shorter maturing securities. As rates fluctuate over time, the borrower will reinvest at differing interest rates and will ultimately achieve a blended return based upon actual market behavior.

By choosing this approach, borrowers have the potential to benefit if market rates rise in the future by reinvesting a portion of the DSRF at a higher rate. If market rates decrease, the portion originally invested in longer term securities is not affected. However, if the market does “improve”, this improvement will cause the value of the remaining securities held in the DSRF to decrease in value as interest rates rise. Depending on the borrower, it is usually required to mark to market the securities in the DSRF annually or semi-annually and if the value of the securities falls below the required deposit in the DSRF, they must replenish this shortfall, creating, in essence, a so-called “margin call”.

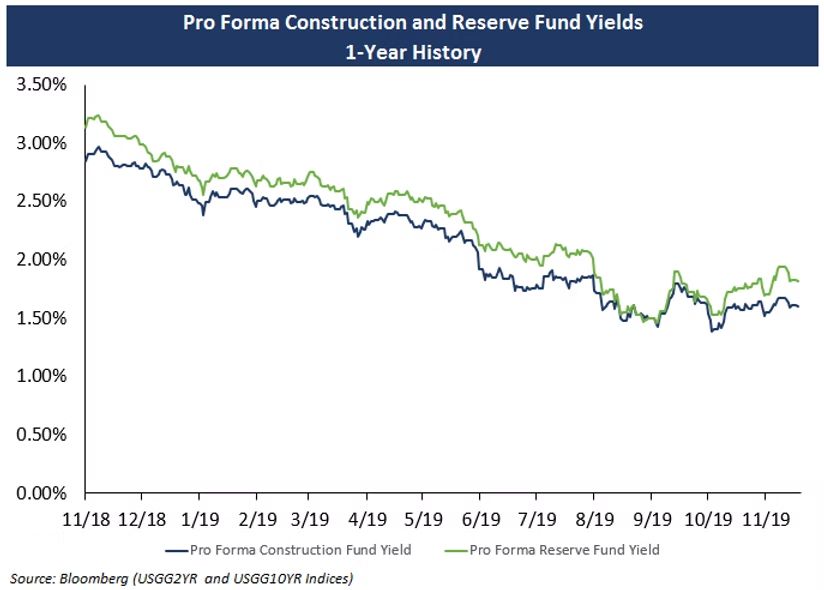

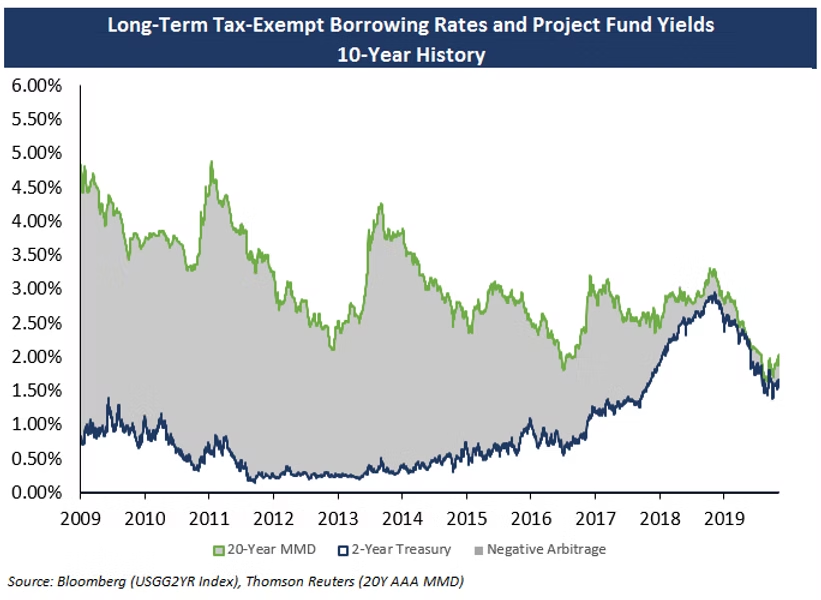

In the current market environment, the yield curve remains relatively flat, meaning that borrowers will not realize a significant increase in yield by purchasing longer dated securities. In fact, the longer the maturity of the securities purchased, the greater potential for future margin calls on the DSRF. While there is comfort in locking up a known yield on an investment, we encourage our borrower clients to weigh this comfort with the potential for future margin calls.

About the Author:

Georgina Walleshauser joined Blue Rose in April 2017. As an Analyst, she is responsible for providing analytical, research, and transactional support to senior managers serving higher education, non-profit, and government clients with debt advisory, derivatives advisory, and reinvestment services. She also prepares debt capacity modeling, credit analysis, and market analysis to support the delivery of comprehensive, strategic, and resourceful capital planning tools to our clients.

Georgina can be reached at: [email protected]